Articles and News

Affluents’ Outlook Positive For Economy, Personal Wealth, And Spending, New Survey Says | April 16, 2014 (0 comments)

Alpharetta, GA— A new survey by the American Affluence Research Center shows strong improvement in affluent consumers’ 12-month outlook for the economy, the stock market, and their own personal wealth. The 25th in AARC’s series of semi-annual Affluent Market Tracking Studies, the spring study finds affluent consumers are quite upbeat and positive about both the economy and their own personal situation. Their optimism is reflected in plans to increase spending for major items such as autos and home remodeling, and certain luxury products (such as vacations and home furniture) that are tracked in each of the twice-yearly surveys.

“Typically, spring ratings are greater overall in terms of optimism than fall ratings,” said AARC president Ron Kurtz. The stronger spending was already evident at the end of last year, in respondents’ reported expenditures for December holiday gifts. More affluent consumers bought holiday gifts—and spent almost 25% more on average—than what was estimated in AARC’s fall 2013 survey. In total, affluent consumers spent $30 billion on holiday gifts, with more than one-third ($11 billion) of that spent online. AARC’s findings dovetail with The Centurion’s own index of holiday luxury jewelry sales.

For spring 2014, the AARC index for future business conditions rose 12 points to 117, and the index for change in the stock market increased 13 points over fall 2013, to 119. Both are well ahead of the spring 2013 index. The composite ACE (Affluent Consumer Expectations) 12-month Economic Outlook Index was 13 points above the Ffall 2013 survey, returning to positive territory at 109, its highest level since spring 2012, when it registered 126. (Index values range from 0 to 200 and are compiled by subtracting negative feedback from positive. A neutral response is 100, meaning equal positive and negative feedback.)

Respondents’ expected change in after-tax personal income (index of 90) rose 12 points from fall 2013 and is 14 points above spring 2013. But equally, if not more important, almost half (46%) of respondents expect their net worth (index of 132) to be higher by March 2015.

Spending is stable. In most categories, spending plans for eight major items (i.e. auto, vacation home) and the indexes for the change in spending for the 17 luxury products and services tracked by these surveys are about the same or a little stronger than the prior two surveys. All but three categories were essentially equal to or stronger than the fall 2013 survey.

“Consumers in the lower levels of affluence might still feel more pressure on their finances and remain inclined to spend less than they used to,” Kurtz told The Centurion. Pre-recession, he said, this group of aspirational affluents spent like crazy—often on credit—and that’s no longer the case. Despite the overall optimism of respondents, 36% still are feeling cautious, he said.

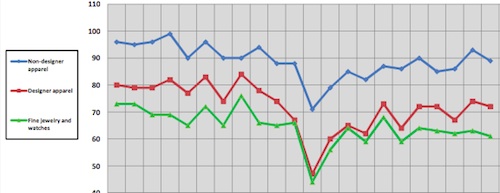

Purchase expectations for fine jewelry and watches dipped slightly (two index points) from the fall 2013 survey, but so did purchase expectations for designer apparel and collectibles, so it’s not necessarily an indication that jewelry is less desirable than any other product. It may, however, signal a shift in spending priorities overall, from material to experiential. Indeed, the index for both domestic and international travel increased from the fall study, as did casual dining.

Respondents' spending expectations for fine jewelry and watches dipped very slightly (green line), but so did their intentions to purchase apparel, whether designer (red line) or non-designer (blue line).

“As people mature past stages of accumulating tangible, material goods, they shift spending toward experiences or they grow concerned about saving for retirement,” says Kurtz. He also believes older affluent consumers aren’t being replaced by younger consumers as quickly as in years past.

Millennials are sexy to luxury marketers, and most emphasis is now being put on targeting this generation, but don’t neglect the low-hanging fruit of more mature customers, Kurtz cautions.

“The Millennials have had a tough time since the recession. They’ve had career setbacks (or even non-starters) because of the recession,” he says. “I don’t disagree that you have to be looking forward to new markets, but I wonder if all the emphasis on Millennials [for luxury] might be unwarranted.”

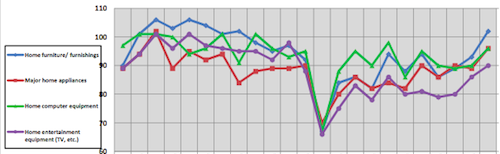

One area of material goods that showed strong growth was spending on the home, which can be construed as either material or experiential—making improvements to create a sense of wellbeing, as opposed to simply accumulating objects. It also dovetails with the stage-of-life expenses of younger affluent consumers.

Since the recession (the lowest dip of the chart above), spending on the home has been consistently on the uptick among affluents. The top performing category is home furnishings (blue line), followed by major appliances and computer equipment (red and green lines, respectively), and last, home entertainment equipment (purple line).

About the survey. AARC’s survey is drawn from the wealthiest 10% of U.S. households based on net worth. Respondents, who must have a minimum net worth of at least $800,000 to participate in the study, reported an average income of $268,000 per year and average net worth of $3.1 million. The average value of their primary residence is $1.1 million.

Net worth is more stable than income as an indicator of wealth and attitudes toward spending, according to research by both the Federal Reserve Board and the Internal Revenue Service, says Kurtz. Further, he stresses, studies that define the floor of affluence at $100,000 in annual income are not necessarily representative of the spending abilities of the truly affluent, especially for families in major cities on the east and west coasts, where $100,000 doesn’t go far.

Top image: Luxury Daily