Articles and News

LEADING RETAILERS OFFER TIPS ON PROFIT AND PLANNING | February 13, 2013 (1 comment)

Scottsdale, AZ—“Financial management is not just profit and loss.” With that statement, Don Grieg of Focus Business Management Institute, opened a morning panel discussion titled “Financial Management and Your Company,” during the Centurion 2013 Show. Panelists were Kim Murphy of Murphy Jewelers, with three stores in eastern Pennsylvania, and John Jackson of Smyth Jewelers, a multi-store operation based in Timonium, MD. The company operates three stores under the Smyth name, plus a series of Pandora boutiques, and in September took over management of the nine-store Bailey, Banks & Biddle chain.

Grieg began with an example of a hypothetical prestige jewelry store doing $2 million in annual sales. At keystone, the cost of sales is $1 million, leaving $1 million in gross profit. Fast selling merchandise typically sells in less than 90 days, and is responsible for generating 70% to 80% of a store’s volume, he said, warning that if it doesn’t sell in 90 days, there’s a good chance it will never sell. As such, he recommended that 70% to 80% of a store’s merchandise dollars go to fast sellers.

“This industry works with no cash!” he exclaimed. It takes $25,000 worth of merchandise to achieve $100,000 worth of sales, he said, and keystone isn’t enough of a markup. A store needs a markup of at least 140% to be profitable.

Murphy said the most important part of successful financial management is to have a plan.

Retailers Kim Murphy and John Jackson shared their financial management expertise.

Every year in January, Murphy Jewelers sets down “Our Plan for Profit and Success,” which evaluates everything from inventory to pricing to sales goals. Are inventory levels in line? What are the goals for the year? The month? Every day? For every sales associate?

The plan also includes detailed vendor reports. What are the stores’ sales goals for the top 10 vendors? What are staff sales goals by vendor? What’s the plan for underperforming vendors, to make room for new vendors? What’s the plan for dealing with aged inventory so that money is freed up for the open-to-buy?

Then she forecasts by category; i.e., bridal, fashion, watches, etc., to accurately forecast an open-to-buy for each.

“We may have to adjust our numbers each month, but we have a plan,” she said. “And we have a plan to pay down debt,” she added.

But all those numbers can make anyone’s head spin, she acknowledged, and admitted she doesn’t like reading endless spreadsheets either.

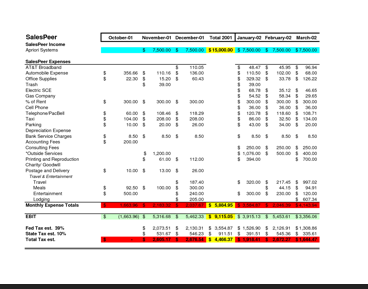

“I’m not an accountant, and I’m not our controller. Pages of Quickbooks figures don’t do it for me,” she admitted. Instead, she asks the controller for a weekly “flash report,” which gives her cash on hand, inventory on hand, outstanding invoices and purchase orders, and operating expenses—spelled out in plain English, not accountant-ese. Then every quarter, she sits with the company’s accountant to review benchmarks: this quarter vs. last quarter, and year-over-year figures by quarter. She looks at payroll, the ad budget, and anything that requires signing a check.

Kim Murphy doesn't want to read pages and pages of spreadsheet. Instead, her team prepares a weekly "flash report" with key figures.

Jackson pointed out that the rapid pace of change has more affect on a jeweler’s finances than many would think. “Trends change so quickly. We think we know what young people want, but it changes so fast with Facebook, Pinterest, and so forth.

“You have to stay on top of trends to reorder your fast sellers, and if you don’t have cash, you can’t stay on trend. You have to stay on top of it!” he emphasized. “If it doesn’t work, send it back!” he continued. “Their [the vendor’s] top sellers may not be your top sellers.”

Grieg again addressed the topic of markups. Repeating his earlier point that a jeweler needs a 140% markup to stay profitable, he acknowledged that isn’t possible with every line or every product, but said the jeweler then has to find other lines and categories that make up for the ones that don’t.

“A $1 million store should be generating $350,000 in profit; a $2 million store, $600,000 in profit,” he said.

“We have what we call our ‘signature product,’ which is non-designer and non-branded,” said Murphy. “That’s where you can get your markup.”

“You have to adjust your prices accordingly, on every delivery and all product,” emphasized Jackson. Especially with metals prices climbing, it’s imperative to re-price pieces already in the store. When it comes to returns, Jackson echoed some of the same comments heard in other sessions: do it immediately as soon as you see something isn’t going to sell. Don’t wait till the next tradeshow.

“Lots of stores wait too long to swap. We bought lots for holiday, but what didn’t sell is still current for them [vendors] and can be a good seller for them elsewhere. We want to swap it out for what does sell [here]. [Jewelers] often wait till a show and come with their sales report. The vendor turns white as a ghost because they come in with $20,000 in stock to return. But if you do it as it happens, it’s not that bad—and you also avoid the risk of the vendor saying they can’t take it back because it’s not current for them.”

The subject of bridal sales and discounts—a common theme—also came in for discussion on this panel.

David Cornell of Cornell’s Jewelers in Rochester, NY, asked the panelists whether they advocate using sample pieces or live merchandise to sell bridal jewelry.

Said Murphy, “We look at it as live samples. When we do our bridal inventory, we look at how many orders are placed off a piece, not just how old it is. We look at how often it turns (with orders). A live sample needs a three or four time turn.” But she said the Murphy sales team also was relying on discounts to close bridal jewelry sales, which was something the management had to get a handle on and fix.

“[Discount] is the easiest close, and customers are trained to ask for discounts, but sales managers have to tell their people to sell on features, benefits, and value,” added Jackson.

“The minute you stop discounting, the more people trust you,” added moderator Grieg. He has a point: French luxury goods maker Hermès just announced record profits; the brand maintains its exclusivity by limiting production and never discounting or having a sale.

Cornell pointed out that upscale specialty stores like Saks and Neiman Marcus get around the risk of being too promotional with “friends and family” discount cards. Luxury stores in the same market, like his, often feel they have to acquiesce and meet the same price.

Jackson suggested price matching be done on a case-by-case basis. “If it’s a long-time good customer, yes, of course, do. But if it’s not a long-time customer and is someone who is just a price-shopper, you’re not going to get their loyalty anyway, so think about it.”

Murphy’s has its own “friends and family” event once or twice a year, said Kim Murphy. “People will take advantage of the event, but they will pay full price [other times] too.”

Top image: jdfletcherassociates.com