Articles and News

2014 Economic Forecast: Sun And Some Clouds | January 01, 2014 (0 comments)

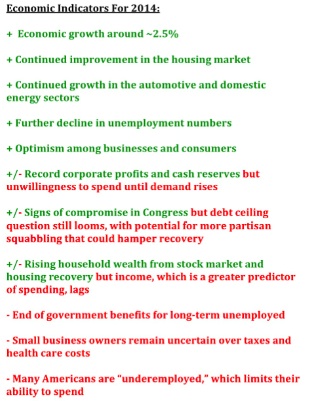

Merrick, NY—What kind of economy can we look forward to in 2014? According to most economic forecasts, the coming year—while by no means a boom—is likely to have a significantly brighter outlook than 2013.

The International Monetary Fund predicts the U.S. economy will grow approximately 2.6% next year, says Reuters. IMF managing director Christine Lagarde said on NBC’s Meet The Press that growth is picking up and unemployment is going down, and she hopes the current signs of compromise in Congress will continue in February when the time comes to vote on raising the debt ceiling.

The 2014 economic forecast report from the Wells Fargo Economics Group says the sustained subpar growth, low inflation and Fed easing that formed the basis of its outlooks for the past three years again will be the key for 2014.

But in 2014, growth should improve to 2.4% (against 2913’s 1.7%), with much of the improvement in the private sector. Wells’ economists expect a modest gain in consumer spending; stronger investment in business equipment, structures, and housing; and slight improvements in the labor market with a modest decline in unemployment to less than 7%. But cuts in government spending will remain a drag on GDP, though less so than in 2013.

Consumer spending will again remain around 2% in 2014, says Wells Fargo. Real disposable income should rise 2.6% on a year-over-year basis compared to the slight 0.8% rise in 2013. Modest inflation pressures combined with the absence of major tax policy changes should help to support more robust real disposable income growth.

More than five years after the end of the recession, the small business sector continues to struggle; however, look for more job and income growth in the sector in 2014. One key source of funding for small businesses that has been missing has been home equity, but the home price appreciation over the past year and the continued housing recovery expected in 2014 should support a more robust pace of improvement in the small business sector, says the report. But other key factors holding back small businesses, like increased healthcare costs and uncertainty around tax policy and regulations, continue.

Wells’ economics group also predicts the global economy will grow 3.5% in 2014, vs. 3.0% in 2013. Most major economies should post stronger growth rates in 2014; China likely will grow more slowly, but should still record one of the strongest growth rates in the world.

The U.S. housing market is trending in the right direction, as it continues to transition away from speculators and investors and toward underlying positive fundamentals. Housing still varies considerably by region, but employment and credit availability are improving modestly, and home prices are set to moderate as supply adjusts to the economy’s slower long-term growth trend.

Kiplinger.com’s economic forecast looks similar to Wells Fargo, but its economists are predicting a little more momentum in the GDP in 2014, resulting in a 2.6% growth vs. Wells’ prediction of 2.4%. Kiplinger also predicts business spending to grow between 4% and 5% (with the caveat of continued uncertainty); housing sales to grow 4% for existing homes and 16% for new homes; unemployment dropping to 6.5%; and retail sales to grow between 5.2% and 5.7% for the year in 2014.

Although unemployment will decline, the end of government extensions on unemployment benefits at the end of 2013 will hurt some four million people classified as long-term unemployed (27 weeks or more). That will hurt a bit, at least in the short term, said economist Nariman Behravesh in an interview on NPR (National Public Radio)’s program “Morning Edition.” And a report on CNBC says that while the numbers are trending in the right direction, they don’t tell the whole story. Many Americans remain underemployed—either working part time when they want to work full time, or college graduates working at low-end jobs instead of careers with advancement. It’s a vicious circle: underemployed Americans don’t have any extra money to spend, which in turn hampers economic growth, which in turn creates more and better jobs. But corporate profits keep rising—in part because wages are so low—and companies are sitting on mounds of cash, says the article. Corporations have the cash to invest in expansion, but won’t spend it unless they see rising demand, which won’t occur until consumers have higher-quality, better-paying jobs. Thus completes the other vicious circle.

Behravesh believes ranks of the long-term unemployed should continue to come down slowly, though he sees another two or three more years to reach pre-recession numbers. But overall, he sees unemployment dropping to the “low sixes” by the end of 2014, and points to GDP numbers from 2013 that keep getting revised upward. He expects that trend to continue, suggesting things are actually better than they seem. He predicts increasing optimism about the economy in 2014, and a lot of the headwinds facing economic growth easing—to the point where it’s even conceivable people might stop defining the economy as “struggling.”

George Perry, senior economic fellow at the Brookings Institution, concurs with the optimistic forecasts that put growth around 2.5% or better. He says some forecasts suggest growth over 3.5% to 4%, but calls those the “outer fringe.”

But he predicts growth just from the improved atmosphere in Washington. Congress is playing nicer: the budget stalemate has been moved to the back burner, he says, and the recent agreement to undo some of last year’s sequestration is a plus for the economy and makes it less likely that the debt ceiling will be used to create a new fiscal crisis any time soon. These changes alone should be enough to achieve 2.5 percent growth during 2014, he believes.

Other positives Perry cites are strength from auto sales and homebuilding, along with ongoing development of the domestic energy industry, which has added jobs throughout the current expansion. But while growth in these areas will continue, he doesn’t anticipate it to accelerate further, which puts the onus on other sources. Overall, Perry joins the other optimists in predicting a growth between 2.5% and 3%. He also feels positive about the appointment of Janet Yellen to head the Fed.

During 2013, household wealth has surged as a result of both stock market and housing value gains, though he cautions these are not good short-term economic predictors. Income is a much stronger predictor of consumer spending, he says, and growth there has been slow, which leaves optimism as a main driver of growth—and he feels it’s likely to be a positive shift.

Consumer sentiment also bounced back in December after dropping in both October and November. The Conference Board said the consumer confidence index jumped to 78.1 from a revised 72% in November; the highest reading since September, before the U.S. government shutdown. The present situation index rose to 76.2 from 73.5, while the future expectations index advanced to 79.4 from 71.1. "Looking ahead, consumers expressed a greater degree of confidence in future economic and job prospects, but were moderately more pessimistic about their earning prospects," said Lynn Franco, the Conference Board’s director of economic indicators. "Despite the many challenges throughout 2013, consumers are in better spirits today than when the year began."

But in the long term, the United States—like other Western nations—is facing a significant demographic shift with aging baby boomers, which will have implications for federal programs like Social Security and Medicare, says Wells Fargo. Meanwhile, the Millennial, or echo-boom, generation is facing a tight labor market and high student debt, and already is showing signs of diverging tendencies from generations before it. These are issues that will need to be addressed in the coming years.

Top image: Tysto.com