Articles and News

EXCLUSIVE INTERVIEW: TOP ECONOMIST SAYS HEALTH OF BUSINESS SECTOR EXCELLENT; INVEST, BUT WITH CARE | January 23, 2013 (0 comments)

Bethlehem, PA—The economy this year is expected to continue its expansion, albeit slowly. In an address to the Lehigh Valley Chamber of Commerce, Dr. Jay H. Bryson, managing director and global economist for Wells Fargo Securities, said that 2013 will be “halfway decent, but not great,” especially in the first half as all consumers adjust to new taxes and see a bit less in their take-home pay. The luxury sector is--and should remain--strong, but higher taxes might impact some spending there too.

On the upside, Bryson feels there’s little chance of another recession, unless the United States as a nation does something stupid like default on its loans. Employment is improving, growing at about 1.5% per year, but is still only about halfway back to the employment levels of 2009, he said. Housing prices have stabilized and are not dropping further--but they haven’t recovered to pre-recession levels. Housing starts, however, are up 20%. Though only 2% of the economy now compared with 6% at the height of the real estate bubble, it’s nevertheless trending in the right direction.

The health of the business sector is excellent, said Bryson. Revenue levels among state and local governments also have stabilized and are improving, but restrained Federal spending remains a headwind to growth. Other potential headwinds are more global: Europe’s problems have been duct-taped but not fixed, and China’s rocketing growth has slowed. Global growth, which had been averaging 3% to 4% per year, is likely to be slower in 2013 as well.

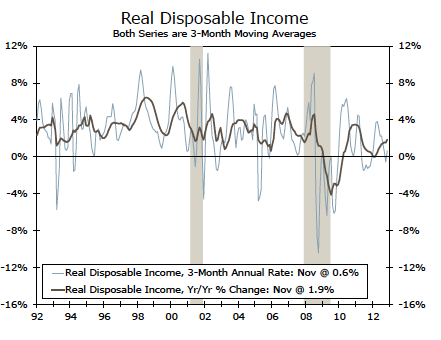

But what matters most to luxury jewelers is income growth and disposable income, which of course translates to purchasing power. Income growth is averaging about 2% growth per year, compared with the 3% growth in the last economic cycle (before the recession). But, says Bryson, when two-thirds of your economy is based on consumer spending, slower growth in income means slower growth in the economy.

This chart from Wells Fargo's economics group shows disposable income growth at approximately 2%.

“Overall, caution is still advised. Don’t get a bunker mentality and jump in a foxhole and cover. Do invest in business, new deals, and new equipment, but just stress-test your assumptions. If you assume 15% growth, also run a “what if” scenario if growth is only 5%.”

In an exclusive interview with The Centurion, Bryson said the one thing luxury jewelers might want to keep an eye on is the implications of the new higher taxes on their customers. Luxury has done fairly well against a backdrop of subdued consumer spending, he said, and in general the top end always continues to do well and those consumers always continue to work unless things get “really bad.” But with taxes going up for consumers with income above $400,000 for a single filer and $450,000 for married filers, it may impact their disposable income. Or, he added, it may not, if the business they’re in is doing very well.

But Millennial consumers—the generation jewelers need to cultivate as the Baby Boom moves toward retirement—are facing a somewhat grim employment picture, and wealth may come much later to these consumers. While there are some digital and financial wizards who were millionaires before age 30, that’s not the norm. It’s a generation that at the moment quite embodies the old adage of having champagne tastes on a beer budget. They’ve grown up with and desire luxury brands, but for many, post-college reality means they can barely afford to move out of their parents’ house, let alone buy a Rolex.

“For every Mark Zuckerberg (the billionaire founder of Facebook), there are lots of Millennials who are struggling,” Bryson told The Centurion. Unemployment for recent Millennial college graduates (seasonally adjusted) is currently about 8%, comparable to the national average of unemployment, but almost double the unemployment figure among all college graduates, which stands at about 4%.

But the Millennials grew up consuming, and the good news is that Bryson does see this generation returning to consumption once things improve.

“Millennials are not going to become the next Depression-era generation. They’re not going to be scarred for life. That was a much worse situation—21% unemployment, vs. 8% now.” But for Boomers and Gen-X, closer to retirement age, Bryson said they already know what the new reality is: they will have to either work longer or scale back on spending if they want to retire comfortably.

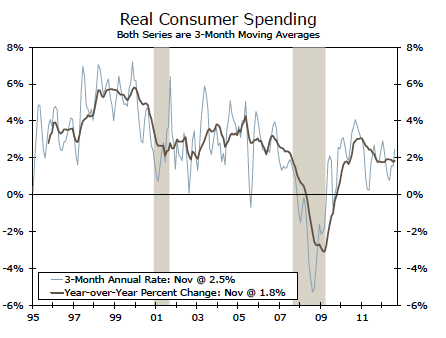

Real consumer spending (which takes into account volume, not just growth due to price increases) is up about 1.9% year over year, just shy of the 2% gain in personal income. Consumers are not adding revolving debt. Source: Wells Fargo

Will we ever see a return to the kind of rampant consumerism that marked much of the early part of the 21st century?

“At some point, yes. In 2013 or 2014, no,” Bryson told The Centurion. Consumers are continuing to deleverage and live within their means, which is good for the economy long term. The amount of revolving debt is not growing, but the amount of non-revolving debt is growing, driven somewhat by big-ticket spending like automobiles, but more by student loans, both among Millennials and among older people trying to retool themselves for a new career.

Finally, more good news: the jewelry sector has not only held strong but outperformed general retail not just at holiday but throughout all of last year. Growth in the sector rose 3.4% year-over-year through the third quarter of 2012, compared to 1.9% growth in all goods for the same period, according to Sarah Watt in Wells Fargo's economics department.