Articles and News

NEW SURVEY FINDS AFFLUENTS REMAIN CAUTIOUS BUT WILLING TO SPEND FOR LUXURY GOODS | April 24, 2013 (0 comments)

Alpharetta, GA—Findings from the latest American Affluence Research Center biannual survey of affluent consumers show most won’t curtail purchase intentions because of higher income taxes. Although the number of respondents who expect their personal after-tax household income to drop because of higher taxes, most did not feel it would impact their lifestyle significantly.

The AARC survey is conducted every spring and fall among the wealthiest 10% of Americans. Surveys were sent to a random national sample of 4,500 households with a minimum new worth of $800,000.

Affluents’ assessment of current business conditions rose 18 percentage points from the fall 2012 survey, conducted in October. But AARC president Ron Kurtz says the spring ratings in both 2011 and 2012 were higher than the subsequent fall ratings each year. This spring, respondents’ ratings of business conditions as “positive’ rose by eight points, “neutral” by two points, and the “negative” rating fell by 10 points.

Affluents still remain cautious. The index for future business conditions dropped eight points below the fall survey. Kurtz told The Centurion it reflects an expectation of limited improvement from a poor starting point, and is consistent with the March Consumer Confidence Index from the Conference Board.

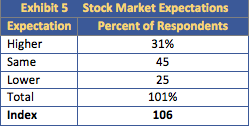

But affluents feel good about the stock market. More than three fourths of respondents (76%) expect the stock market—which has enjoyed record highs—to be the same or higher in the next 12 months. Only 25% expected it to go down.

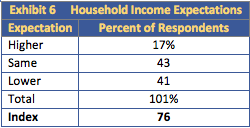

Affluent consumers told AARC researchers they feel good about the stock market, left. At right, the percentage of respondents who anticipate their income will be higher, the same, or lower this year than last. Charts courtesy AARC

This can be good news for jewelers, as industry analyst Ken Gassman has often said that the bottom line of people’s investment portfolio is a better indicator of their willingness to spend than other factors affecting the jewelry market such as the price of gold.

42% of respondents plan to make one or more purchases in the following categories: auto, major home remodeling, cruise, power or sailboat, purchase or build a new home as either a primary or vacation residence.

Luxury jewelry and watches. In the jewelry and watches category, the purchase index remained essentially unchanged from fall 2012. 55% of respondents plan to spend the same on jewelry or watches; 4% plan to increase spending in the category, and 42% believe they’ll spend less in the category this year.

The index for the jewelry and watches category has shown a gradual but continued decline, though it still remains far above its record low in spring 2009 and is only a few points below prerecession levels.

Kurtz says respondents’ age and corresponding life stage may be the key factor driving the slow decline. Research has shown that after age 50, luxury consumers tend to shift spending from “things” to experiences.

“I think it’s a combination of both [the economy and life stage] but more about lifestyle, given the age of affluents. Where the money is, is among the older demographic,” Kurtz told The Centurion. 65% of the AARC survey respondents were Baby Boomers, 18% were Gen-X or Millennial, and 18% were over age 70.

But here’s a key figure: among the 18% representing Gen-X and Millennials, only 2% were under age 40 (the survey didn’t break out further by age under 40). The eldest Millennials turn 35 this year, so the figure suggests very few have reached the top 10% of affluence.

By age, those 50-59 planned to increase spending on jewelry and watches the most; next, those under age 50. Affluents over age 60 plan to spend the least on jewelry and watches this year. By income, those in the lowest group (net worth between $800,000 and $1.5 million) and the highest (net worth over $6 million) plan to spend the most for jewelry or watches. Those in the middle (net worth $1.5 million to $5.9 million) plan to spend the least.

Competing for share of wallet. The biggest winners are travel and home. 25% of respondents will spend more this year on domestic vacation travel and 23% will spend more on international vacation travel.18% plan to increase spending on home furnishings, 17% on major appliances, 16% on home computer equipment, and 15% on home entertainment (i.e. TV, home theater, etc.)

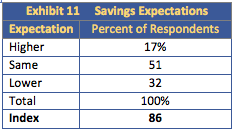

Saving vs. spending. In the past 12 months, 24% of respondents made a conscious effort to reduce or defer expenses. 20% will do so in the next 12 months. But younger affluents seem more optimistic than their older counterparts. The percentage of younger affluents that will reduce or defer expenses in the next 12 months is significantly lower than who did in the past 12 months. Among older affluent consumers (age 60+), the trend is exactly the opposite.

AARC's research found 68% of respondents expect their savings level to remain the same or higher this year than last year. Only the oldest group anticipate their savings to be lower. Chart: AARC

Mobile technology and social media use among affluents. Each season, AARC examines a particular category in depth. This spring’s survey addressed smartphones and tablets, as well as affluents’ social media usage and online shopping habits.

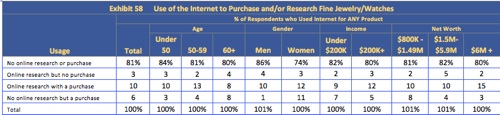

Among total respondents to the American Affluence Research Center survey (first data column, headlined "total"), 81% said they bought jewelry and watches in the last year without consulting a computer. 3% did online research but didn't buy, 10% did online research and did buy online, while 6% bought online without researching the purchase first. In subesquent columns, the data breakout varied relatively little by age or income level.

More than 80% of respondents own a tablet, smartphone, or both. Apple products (iPhone, iPad), far outweighed competitors—iPad ownership among affluent consumers is more than five times the combined ownership of Android, BlackBerry, or other devices; iPhone ownership is more than double the combined ownership of all other smartphones. Smart device ownership is lowest among the oldest respondents.

Facebook ranked number-one in social media usage, followed by LinkedIn and Google+. But “none” ranked far higher than Twitter, Pinterest, or other sites.

Of any social media used to receive regular communications from a retailer or brand, the overwhelming choice was “none.” But of those that do receive communications from a retailer or brand via social media, Facebook was the top site. Google+ came in second—but oddly outranked Facebook among the ultra affluent (net worth above $6 million) and the oldest affluents (age 60+).

But Kurtz believes this may be an error. He believes the oldest or most affluent—the demographic where usage spiked—are confusing Google+, the social site, with Google the search engine.

“It’s just too much of a deviation from all the other data, and there’s no real reason,” he told The Centurion.

Something Kurtz found interesting was online research done prior to purchasing a product. Most affluent consumers do research online before buying a product—but the percentage of online research hasn’t increased since 2003, and in some cases, even declined a few points.

But purchasing online has increased, says Kurtz. “Maybe the amount of research they do online hasn’t changed, but they are more comfortable making the purchase there.”

For the jewelry and watch category, only 10% made a purchase online after researching. The overwhelming choice of affluents buying jewelry is still brick and mortar—62% of those who bought jewelry in the past year did so in a store, while 38% bought it by computer (the survey did not break out whether they bought it from a pure-play e-tailer or the website of a brick-and-mortar store.) No respondents bought jewelry by phone or mobile device.

Top image: Par Excellence magazine