Articles and News

RAPAPORT SAYS DON’T FEAR THE DRAGON OR TIGER | February 02, 2012 (0 comments)

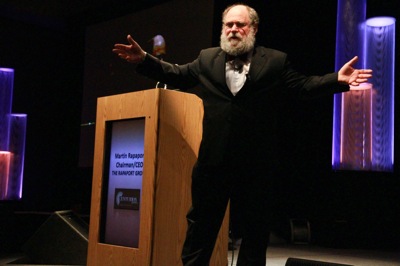

Scottsdale, AZ—In a follow-up to his highly popular presentation about global change at Centurion last year, Martin Rapaport, CEO of The Rapaport Group, told attendees at Centurion 2012 that while globalization remains an important topic not to be dismissed, the nature of globalization changes.

“Globalization isn’t a monotone,” he said. “Globalization is evolving, and uncertainty is a certainty, but it isn’t as bad for the United States as it was [last year].”

Last year, it seemed as though the diamond market in the United States was about to be devoured by a tiger (India) or incinerated by a fire-breathing dragon (China). This year, however, things are different. “Europe is dying, the U.S. is doing ok—sort of—and both China and India are having some indigestion.”

In 2011, the first half saw diamond prices rocket like crazy, only to be moderated by a “lousy” second half, in Rapaport’s words. But overall, he said, diamond prices still beat the S&P 500.

Part of the problem is that rough supplies are too far ahead of polished.

“The idea that the miners can control rough prices is going the way of Nicky Oppenheimer, and he’s retiring,” Rapaport said. “There’s a global overstock of polished and you’re in the position of demand. Diamonds do not defy economic gravity.”

With the global supply of rough that the Indians are anxious to sell—credit is getting tight there—and the Chinese market suffering what he called “indigestion,” the opportunity for the United States is very good in the diamond market right now. But, he warned, it’s only temporary: the Chinese will get over their economic “indigestion” and the Indians will push through the rough, so the window of opportunity is open right now.

“Go deep. Don’t go wide,” he told the audience. “The United States is currently the most stable market, so source and sell locally. Think about how you position your value, and the symbolic nature of diamonds. It’s not about ostentation or bling.”

The American market for diamonds is doing ok, says Martin Rapaport, but take advantage of the window of opportunity now.

He also discussed the importance of the street as supply. “A diamond is forever. It outlives the people who own it,” he said, adding that more diamonds now are coming from Americans who want to sell them than are coming out of South Africa.

“Can you buy what you can’t sell? Absolutely! Buy it, then liquidate it. Offer a fair market value and then liquidate it. There’s a tremendous amount of money to be made even if you don’t put it in your showcase.” The U.S. market for recycled diamonds and jewelry is growing.

Finally, he devoted a portion of his presentation to his own pet subject: ethical diamonds. Exhorting the audience again to ask where their stones come from, he said the industry is a lot like the army’s old “don’t ask, don’t tell” rule: dealers don’t outright lie, but unless you ask where the stone came from, most don’t bother to say.

“150 million diamonds from Marange [region in Zimbabwe] were sold at Surat last year. Ethical sourcing has to be part of your practice. Tell your suppliers you won’t accept any Marange stones. Insist on full disclosure and a guarantee that they are not from that region.”

Social and environmental responsibility is essential today, he said. “Our kids are better than us. Their concern about social, ethical responsibility is amplified. Turn challenge into opportunity. Market social responsibility as a way to differentiate yourself.

“Can you get people to pay more for ethical diamonds and jewelry? Yes! Diamonds are only as good as the people who sell them.”