Articles and News

Affluents To Spend $31 Billion For Holiday Gifts in 2014 | October 15, 2014 (0 comments)

Alpharetta, GA—Affluent consumers are feeling fairly positive about their own future, but recent events in the world (ebola, Ukraine, etc.) that are rocking the stock market also are rocking some of their confidence, leaving them with an unsettled feeling.

According to the latest study by the American Affluence Research Center, 97% of affluent households are forecast to spend an average of $2,623 for December holiday gifts, which is about the same as last year, and represents a total of about $31 billion. 80% say they plan to spend the same or more than last year, according to AARC president Ron Kurtz; only 20% plan to cut back. But in 2013 the affluent spent 12% to 24% more than they had anticipated in AARC’s Fall 2013 survey, supporting the premise that people, especially the affluent, often tend to spend more for gifts than they had planned.

AARC’s assessment of current business conditions (index of 88) is essentially unchanged from the Spring 2014 survey, but five points below the Fall 2013 index. The index for future business conditions (107) declined 10 points from the spring survey and is five points below the Fall 2013 survey. The index for change in the stock market declined 21 points from the Spring 2014 index. While still remaining near or slightly above neutral territory, these indexes suggest some uneasiness, especially as global tensions and stock market volatility were highly prevalent during September, when the survey was in the field. Although stocks reached record highs in mid-September, increasing global tensions and the resulting volatility and declines in the stock market into October quickly dampened enthusiasm.

The composite ACE 12-month Economic Outlook Index (which is the average of the 12- month outlook for business conditions, the stock market, and household income) declined a substantial 10 points from the Spring survey, but remains three points above the Fall 2013 reading and is just below positive territory (99). This index is in neutral territory while the overall Consumer Confidence Index is slightly negative.

Affluents’ expected change in after-tax personal income (index of 93) rose a modest three points from Spring 2014 and is a strong 15 points above Fall 2013. Over a third expect their net worth (index of 121 versus 132 in Spring 2014) to be higher in September 2015. These are positive factors for potential increases in spending.

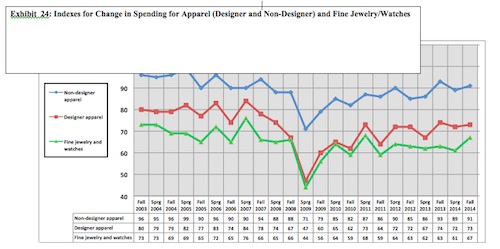

The indexes for change in spending for the 17 products and services tracked by these surveys are about the same as the prior two surveys in most cases. Of the 17 product categories, 11 were equal to or stronger than the Spring 2014 survey, but still only two (both vacation travel categories) are in positive territory, and seven are in the neutral range. This could suggest a decline in spending, although there was a small improvement of three percentage points in the number of affluent consumers planning to defer or reduce expenditures during the next 12 months—a record low for this reading.

The American Affluence Research Center's index for spending on jewelry and watches (green line) rose from its spring 2014 survey, close to tying its highest point since the recession.

The expenditure per affluent household for gifts is about four times that of all households as estimated by the National Retail Federation (which has forecast a 4.1% increase in total retail holiday gift sales for this year) and by PriceWaterhouseCoopers (which has forecast a 7% decline in holiday gift expenditures).

When given five choices as possible priorities for spending discretionary income, about 42% said they prefer to divide the discretionary income among durable goods, and local experiences or travel. This response did not vary significantly among the different demographic segments of the survey.

Here were the figures for fine jewelry and watches:

- The total index for those who plan to spend more on jewelry and watches this year was 67.

- The index was highest—79—for those ages 50-59 (see accompanying story). It was 68 for those under 50 and dropped to 60 for those over age 60.

- More men (index of 72) than women (index of 66) indicate an intention to change their spending on fine jewelry and watches as a holiday gift, vs. last year.

- Not surprisingly, plans to spend more in the category increase with income (<$200k, index of 63; >$200k, index of 72), and with net worth. Those with a net worth of $6 million or above were the most likely candidates to spend more in the category, with an index of 85.