Articles and News

Another Survey Shows What—And When—Affluent Consumers Plan To Buy For Holiday 2015 | September 30, 2015 (0 comments)

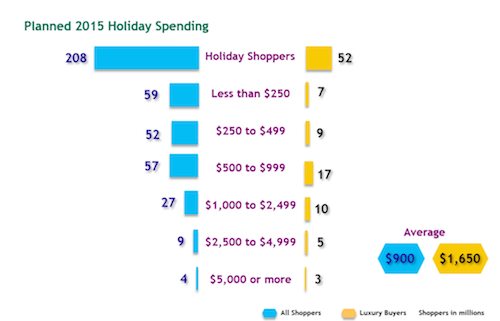

New York, NY—Luxury consumers will spend 83% more on their holiday gifts than the general population, according to a recent survey conducted jointly by Shullman Research Center and Kantar Media. The average holiday spend among all holiday shoppers will be about $900, while the average holiday spend for luxury shoppers will be about $1,650.

Calculating among an estimated total of 208 million U.S. holiday shoppers, Shullman and Kantar determined that approximately 52 million of those are luxury shoppers. Almost half of all luxury shoppers (46%) will spend the same or more than last year; only 9% will spend less this year than last year.

Luxury buyers tend to shop early—many start or even finish before Thanksgiving—or they’ll wait till well into December. The survey found they’re more likely to be Millennial males than any other demographic, and while they will be shopping at all manner of brick-and-mortar stores, they are likely to spend almost half (41%) of their total holiday budget online. But Bob Shullman, president of Shullman Research, cautioned that while the bigger share of shoppers are likely to be Millennials, the Boomer and Gen-X shoppers are likely to spend more because their income is typically higher.

Luxury consumers (yellow bars) will spend 83% more than non-luxury consumers (above), and almost half will spend the same or more than last year (below). Charts, Shullman Research Center.

Top holiday gifts among luxury shoppers include, in descending order, gift cards, personal electronics (i.e. smart phones and tablets), toys, jewelry, designer clothes or accessories, and designer or premium cosmetics and fragrances.

The Shullman/Kantar study also examined holiday marketing among both luxury brands and retailers. The marketing strategies for seven brands and seven retailers were reviewed as a guideline to what might happen this year. Key findings:

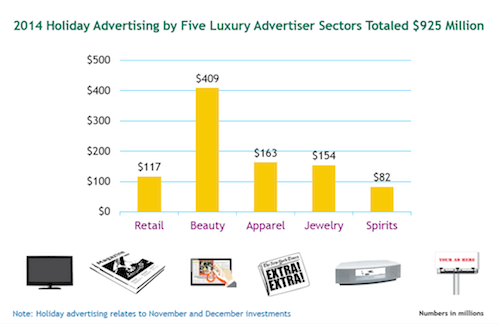

Beauty was the top-grossing category for ad spending, at $409 million. Apparel generated $163 million in ad spending, followed by jewelry at $154 million. Rounding out the top five categories in ad spending dollars were retail ($117 million) and spirits ($82 million).

Despite its reputation for stingy spending, the jewelry sector spent more in holiday advertising than many other categories in 2014. Chart, Shullman Research Center and Kantar Media.

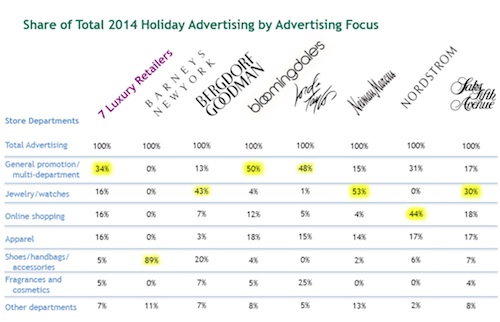

Among the seven luxury retailers Shullman and Kantar studied, six focused their spending efforts in print: four skewed heavily into newspaper and two into magazine advertising. Only one, Nordstrom, placed the bulk of its budget into digital advertising. And all but one—Lord & Taylor—didn’t bother doing much advertising during the heavily promotional Thanksgiving week, reinforcing the conventional wisdom that Black Friday isn’t a key event for luxury retail.

In terms of what the retailers advertised, three—Neiman Marcus, Bergdorf Goodman, and Saks Fifth Avenue—placed emphasis on jewelry and watches. Nordstrom used its budget to drive consumers online, while the others focused on general promotions or shoes and handbags.

Bergdorf Goodman, Neiman Marcus, and Saks Fifth Avenue focused the bulk of their 2014 holiday advertising on jewelry and watches. Source: Kantar Media

Among the seven brands studied, only one—Tiffany & Co.—put its heaviest emphasis on jewelry, not a surprise. Tiffany’s 2014 holiday ads focused mainly on bridal, with a theme of urban sophistication and ads showing iconic New York City images.