Articles and News

The Centurion 2014 Holiday Sales Success Index: Excellent Results For Most Prestige Jewelers | December 30, 2014 (0 comments)

Merrick, NY—For the majority of luxury jewelers, the holiday season turned out in strongly positive territory. Early reports were stellar, and even a hiccup in the third week—where 47.6% of jewelers reported a dip in sales—didn’t dampen the final results.

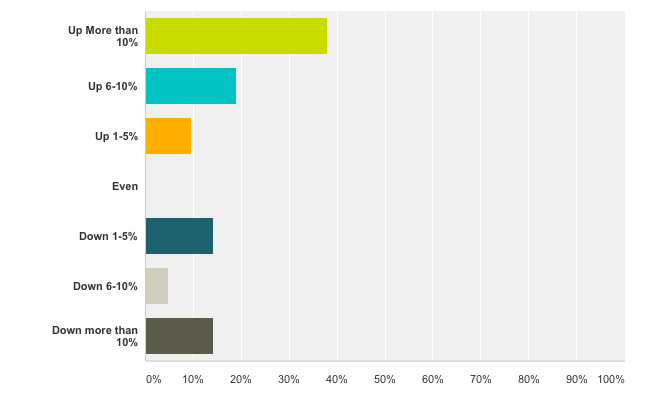

According to the Centurion Holiday Sales Success Index, a spot-check survey of prestige jewelers across the nation showed more than 38% of respondents posting holiday sales gains of 10% or more over 2013 figures. Another 19% were up between 6% and 10%, and 9.5% were up anywhere from 1% to 5%, for a total of more than two-thirds of respondents posting gains over last year’s holiday sales. The remaining one-third of Centurion respondents did experience a decline in holiday sales this year, vs. last year.

But overall, luxury stores fared better than non-luxury stores where, according to a report in National Jeweler, results were mixed. JCK also reported mixed results, though generally more positive than negative. Brands and basics ruled, said that report.

"How Was Your Total Holiday Business For 2014, Compared With 2013?"

Luxury jewelers overwhelmingly reported a strong season, with the majority experiencing solid sales gains over last year's figures.

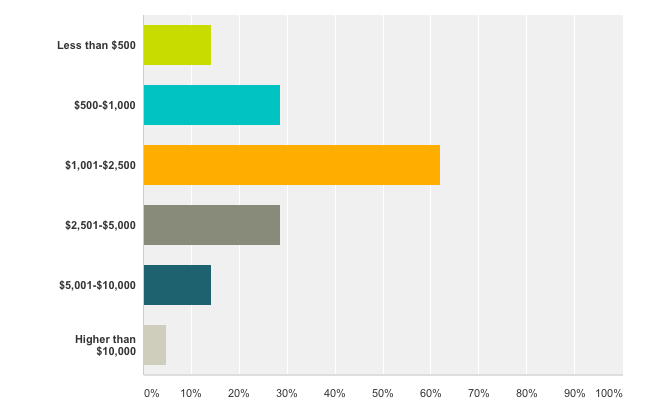

Overwhelmingly, prestige jewelers reported that goods with a price tag between $1,000 and $2,500 sold best. More than 60% of jewelers responding to the Centurion survey said that was the strongest-selling price point for the season. Price categories just above and just below also showed strength: 28.5% of respondents each cited $500-$1,000 and $2,500-$5,000 as their best-selling price point. 47.6% said their typical sale was higher than last year; 38% said it was consistent with last year, and 19% said their typical sale in 2014 dropped vs. 2013.

"What Was Your Best-Selling Price Point For Holiday 2014?"

Jewelers did very well with mid-range merchandise priced between $1,001 and $2,500 this year (orange bar). But sales overall were evenly spread between lower prices (aqua and green bars) and higher prices (dark gray, teal, and light gray bars) this year.

Some Centurion respondents also shared their single biggest sale of the season. The winner was a David Mor pink diamond ring for $780,000. Another sold a ruby valued at more than $200,000, and many reported sales in the high five figures, such as a five-carat cushion cut anniversary ring valued at $80,000, an emerald and diamond ring at more than $70,000, and a number of Rolex sales in the $50,000 range.

To nobody’s surprise, the best-selling products among luxury jewelers were the usual suspects: diamonds, Rolex watches, and David Yurman jewelry. John Hardy also sold well, and Breitling was the second-most mentioned watch brand. Other brands that jewelers cited as strong sellers were Lagos, Charles Krypell, Gurhan, Le Vian, Roberto Coin, Konstantino, Elizabeth Locke, and Honora. Categories that sold well were colored gemstones, and, for some, sterling silver. But Pandora was not nearly as popular as it has been in previous years—literally only one respondent cited it specifically as a strong holiday seller.

When asked to describe sales trends for the season as a whole, responses were mixed. Not surprisingly, many jewelers said business came very late in the season (38%)—but 26% said business came early or stayed steady throughout the season.

“It felt like the season didn't ramp up until the last 8 days. The days before were consistent and busy but it really got busy the last 8 days. We saw a tremendous increase in new customers,” wrote one. “Started earlier and stayed strong through 4 pm Christmas Eve,” said another.

“It was a very late season and Christmas Eve was busier than it has been in previous years,” wrote one of the respondents who felt the season’s better sales were later than last year.

“I’m exhausted!” laughed another, probably summing up every jeweler’s feelings.

In terms of marketing, traditional media still wins with luxury jewelers. 68% said they felt their traditional marketing efforts (TV, billboard, magazines, etc.) were the most effective at bringing in customers and sales this season. 31% credited special events such as trunk shows, 25% credited social media and 18.7% said digital marketing (such as paid search) was effective.

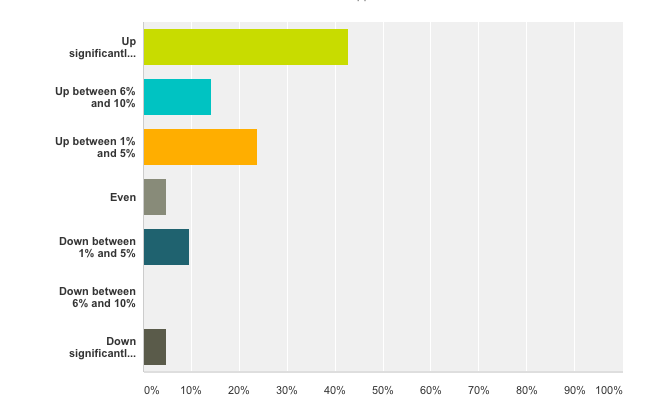

For the year in total, 2014 was very good for luxury jewelers. 81% of respondents said business for the full year surpassed 2013. More than half of those—43% of the total—said their full year business grew more than 10% over 2013 full-year figures.

"How Were Your Total Sales For 2014, Compared To 2013?"

Luxury jewelers report a strong year of gains, with 43% of respondents saying their total year sales for 2014 were at least 10% higher--sometimes much higher--than 2013. More than 80% of respondents had an "up" year, and the majority of those who didn't experienced a relatively small drop of 5% or less.

Turning to the broader retail picture, the season ended up on a positive note, with the National Retail Federation predicting a 4.1% increase in sales overall, the biggest holiday increase since 2011. The holiday SpendingPulse report from MasterCard Advisors highlighted some surprising winners and losers. In the winners’ circle, casual dining and lodging suggest experiences are gaining as a gift category, while electronics were a surprising loser. Gadget sales were flat for the period from Black Friday through Christmas Eve—and in negative territory when the entire month of November is taken into account.

Top image: turningpp.com