Articles and News

Metals Focus: $1100 Gold Possible This Year May 14, 2014 (0 comments)

London, United Kingdom--Global gold and silver mine supply continued to rise in 2013, with gold growing 4% year on year and silver 5%, according to a first-quarter report from Metals Focus, a global precious metals consultancy.

Both metals continued to benefit from the ramp-up and start-up of projects conceived earlier in the commodities cycle. Gold mine supply is expected to rise again this year, but post-2014, the gold production outlook appears more uncertain and from 2015 could enter a period of decline. By contrast, the silver supply forecast is more positive, with further gains expected at least through 2016, albeit at a slower pace than recent years.

Gold experienced a sharp drop in recycling; the supply increases came primarily from mining. Demand increased approximately 17% in 2013, with the majority of the gains coming from jewelry and physical investment. Silver also saw a drop in recycling, and a demand increase of approximately 10%, mainly from physical investment and industrial fabrication.

Production cost inflation slowed dramatically in 2013, and for silver even reversed slightly.

Metals Focus expects gold production costs to remain contained this year, but costs for silver production may come under pressure.

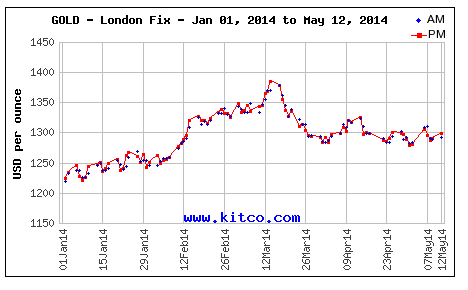

In terms of prices, following a poor 2013, this year’s start was strong but the organization believes the high for 2014 may already have passed and further decline from current levels is possible. “For gold, we therefore would not rule out a brief drop to around $1,100. It is a broadly similar picture for silver, in part governed by gold’s moves and so we expect the full year average to fall just short of $20,” says the group’s spring report. Their findings concur with other experts who last year identified $1,100 as a threshold to watch.

At press time, gold was trading at $1,310; silver at $20; and platinum at $1,483 the ounce.

Gold's price performance to date in 2014. Source: Kitco.com.