Articles and News

Up Or Down? Diamond And Gold Price Outlooks For 2017 | December 14, 2016 (0 comments)

Merrick, NY—Despite a few sporadic upticks, diamond prices have been on a steady decline throughout 2016. Year-to-date figures from Rapaport show a 3.8% decline in the RapNet Diamond Index (RAPI) for one-carat polished diamonds. Global demand was quiet in November, with a severe liquidity crisis in India’s diamond industry after the government invalidated 500 and 1,000-rupee notes. Demand in the Far East remains cautious at best, as Hong Kong jewelry sales plunged and the Chinese yuan dropped 2% against the dollar in November.

In the United States, a good holiday season is forecast but jewelers are managing with lower inventory levels than reported last year. This should, however, drive first-quarter demand to replenish goods sold, says the report. Read more here.

Also last week, Bain & Co. and the Antwerp World Diamond Centre released their 2016 Global Diamond Industry Report. Global retail sales of diamonds moderated in 2015 following three strong growth years from 2012-2014, but 2016 results are a bit stronger than last year. The United States is the engine that drives the global diamond market, although the jump in growth is coming from the middle class—perhaps feeling flush at last—who shop at mainstream jewelers, rather than the high-end market that has been strong already.

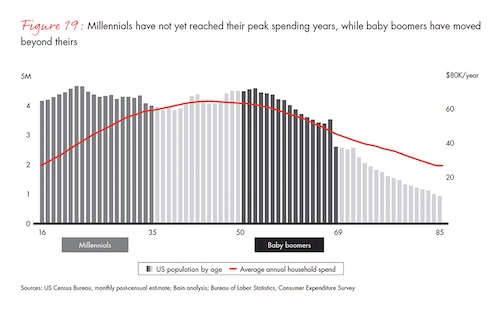

The gap between aging Boomers and not-yet-affluent Millennials is making itself felt in the jewelry industry, as 2016 sales reflected some falloff of Boomers who have passed their peak spending years but the delayed affluence of Millennials has not yet picked up the slack. Other experts predict this may remain the case for the next five to 10 years—or longer—until the late 2020s or even 2030. Not surprisingly, Bain/AWDC’s report found Millennials tend to spend a bit less per piece on diamond jewelry than non-Millennials.

Millennials have not reached their peak spending years yet, but Boomers are starting to pass beyond theirs. Gen-X, currently in their peak years, is approximately 11% smaller as a group than either the Millennials or the Boomers, which would naturally drive total sales down if they spend at the same pace. Chart: 2016 Global Diamond Industry Report, Bain & Co and Antwerp World Diamond Centre.

Millennials the world over do seem to value diamonds as a gifting choice, though in the United States the category ranks number three behind money and electronics. U.S. Millennials are far more likely to shop online for diamonds than their counterparts in either India or China. And Millennials the world over are willing to consider synthetic diamonds, mainly for their lower cost. The Bain/AWDC report did cite some negative attitudes toward them (“cheap,” “fake,” “not real”) but just as many neutral attitudes (“affordable,” “technology,” “less expensive”), suggesting the category is not to be dismissed lightly.

U.S. Millennials do like to receive jewelry and watches as gifts, though they are not as into the category as their counterparts in India and China. In the United States, it was the third-favorite gift among Millennials, trailing currency and electronics. Chart: 2016 Global Diamond Industry Report

The same challenges continue to dog the industry, however: the midstream sector needs to both improve its business model and secure access to more financing. Longer term, synthetic diamonds are emerging as a competing category, consumption in China may continue to slow, and there’s risk of a cyclical recession in the United States. Uncertainties about the social, political, and economic environments in key markets also cloud the medium-term outlook, but long-term the overall outlook remains positive. Bain/AWDC expects a gradual return to positive growth trajectories beginning in 2018, with mid-single-digit annual growth through 2030.

Real disposable income growth of 1.5% to 2.5% per year in the United States should stimulate diamond jewelry consumption, consistent with historical trends. Demand growth in China is expected to resume a modest upward path in 2017. China and the US are expected to remain the leading diamond jewelry markets, with India moving into number three ahead of Europe and Japan by around 2020. Indeed, the luxury market in India grew by 25% this year, fueled by an aspirational and younger middle class, rising Internet penetration, and greater awareness of global luxury brands. Key growth segments include fine dining, electronics, luxury travel, personal care, jewelry, and luxury cars; watches and jewelry are expected to remain number two and three of the top five key growth areas in the future, with only fragrances ahead of them and skin care and apparel in the number four and five spots.

Global rough-diamond demand through 2030 is projected to grow at an average annual rate of about 2% to 5%, and supply is projected to decline by 1% to 2% per year, says the report. This forecast reflects fundamental supply and demand factors rather than short-term fluctuations or unforeseeable long-term macroeconomic shifts, though an increase in demand for synthetics over natural diamonds would skew expectations to the lower end of the range.

Access the Bain/AWDC report here.

Gold. It’s not exactly a K-mart Blue Light Special, but gold is in a “markdown phase” right now. How far down it will go remains to be seen, but at least one analyst says it hasn’t hit bottom. “Stocks are soaring to new all-time highs and western traders are dumping out of gold. It's a momentum play. Stocks are hot and gold is not,” says Kira Brecht in this article on Kitco.com.

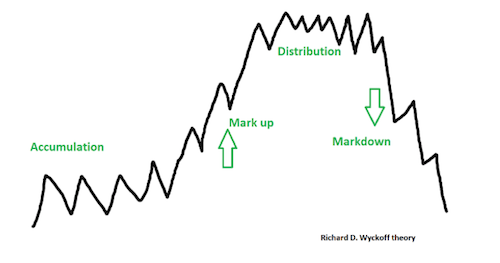

Metals prices tend to repeat history in predictable patterns, which is why traders study past charts so closely. The theory developed by legendary trader Richard D. Wyckoff in the 1900s has four phases: accumulation, markup, distribution, and markdown. Gold is currently in the markdown phase and hit $1,160 an ounce on Monday. (At press time it was trading at $1,152.) Kitco believes it may well hit last December’s low of $1,046 the ounce, though the Fed's Wednesday announcement of an interest rate hike was already factored in and did not impact the metal's price significantly.

Legendary gold trader Richard Wyckoff devised this chart more than 100 years ago to describe the repeating pattern of the gold market's four phases. His theory is still used today to predict bull and bear markets. Chart: Kitco.com

Meanwhile, this article on Seeking Alpha.com speculates gold could drop as low as $500 the ounce (inflation adjusted)—based on the theory that its current charts resemble a bubble. But the Seeking Alpha report—as well as this one predicting $1,900 gold in 2017—are the outliers. The majority of gold analysts are in agreement of a short-to-medium-term outlook of around $1,200 the ounce, give or take a few hundred in either direction.