Articles and News

Diamond Update: Uptick Ends As Prices Dip In April; De Beers Ramps Social And Environmental Spend May 04, 2016 (0 comments)

De Beers Boosts Investment In Skills Training And Social Projects

London, UK—The De Beers Group of Companies ramped up its investment in skills training for the local workforce and social projects by 13% in 2015, to US $52.5 million, according to the company’s Report to Society, published Tuesday. De Beers also improved its environmental performance, with reductions in energy consumption and carbon emissions.

De Beers invested US $24.3 million in development training for its workforce in 2015, a 30% increase over the $18.8 million the company invested in 2014.

The company also invested $28.2 million in social projects benefiting 47,800 people in its producer countries. The report also shows:

Safety performance continued to improve in 2015, achieving a 15% reduction in the total recordable case frequency rate;

The company reduced its environmental footprint, achieving savings of US $6.8 million as a result of reduced energy consumption and carbon emissions over the last two years;

Compliance with performance standards in 2015, becoming re-certified with the Responsible Jewellery Council and marking the 10th anniversary of its own externally assured compliance program, Best Practice Principles, which now covers 320,000 people across the diamond pipeline in 72 countries.

CEO Philippe Mellier said, “Investing for the long term, driving positive change, and unlocking opportunities through diamond development are at the core of what we do and I am very proud of our performance in these areas in 2015. However, positive performance must not be seen as grounds for complacency and we will redouble our efforts in 2016 so that diamonds continue to have a positive and lasting impact for our partners, our employees and the communities in which we operate.”

The Report to Society can be downloaded here. A Summary Review can be downloaded here.

Diamond Prices Soften Again With Weaker Global Demand

New York, NY—Polished diamond trading slowed in April due to sluggish demand at the start of a seasonally quiet period. According to a report from Rapaport, sentiment weakened as the positive momentum from the first quarter failed to gain traction, and supplies significantly increased due to high rough sales and polished production in the first quarter.

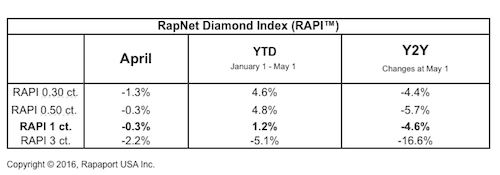

The RapNet Diamond Index (RAPI) for one-carat, GIA-graded diamonds slipped 0.3% in April. RAPI for 0.30-carat diamonds fell 1.3% and RAPI for 0.50-carat diamonds also declined 0.3%. RAPI for three-carat diamonds dropped 2.2%.

Although the RAPI for one-carat diamonds rose 1.2% in the first four months of 2016, it remains down 4.6% from a year ago.

The Rapaport Monthly Report highlighted concern among diamond traders that consumer demand is weak. While a steady U.S. market supported the diamond industry, sentiment in the Far East and European markets remained cautious.

Polished inventory levels rose during a period of restocking in the first three months. Jewelers avoided any unnecessary build-up of inventory and took goods on memo, which put additional pressure on manufacturers’ liquidity. Selective buyers offered lower prices for goods as new supply came on stream in April. Suppliers held prices firm for better-quality RapSpec A2+ diamonds, but were more flexible on their older stock of lower-quality goods. Demand for diamonds three carats and up was weaker.

Manufacturers’ profit margins continue to be squeezed as rough prices remained high during a period of weaker polished trading. Rough demand was robust even as De Beers raised prices by an average of 2% in April, according to Rapaport estimates. De Beers and ALROSA reduced inventory that was accumulated in 2015 as sales volume outpaced production.

Rough demand is expected to slow from May as manufacturing levels have stabilized. Polished trading is also expected to remain slower this month. Amid declining global demand, dealers have shifted focus to the U.S. ahead of the Las Vegas shows that begin May 31.

The Rapaport Monthly Report can be purchased here.