Articles and News

Exclusive! MasterCard Exec Tells Why Luxury Jewelry Is Suddenly Booming And Will See Huge Growth | June 24, 2014 (0 comments)

Purchase, NY—Fine jewelry costing more than $2,000 has been a very strong retail category for the last six months, and it’s only going to get stronger, says the latest data from MasterCard Spending Pulse. Even better, independent jewelers own the market. According to MasterCard’s data, 83% of all fine jewelry sold is sold in independent jewelry stores.

“People want something that’s permanent and is going to last, rather than throwaway items,” says Sarah Quinlan, left, senior vice president of market insights for MasterCard Advisors. In an exclusive interview with The Centurion, Quinlan outlined some of the key trends MasterCard Spending Pulse has been tracking, and why the data is pointing to a boom in jewelry spending while apparel spending lags.

MasterCard’s data shows all three major generational cohorts—Boomers, Gen-X, and Millennials—are contributing to the boom in fine jewelry. Millennials—who haven’t yet reached peak affluence—may be spending less per purchase, but they’re very attuned to buying it.

Quinlan says fine jewelry is part of the trend toward experiential spending, vs. the mere acquisition of objects. While purveyors of many luxury products already feel threatened by the shift toward spending for experiences rather than “things,” Quinlan says fine jewelry actually fits the experiential category because of the emotional significance it carries that other goods don’t.

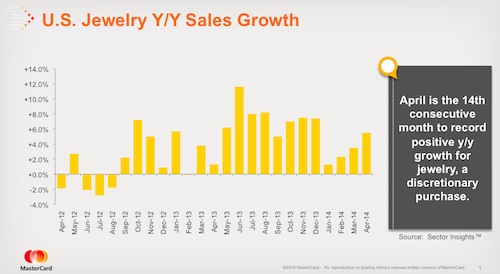

This chart from MasterCard Advisors shows jewelry growth in positive territory since March 2013, and with the exception of February 2013, it has been in positive growth territory for 19 of the past 20 months.

Boomers and Millennials are focused on experiential spending for different reasons. For Boomers, it’s a maturing process: with the youngest Boomers turning 50 this year, they’ve acquired all the things they need by now. But for Millennials, it’s further evidence of a trend away from home ownership and toward a more mobile, urban existence.

Everything changed after 2008, says Quinlan.

“Millennials watched their parents’ jobs of 20+ years blow up in their face. And they also know their own jobs may not stay in one place, so they’re less likely to put down roots and buy a house because they need to go where the opportunity is,” she says.

Of the oft-discussed “boomerang” trend—Millennials moving back home—that’s true, says Quinlan. But what many people fail to realize is that often the parents really aren’t in a position to help out their children beyond allowing them to continue to live at home, and it also may not be forever, as this generation will readily move where the opportunity is.

“We’re in the Northeast, among many fairly high-earning families, so we get a skewed view, but across the country, parents more often really can’t help the children out,” she told The Centurion.

So if the kids can’t afford to move out of the basement, how can they afford a Rolex?

Simple. They’re not buying homes and, increasingly, not buying cars, either. So they move down to the next level of major spending, and they still want something that feels permanent, says Quinlan. They may not be earning gobs of money, but they’re not earning zero, either, and if they’re not saving up for a house, what are they doing with it?

Enter fine jewelry and watches, along with vacations and dining out. “Casual dining is through the roof,” says Quinlan. “They’re getting together with their friends and having fun.” Or they’re taking vacations and romantic getaways that leave lasting memories.

This already is a group that doesn’t define success the way their parents did, says Andrea Hill of Hill Management Consultants. So it’s not surprising that they don’t care as much about climbing the corporate ladder as much as they care about having work they enjoy and time to build a life they perceive as meaningful.

It’s also not surprising that they often would rather rent than own a home or car. In addition to watching their parents’ formerly-secure jobs blow up, Millennials also saw lots of formerly-valuable real estate go upside down in 2008, so they’re not as convinced of the long-term value of real estate as an investment. And with many also carrying huge student-loan debt, it’s no guarantee they would qualify for a mortgage anyway.

