Articles and News

Study Shows Affluent Millennials Have Favorable View Of Synthetic Diamonds | July 20, 2016 (0 comments)

Los Angeles, CA—More grist for the synthetic mill: a consumer research study conducted in May 2016 by MVI Marketing Ltd. shows Millennials are very open to the idea of synthetic diamonds. Though a relatively small sample was studied—650 U.S. consumers between ages 21 and 35, with incomes of $75,000 or greater—the results are qualitative and directional.

The release of MVI’s findings come on the heels of a Morgan Stanley report calling lab-grown diamonds a “serious potential disruptor” to the market, especially for melee. That, plus other bellwether signs in the industry point to the disruption to come sooner, rather than later.

MVI’s findings show high consumer recognition (64%) for the terms “blood diamonds” and “mined diamonds” (60%), then dropping to less than half for terms like “man-made diamonds,” “lab-grown diamonds,” and the like, all of which were around 40% in their name recognition among respondents.

That's significant, says Liz Chatelain of MVI Marketing. “What I found interesting about this study is that the term “lab created” or “lab grown” is so exposed in such a short time. 24 months ago this wasn’t even in the consumer realm. 18 months ago people first heard about it, so for it to be in the 40% range already is really high. Blood diamonds was at 64% when the movie came out, and it hasn’t changed much since then, so if 'lab-grown' and 'lab created' is at 40% already, that tells me consumers are seeking alternatives and information.”

After the survey explained to respondents what lab-grown diamonds are, 56% of respondents expressed interest in knowing more, four times the number of respondents who expressed concerns about being deceived about man-made vs. mined diamonds.

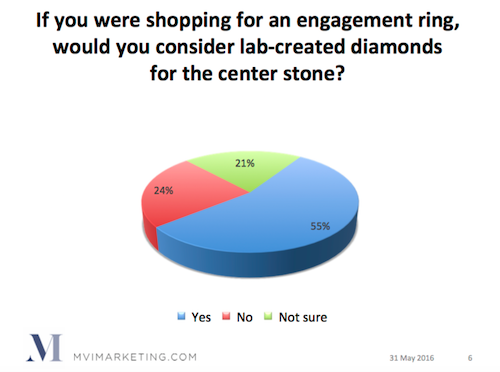

But perhaps most telling was the question, “If you were shopping for an engagement ring, would you consider lab-created diamonds for the center stone?” 55% of respondents said “yes,” which strikes at the very heart of the one category the industry believes will be resistant to synthetics. 24% said they would not consider a synthetic center stone, and 21% said they’re not sure.

But Chatelain says previous MVI studies have shown Millennials are also open to CZ for an engagement ring, either for social/environmental or budgetary reasons. Synthetic diamonds now presents an alternative that’s appealing, she says. It’s a real diamond, but without the social or economic cost they associate with mined stones.

65% of respondents said man-made diamonds should be called diamonds because they’re comprised of the same ingredients as natural diamonds, just created in a lab. Only 32% said they shouldn’t be called diamonds if they’re not mined.

Analysts studying the Morgan Stanley report believe cost would be a leading driver in the potential for synthetic diamonds to disrupt the market. An article in Forbes said, “…people without deep pockets do not seem to be interested in the provenance of the diamond they’re thinking of buying with price the key determinant.”

Cost was much less of an issue to the affluent young consumers polled by MVI. Lower cost and/or equal perceived value came in third as the reason why they’d consider buying a synthetic diamond. The predominant reasons cited by MVI study respondents were environmental and social, but the study did skew toward an affluent consumer.

When asked what they thought lab-grown diamonds should cost, the majority of respondents ticked off "21% to 30%" savings over natural diamonds, though Chatelain said it wasn’t an unaided question and that was the greatest discount choice the study offered. But she told The Centurion that almost 30% of consumers in the study assumed a lab-grown diamond is more expensive, not less, than a mined stone—and cautions the industry has no model to demonstrate a price threshold for synthetics.

Among respondents, 87% said they’ve purchased fine jewelry within the last two years, and for more than half, that was bridal jewelry. Tiffany and Kay came out on top as the preferred retailers for respondents, at 38% and 35% respectively checking those options off for their top shopping choice. “Local independent fine jewelry retailer” came in at number three, ranked first by one-third of respondents—not terribly far off the Tiffany and Kay numbers, and tied with Zales. Perhaps surprisingly, both Blue Nile and warehouse clubs like Sam’s and Costco were at the bottom of the list, named as top preferences by only 13% of respondents respectively.

Read the entire study report here.