Articles and News

Holiday Season Brings Mixed Results But Total Year Was Good For Luxury Jewelers | December 30, 2015 (0 comments)

Merrick, NY—Luxury jewelers across the United States reported mixed results for holiday sales, but the year overall turned out well for most.

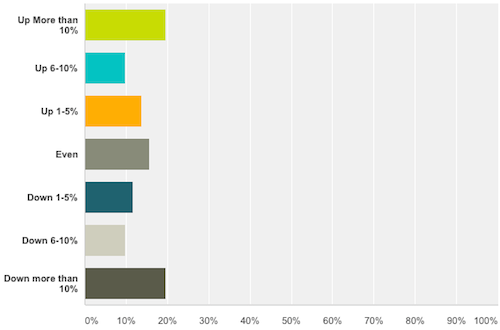

According to the Centurion 2015 Holiday Sales Success Index, 19.6% of respondents said their holiday sales grew significantly—more than 10%—over last year’s holiday. But an equal number saw declines of more than 10% over last year. In total, 58% of respondents were at least even or somewhat ahead of last year’s holiday sales figures, while 42% experienced a drop in holiday sales.

“How crazy is business? We had greater revenues on Dec. 22 than we had the entire month of November!” wrote one respondent in New Mexico. But another jeweler said November sales rocketed up 11% over the same period last year—while December dropped 5%. Together, however, the two month period was “almost dead even” with last year,” he wrote.

Those who did well attributed it to good promotions and advertising. “New location and much better exposure! Did more advertising and got a huge amount of new people through the door!” said one.

"How Was Your Total Business For The Holiday Season 2015 vs. 2014?"

Total holiday season sales results for prestige jewelers were more mixed this year than last year.

More than a few stores observed attributed this year’s smaller holiday to the absence of a few good customers or big sales that pushed them over the top last year, and a larger volume of smaller sales seemed to be the trend this year for many respondents. Local economics--particularly in areas heavily dependent on the oil and gas industries--played a role in lower sales for many jewelers. Yet an impressive two-thirds of stores reported five- and six-digit sales: of these, 17.6% reported their single biggest sale was more than $100,000, and 29% said their biggest sale was between $50,000 and $100,000. The biggest sale reported was $200,000; for a radiant-cut diamond ring.

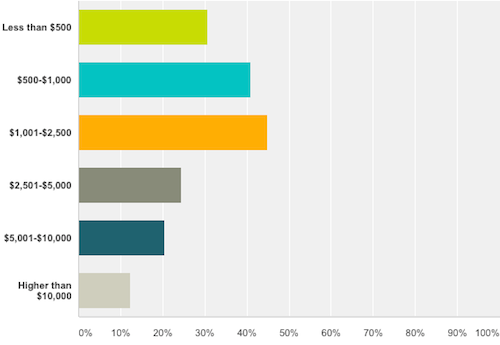

Overall, the best-selling price points among luxury jewelers for this holiday season were from $1,001 to $2,500, unchanged from last year. 45% of respondents said this was their strongest category in 2015, compared to 62% last year. But whereas last year the remaining responses were spread evenly between lower and higher prices, this year the strength was in the lower end: 41% said their best-selling price points were between $500 and $1,000 and 30% said their best-selling price points were under $500. 24% said they did best with pieces priced between $2501 and $5,000; 20% between $5,001 and $10,000, and 12% said their strongest category was big-ticket items costing more than $10,000.

By comparison, in 2014 the number of jewelers reporting their strongest sales between $2,501 and $5,000 was slightly higher than this year—28% vs. 24%, but the number of jewelers who reported very high-ticket goods were their best sellers grew this year: 20% said their best sellers were priced between $5,001 and $10,000; fewer than 15% cited this category last year. And 12% this year said their best sellers carried five-digit price tags, compared to only 5% last year.

"What Were Your Best-Selling Price Points For Holiday 2015?"

The best-selling category for holiday 2015 is unchanged from 2014: goods between $1,001 and $2,500 (orange bar). But this year more stores reported gains on the lower end, while the total number of stores reporting very-high ticket sales also increased significantly over last year.

Unsurprisingly, diamond jewelry of all kinds—including natural color diamonds—was the best-selling category for luxury jewelers this holiday season. Brands singled out most as best-sellers in descending order: Rolex, David Yurman tied with Pandora, Forevermark tied with Hearts On Fire, and Roberto Coin tied with Marco Bicego. But the majority of respondents cited a variety of brand and designer names, showing the trend for branded jewelry is solid and growing.

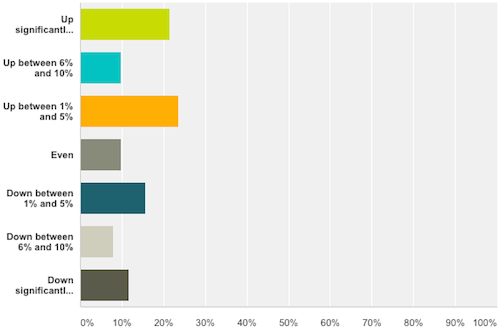

But the year overall was solid for prestige jewelers: almost two-thirds (65%) of respondents said their total year business was at least even or ahead of last year, which was a very strong year. Of those, 21% said their total year sales were more than 10% higher than 2014. 10% were ahead between 5% and 10%, and 23% saw more modest gains between 1% and 5%.

"How Was Your Total Year Business for 2015, vs. 2014?"

It wasn't the strongest holiday season, but more prestige jewelers reported a good year overall than an off year.

In the total retail picture—all consumer goods, not just luxury or jewelry—sales eked out a respectable showing for holiday 2015. Early indications, especially on Black Friday, had analysts worried but a late season rush and strong online sales pulled the season up to meet predictions of 3%-4% gains. The off-price sector was the big winner, says a report in Women’s Wear Daily, as “shoppers displayed an accelerated flight to value-focused venues.”

A report from the National Retail Federation said total sales were down—but the drop was due to lower prices on consumer goods, not fewer shoppers. General retail prices are about 2.9% lower than the same period last year, which means consumers can buy more goods for the same expenditure, but retailers earn less revenue.

This was the season that online really flexed its muscle, and Amazon smashed all records with a holiday season that Time magazine called “insanely successful.” The downside was that delivery services such as FedEx and UPS had a hard time keeping up and some disappointed consumers got a late delivery notice rather than a wrapped package for Christmas.

What will 2016 bring? Consumer confidence rebounded in December to 96.5, according to the Conference Board. Attitudes about current conditions improved, especially consumers’ view of the labor market, which had been trailing actual data showing stronger job growth, fewer layoffs, and a declining unemployment rate.

Top image: Midwest Dramatists