Without home ownership, consumers also don’t feel the need to invest in a lot of furniture, freeing up more disposable income for jewelry. Instead of investing in a new couch they may have to pay to move or that doesn’t fit the new space after they do move, they’ll invest in throw pillows to dress up the couch they have, explains Quinlan. Accessories are it in both home and personal adornment.

Fast fashion is so last decade! One trend that has had jewelers worried is Millennials’ focus on fast fashion and its seemingly insatiable appetite for new electronic gizmos. In their book, Gen Buy, authors Kit Yarrow and Jayne O’Donnell highlighted the difference in what a high school senior in 1978 vs. 2008 owned. The former had a few pairs of jeans and a few sweaters to last the school year; the latter bought a new outfit for every event and discarded it a few months later, resulting in a wardrobe that turned over several times a year. Jewelers were truly concerned about how to sell costly luxury to a consumer who didn’t want to wear the same thing twice.

But teen apparel is really struggling now, says Quinlan—year over year sales are down significantly, and younger consumers increasingly value something that will last and can be handed down. Again, enter fine jewelry.

“My daughter never used to talk about nice watches, and now she does. And she just loves Hermés bracelets, so I know that I can always get it right if I give her one for a gift every holiday,” says Quinlan. That ease of gift-giving is another selling point for fine jewelry: parents and significant others don’t have to worry if they got this year’s outfit right, because buying a nice bracelet has meaning and will last.

As for electronics, the category has hit a plateau in terms of innovation, and sales have slowed accordingly. People aren’t replacing their phones nearly as often, and prices have come down because it is such a commodity. Last year the [overall] discount was 21% on electronics, says Quinlan.

“There’s just not enough change in the product [to drive sales],” she told The Centurion. Also, advances in digital technology and use have sharply curtailed sales of ancillary electronics like printers, since coupons and even boarding passes now can be delivered and used electronically. And with more Millennials moving home or sharing housing with roommates—not to mention streaming entertainment—fewer consumers need cable subscriptions.

Price sensitivity drops. Consumers are loyal to their family jeweler, says Quinlan, and in all of MasterCard’s studies, she’s seen a significant drop in price sensitivity across all generational cohorts, including the famously discount-hungry, phone-surfing Millennials.

“When people feel like they’re getting good value for the money, they’re price insensitive,” she says.

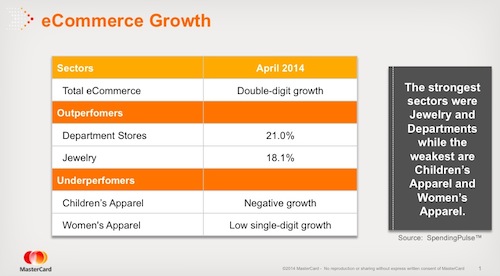

At the FT Business of Luxury Summit last month in Mexico City, Quinlan said 17% of fine jewelry sales come through online channels. This figure still lags behind overall retail, where fully one-fourth (25.3%) of sales come through online channels. Customers also tend to be loyal to one or two favorite brands/retailers per category.

But counterintuitively, another trend her data shows is that consumers are actually willing to pay more online than they might in brick and mortar stores.

E-commerce winners are department stores (i.e., department store websites) and jewelry; losers are women's and children's apparel. Chart: MasterCard Advisors

“Online, people want to buy from someone they feel comfortable with, that they trust and they feel secure about storing their [credit card] information with,” she says. But even in brick and mortar stores, convenience matters, as well as service and the overall shopping experience. People who don’t own cars depend on goods that are accessible, so they’ll pay the extra for them.

Overall, MasterCard’s data concurs with other economists who’ve said the U.S. economy has rounded a corner.

“Spending will continue to accelerate the rest of the year. We’ll see acceleration in all sectors, including jewelry,” says Quinlan.