Articles and News

L2: Jewelry Second Strongest “Hard” Luxury Category; David Yurman Best Digital Marketer | December 23, 2014 (0 comments)

New York, NY—Jewelry has become the second best performing “hard” luxury category behind accessories, according to the latest report from L2ThinkTank, a digital business intelligence firm. The luxury jewelry and watches category is ripe for major disruption, says L2, pointing to factors such as limited consolidation at the top of the market and a relatively low share of branded goods in the market—not to mention the debut of the Apple Watch, which thus far has been positioned more as a luxury product than a tech product.

Both high-tech industry and Wall Street analysts believe the Apple Watch may have more impact than the jewelry and watch industry anticipates. L2 says that while 44% of luxury watch executives acknowledge that smart watches probably are the “next big thing,” only 11% think they’re a serious threat to their current business. But while the watch industry doesn’t believe this will be a replay of the 1970s quartz watch decimation of the mechanical market, the analysts are looking at both demand for wearable technology and previous Apple product launches as their benchmark. They are coming up with numbers that, if accurate, would instantly catapult Apple into the largest watch seller in the world.

But that hasn’t happened yet. In the meantime, digital marketing savvy in the category has improved significantly. From a category that barely registered a few short years ago, this year’s Digital IQ index shows four companies in the Genius category and 14 in the gifted category.

The number-one ranked jewelry brand in terms of its digital marketing savvy was David Yurman (above left), with a score of 148, followed closely by Tiffany with a score of 144. Alex & Ani, with a score of 142, ranked number three, and Swarovski in fourth place earned a score of 141. Scores were determined 40% by the effectiveness of the brand site and e-commerce investments; 35% by search, display, and email marketing efforts; 10% by brand presence, community size, content, and engagement on social media; and 15% on mobile capabilities: compatibility, optimization, and marketing on smartphones.

In the “gifted” category, meaning their digital marketing efforts are very good, although not superior, the leader was Richemont’s Van Cleef & Arpels brand. Familiar jewelry store names like Hearts On Fire, Pandora, and Shinola also earned their way into the “gifted” category, with scores of 125, 130, and 131, respectively. Pandora rival Trollbeads eked into the lower tier of this category with a score of 113.

In the “average” category, Ippolita’s digital marketing earned it 37th place, with a score of 94. Mikimoto and Rolex tied for 39th place, each with a score of 93. But many familiar names, such as Pomellato, Audemars Piguet, Frederique Constant, Patek Philippe, Graff, H. Stern, and Marco Bicego need to step up their digital marketing efforts, according to L2’s scoring.

Omnichannel marketing is the industry buzzword, but in the jewelry and watch category it is manifesting itself differently than, say, luxury apparel. In the jewelry and watch category—perhaps because of price points—digital integration with local boutiques is becoming more sophisticated. In even one year, the number of brands offering online ordering with in-store pickup more than doubled, from 4% last year to 11% this year.

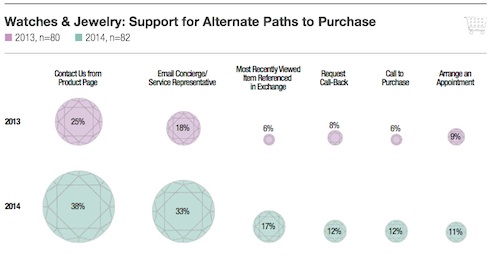

In the past year, the jewerly and watch category has improved support for each potential channel for purchase. Previous year's numbers are in purple on top; this year's numbers are in green on bottom. For example, 13% more companies offer a way to contact them from the product page than offered that service last year. 15% more offer an email option to reach a concierge or service representative, and 11% more track the viewer's past browsing. Source: L2ThinkTank.

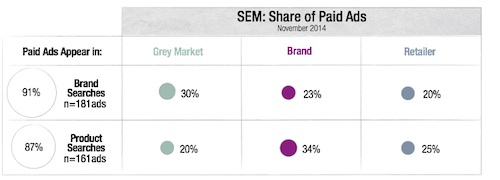

The gray market vs. brands and retailers. A potential point of concern is the relatively high ranking that gray market sellers have achieved in organic search. While the legitimate watch and jewelry brands still hold the largest share of organic first-page search results (21%), gray-market resellers are not far behind, at 17%. Grey market sellers actually excel at achieving visibility through paid ads that appear on 91% percent of search returns for brand queries, ultimately controlling the largest swath of sponsored results (30%), says L2. But brands are engaging more actively in paid search on terms that signal a customer has narrowed his or her consideration set to a specific product or model.

Retailers that appear on first-page search results lag behind both brands and gray marketers for brand searches, but they outrank gray market sellers for product searches.

Gray market sellers work hard to be sure shoppers find them. In generic brand searches, gray market sellers outrank both brand marketing and retailer marketing in organic first-page search results. But retailers and brands do better on searches for specific products or models. Source: L2ThinkTank.

Social decline? Some jewelry and watch brands have noticeably dropped off in the number of social media posts they place. For example, fashion brand Alex & Ani is posting almost 50% less now than it did a year ago, and retailer Tourneau is posting less than half as often as it used to. Maison Birks and Tiffany are two more retailers whose social presence has declined markedly between October 2013 and October 2014. Overall for the jewelry and watch category, social postings have dropped 12% among the 87 brands L2 studied.

But brands have discovered quality over quantity. Alex & Ani, for example, has boosted engagement more than four-fold, according to L2’s research. Where general posts garner about 1,500 engagements, the simple branded posts with images of inspirational quotes—part of its #MotivationNation campaign—are tracking at about 7,100 engagements each.

While most brands have decreased the frequency with which they post, some are responding to new Facebook rules exactly the way Facebook had hoped: by paying for visibility, whether through sponsored or boosted posts. Rolex, for example, posts only once a week, but its promoted posts are beating simple organic posts by a whopping 210%.

Mobile is growing. Mobile optimization is becoming the norm among jewelry and watch brands: two-thirds of the brands studied by L2 now have mobile optimized sites. Nearly 40% have some kind of m-commerce capability and more than half (57%) use geo-locators to direct consumers to the nearest retailer. But some services that are available on desktop searches still aren’t available in mobile searches in this category, such as the ability to make an appointment with a local retailer or to request a call back.