Articles and News

The Calculation to Keep You on Track | September 14, 2016 (0 comments)

La Costa, CA—As the fourth quarter quickly approaches and you prepare both store and staff for the most lucrative time of the year, it’s also important to pause and take a look at your inventory positioning.

Presidential election years always make retailers nervous and concerned that the outcome—whether Democratic or Republican—may have an impact on business. This is a legitimate concern that needs to be addressed. We suggest that you look back at previous election years—at least as far back as 2004—and calculate what percent of sales November and December made up of the total year and compare it to non-election years. This percentage applied to your current sales trends for the year should help estimate your fourth quarter sales. Working with your anticipated sales for this time period will help insure you have ample inventory for the holidays and will not be in an overbought position in January.

A quick Open to Buy calculation going into fourth quarter is one of the most important prepatory overviews a retailer can do. Fall purchases should be completed by now, although there may be some inventory yet to be received. Your Open to Buy will show you at a glance your overall inventory position moving into this critical time of year. Examining it now will allow you the opportunity to make any additional purchases or changes if necessary.

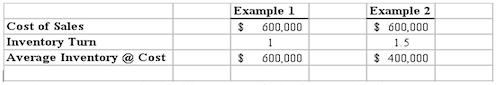

The first step is to determine your desired ending inventory (December 31). An easy way to do this is to state your inventory turn goal; everything else falls in place once this is established. The majority of jewelry stores in America have an annual inventory turn of 1 time. In other words, an average store will have an annual cost of goods sold equal to their average inventory at cost. If you want to increase your cash flow - you should work towards a 1.5 to 2.0 time turn, as seen in the chart below.

Chart 1: Annual Inventory Turn

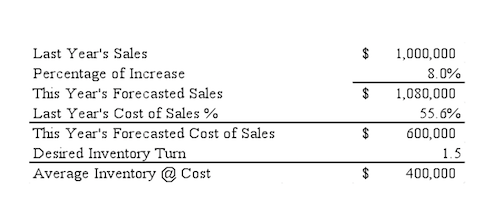

Your inventory turn combined with your cost of sales forecast will give you your average inventory. The following example demonstrates how to determine your average inventory goal.

Chart 2: Annual Average Inventory

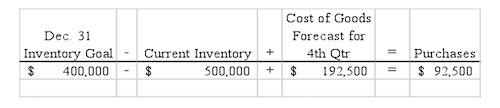

Now to calculate your Current Open to Buy, apply the following formula:

Inventory Goal – Current Inventory + Cost of Goods Forecast = Purchases

An example of 4th quarter Open to Buy purchases would look like this:

Chart 3: 4th Quarter Open to Buy

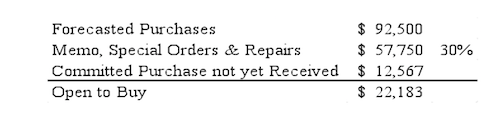

To refine your calculation, you must consider how much of your business is from memo sales, special orders and repair costs and hold those funds. Lastly, subtract any outstanding orders from your purchases which you have already committed to but have not yet received into your inventory. By subtracting these mandatory purchases, you will have your Open to Buy; see the example below:

Chart 4: Refined Open to Buy

Now that you have a total dollar amount to work with you have the opportunity to fill in inventory areas that need attention. Start with the basics that you sell every holiday season. Be certain you don’t have gaps in your assortment of diamond studs and pendants, both by size and also by price point. In most cases, this will absorb any Open to Buy you may have, but if there is some left over don’t hesitate to buy the goods. If you play by the numbers, you will run your business with confidence.