Articles and News

LATEST CONFIDENCE REPORT SHOWS BIGGEST UPSIDE FOR LUXURY May 15, 2013 (0 comments)

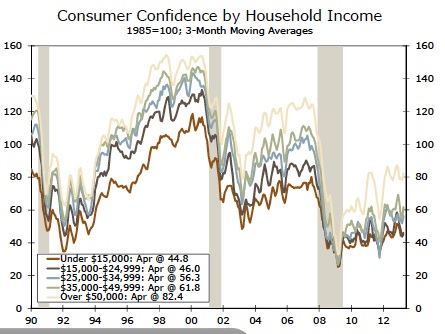

Merrick, NY—The Consumer Confidence Index rose sharply in April to 68.1, essentially reversing all of March’s decline. But nearly all of the gain came from the “future expectations” assessment, vs. “present conditions,” which barely nudged up 1.2 points. By contrast, the “expectations” assessment—driven largely by huge stock market gains—leapt 9.6 points to 73.3, its highest reading since last November.

A report from the Wells Fargo Economics Group says the numbers suggest a two-track recovery. The Fed’s exceptionally low interest rate policy is boosting asset prices dramatically, but has less impact on employment and earnings. According to the report, the S&P 500 is up 13.6% year-to-date and the S&P/Case-Schiller Home Price Index is up 9.3%. As such, the recovery is much more pronounced for those who own houses or significant stock portfolios—which skews to a higher income bracket ($50,000+, according to Wells Fargo). Not surprisingly, confidence has risen far more among these households than for those with lower incomes, and in turn has spurred spending at higher-end retailers and luxury auto dealers.

Chart: Wells Fargo Economics Group

Consumer attitudes among those with less than $50,000 in annual household income tend to more closely track the survey’s employment component series, especially the “jobs plentiful” index, which still has barely budged off its recession lows.

Still, says Wells Fargo’s report, the rise in the S&P still benefits those who don’t own stocks, because it tends to make workers feel more confident about the jobs they do have, and about potential future income growth.

Top image: intoxicology.net