Articles and News

Affluent Americans’ View Of Economy At Six-Year High, But Luxury Brands Don’t Resonate With Them | October 22, 2013 (0 comments)

Alpharetta, GA—The American Affluence Research Center’s survey of current business conditions (index of 93) shows affluents’ confidence rose 22 points from the Spring 2013 survey and is now 40 points above the Fall 2012 index. The survey polled the wealthiest 10% of U.S. households by net worth; these account for almost half of all consumer spending. This is the highest reading for this index since Fall 2007 (108) and indicates good potential for increased spending by affluent and luxury consumers.

The index for future business conditions (105) and the index for change in the stock market (106) are both in positive territory, and essentially unchanged from the Spring 2013 survey. This is contrary to the pattern in 2011 and 2012 when all three indexes were generally higher in the spring than in the preceding and subsequent fall surveys. The affluent seem to have a modestly better outlook for the future than the general public.

About 80% expect their net worth to be the same or higher in the coming months while two-thirds expect their income to be the same or better. Almost two-thirds have no plans to defer or reduce expenditures during the next 12 months, an improvement of 7 percentage points from spring 2013 survey. Expectations regarding future income and net worth typically influence and/or correlate with spending plans.

These results are generally consistent with changes in the September 2013 Consumer Confidence Index of 73.2 (up from 57.9 in March 2013 and 50.2 in September 2012) for “present situation” and 84.1 for “future outlook” versus 60.9 in March 2013 and 83.7 in September 2012, as reported by The Conference Board but more positive than those reported by the Gallup organization. The Spectrem Group’s three confidence indexes in September for millionaire investors, affluent investors, and affluent households were all strong.

Will the recent government shutdown and political wrangling throw a monkey wrench into the good news? According to AARC president Ron Kurtz, probably not.

“I feel the final outcome of the Washington debt and deficit controversy is not likely to affect the mood of the affluent very much in either direction. The outcome is pretty much what people expected, and the all-important stock market was not hurt. We will have to wait and see if I am right, but the new Gallup surveys of the outlook of the general public have improved,” he told The Centurion.

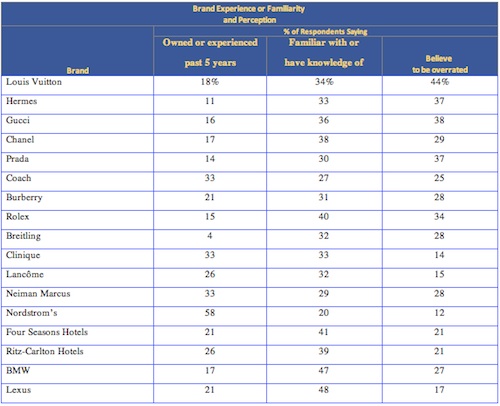

But these consumers—the most natural target for luxury marketers—don’t seem to be engaged with many brands, according to findings in the same survey. Brand ownership/experience during the past five years, brand familiarity/knowledge, and brand impression or perception were measured for 17 different luxury brands, and the level of ownership and familiarity for almost all brands was lower than what might be expected among this group. When combining ownership/experience with familiarity/knowledge, the total engagement for each brand is generally in the range of low 50s percentage to mid 60s percentage of the affluent (see chart). Brand ownership/experience during the past five years ranged from a high of 58% of the affluent for Nordstrom to a low of 4% for Breitling.

In this exhibit, the perecentage of responsdents who say they are “familiar” with a brand (center column) excludes those who have owned or experienced the brand in the prior five years (left column). The third column shows brand perception and whether it is considered "overrated." Some brands have a broad product line, including fragrances and cosmetics that make the brand more accessible and attractive to more consumers or to a particular gender. Also, the experience with hotels and retail stores is partially a function of geographic coverage. These factors should be considered when reviewing the data, says Ron Kurtz.

These results become more understandable knowing that more than 80% of U.S. millionaires are self-made, and were raised in households where experience and familiarity with luxury brands was limited or non-existent, Kurtz continues. In fact, one-fourth or more of respondents perceive a number of top luxury brands as “overrated,” while the ones that got more favorable responses were viewed as targeting value- and quality-conscious consumers rather than status-seekers (a definite negative.)

The brand most often cited as "overrated" was Louis Vuitton, with 44% of affluent consumers perceiving it so. But Gucci, Hermes, Prada, and Rolex also all were perceived as overrated by more than one-third of respondents.

The results demonstrate the opportunity for untapped sales potential, but with a strong need to educate the affluent about the features, appeals, and value of luxury products and brands. It cannot be taken for granted that they automatically recognize and accept these concepts, says Kurtz.

Top image: businessoffashion.com