Articles and News

EXCLUSIVE CENTURION BRIDAL SALES SURVEY SHOWS $10K MINIMUM RING SPEND AT ONE-FOURTH OF STORES | May 02, 2012 (2 comments)

Merrick, NY—Luxury jewelers are bucking the trend on weddings: while recent research shows fewer couples getting married, and those that do spending less on their engagement rings than a few years ago, a recent Centurion survey of luxury jewelers shows that affluent couples still will make an investment in both the day and the ring.

According to figures from the most recent Centurion Bridal Sales Survey, conducted last month, more luxury jewelers are reporting the $10,000+ category as their best-selling price point for engagement rings, and more than half say their typical engagement ring sale is higher now than it was a few years ago.

More than one-fourth—27.8%—of respondents said their best-selling engagement rings are those costing more than $10,000. 22.2% each cited rings between $3,001 and $5,000 or $5,001 and $7,500 as their strongest category. But the survey showed some fall-off in rings priced between $7,500 and $10,000; only 16.7% of respondents say this is their strongest category. These findings suggest that luxury jewelry, like many other categories, has seen a drop in aspirational shoppers, while both value and super-luxury prices are solid.

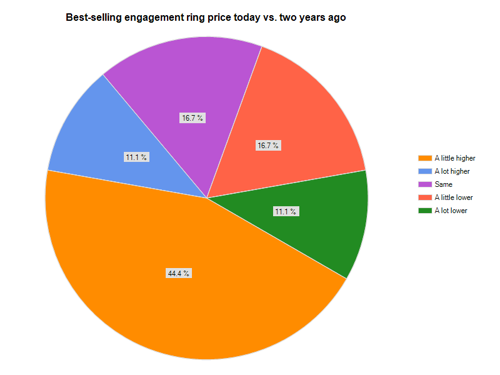

Most jewelers have seen a slight increase in engagement ring spend over the past two years (yellow slice). Some have seen a significant jump (blue slice) while others say the typical spend has stayed fairly static (purple slice). But 16.7% of respondents say couples are spending a bit less on the engagement ring now than they did two years ago (red slice) and 11.1% have noticed marked declines in DER spends (green slice).

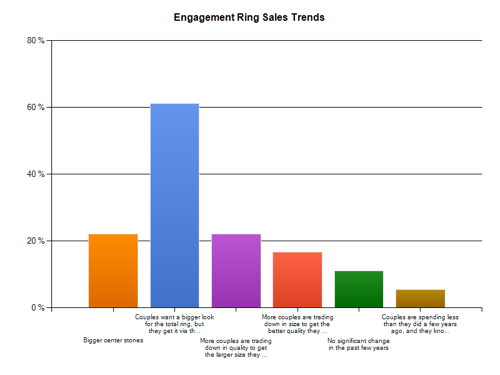

A major trend in engagement rings the past few years has been a shift in emphasis from the center stone to the setting, say jewelers. While size matters (22.2% of respondents say they’re selling larger center stones today than two or three years ago), almost two-thirds of respondents—61.1%—say couples are focusing more on getting a big look via the setting than the center. Indeed, when asked to name their best-selling size for a center stone, a surprising two thirds of respondents said it was one carat or smaller. According to The Wedding Report, the average engagement ring is 1.18 cts., so the Centurion figures suggest that affluent brides aren’t necessarily getting the supersized ring one might have assumed they were. One-third of luxury jewelers surveyed by The Centurion said their best-selling center stone size was more than one carat, but most of those still cited stones of 1.5 carats or less.

Speaking of settings, respondents unanimously say it’s diamond or nothing. The fashion world may be seeing the “Kate Effect” in sales of wrap dresses, nude pumps, and skinny jeans inspired by the simple, elegant style of Kate Middleton, the Duchess of Cambridge, but jewelers aren’t seeing it in engagement ring sales. The new duchess is every bit as much of a fashion icon as the late Princess Diana, whose sapphire-and-diamond ring she inherited upon her engagement to Prince William. But while a replica of the ring sold out in costume jewelry form after the couple’s engagement was announced, it’s not having much impact on traditional diamond bridal jewelry.

Non-branded bridal jewelry still sells best, with 94.1% of respondents indicating it’s the bulk of their business. But branded or designer lines are a close second; 88.2% of jewelers say those account for a significant chunk of bridal business. Almost one-fourth of respondents credit custom design for bringing in between 10% and 20% of their bridal sales, but vintage or estate jewelry accounts for only incremental bridal sales in most stores.

The overwhelming trend in the past few years has been an emphasis on the setting, rather than the center stone. More than 60% of respondents say couples expect the setting to provide the big look they want (blue bar). 22% of respondents each say they are selling bigger center stones, but seeing couples trade down in quality to get the size they want (purple bar). About 18% of respondents (red bar) say couples will sacrifice size but insist on quality, but relatively few jewelers say couples still don't want to settle for a smaller ring to stay within in their budget (brown bar). About 10% (green bar) say the makeup of their engagement ring business hasn't changed appreciably in two years.

What role does advertising play in driving desire for a luxury bridal brand?

According to respondents, it's significant. 26.7% of respondents say it's not uncommon to lose a sale over a particular ring—the customer comes in with an ad or a photo of a particular ring and they will consider no other, so if the jeweler doesn't have or can't get that ring, the customer will leave. One-third of respondents say they're usually able to sell the customer on something else—often even another brand—and another third say customers often come in with a brand in mind but not a particular ring.

The top-selling bridal brands among respondents were Hearts on Fire, Simon G. and Tacori. Other mentions include Verragio, Kwiat, Coast, JB Star, Kattan, Parade, and 2012 Henry Daussi.

Age-wise, luxury jewelers' bridal customers track fairly closely with the national average (average age at first marriage is 28, according to TheKnot.com), but 37.5% of respondents to the Centurion survey have a slightly older (and presumably more affluent) bridal clientele, typically early thirties.

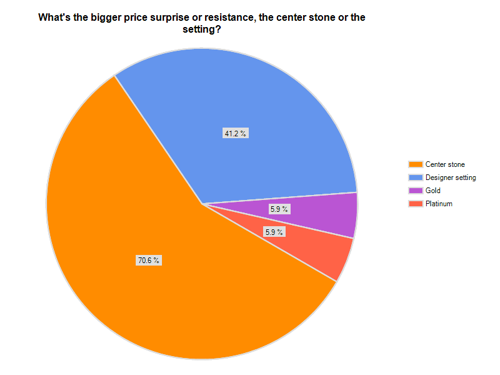

Just because they have more money doesn't mean luxury bridal customers aren't taken aback by what they perceive as high prices. 83.3% of respondents say their bridal customers "often" are surprised by the price of a nice ring. 70.8% of respondents say the biggest surprise is the price of the center stone, while 41.2% say it's the price of a designer setting. But despite the current flurry of news about gold prices, jewelers say their customers are curious but rarely put off by the price of either gold or platinum. It's still the diamond or the setting that gets the most price resistance.

When it comes to getting the customer in the door, jewelers say it's still the old fashioned word of mouth—a referral from family or friends. But in the absence of familial advice, the next most popular that customers end up in a particular store is because of an online search, including mobile.

Local print or broadcast advertising still works best for 27.8% and 22.2% of respondents, respectively, and 11% credit Facebook with driving traffic.

Finally, as more states legalize same-sex marriage, jewelers are benefiting. 89% of respondents say they've served same-sex customers at least occasionally, if not frequently.