Articles and News

ALL IN GOOD TIME: THE CENTURION’S EXCLUSIVE SURVEY OF LUXURY WATCH SALES | July 20, 2011 (4 comments)

Merrick, NY—Jewelers for years have had a love/hate relationship with watches. They love that status brands draw traffic, hate how much investment is required to buy into those brands. Love that luxury brands enhance their image, hate when they show up discounted online. Love building a base of collectors, hate to tell a customer that a watch has to be sent to Switzerland for repair and it might be months before it’s back. And so it goes.

The Centurion did a spot-check survey among prestige jewelers to gauge sales of luxury watches. Most of the survey respondents (89.3%) sell watches; only a small percentage (10.7%) do not. Among those, the reasons why they don’t were equally split between lack of margin and too much inventory buy-in required by the brands they would want.

Watches have, overall, been a good category for prestige jewelers. Most of our respondents (85.7%) said their watch business has increased or, at the very least, remained stable over the past two years. 4.8% reported a slight decrease in revenue from watches, and 9.5% reported a significant decrease in revenue from watches. Most (77.8%) also plan to stay in it, though 1/3 plan to shift resources within the category.

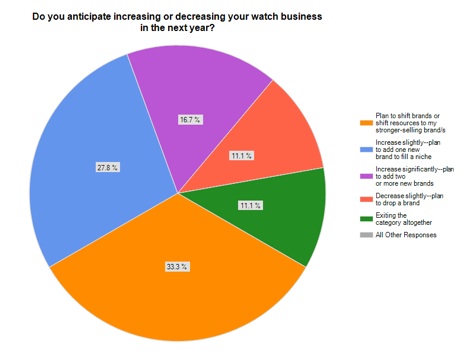

Most retailers are staying the course with watches. 33.3% of respondents (orange slice) say they plan to shift their resources toward stronger-performing brands next year, 27.8% (blue slice) plan to add one new brand to fill a niche, and 16.7% (purple slice) say they're going to increase their watch offerings signifcantly by adding two or more new brands in the next year. 11.1% of respondents each indicated they plan to drop one brand (red slice) or exit the watch category altogether (green slice).

Choice is good—for most. 47.6% of respondents sell three, four, or five brands of watches. 23.8, however, are heavily focused on the category, with a selection of between 10 and 20 brands. But a surprising 19% of respondents only offer one or at most two choices of watch brands.

Among our respondents who sell watches:

- 41.7% said their strongest price category is mid-level luxury, with retail price points between $5,000 and $10,000.

- One third of respondents (33.3%) do best with midrange brands that retail between $500 and $2,500.

- Low-end watches (less than $500 retail) were strongest for 16.7% of respondents.

- Only 8.3% said that entry-level luxury ($2,500-$5,000) was their best category.

- Zero respondents identified high-end luxury watches ($10,000+) as their best-selling timepiece category.

These figures are in line with what most retail analysts have posited about post-recession consumer spending patterns. Those consumers who were solidly rich—not living beyond their means—before the recession still are well off and can comfortably afford a luxury timepiece. They also may well be able to afford the ultra-high price point, but simply choose not to spend the extra money unless there’s a tangible demonstration of value to justify the difference. But the recession hit aspirational luxury consumers the hardest, and the Centurion study also shows entry-level luxury underperforming at retail.

Respondents were asked to list their top three best-selling brands. The greatest percentage (35%) listed Rolex (pictured top left) as their top-selling brand. 15% of respondents cited either Citizen or Cartier as their top seller, with the remainder split among Tissot, TAG Heuer, Michele, Technomarine, Belair, Bulova, and Breitling as their top-selling brand.

Some of the other brands named most often among jewelers’ top three included Swiss Army, Seiko, Panerai, Omega, Patek Philippe, Glycine, Frederique Constant, Ebel, Philip Stein, Cyma, and private label.

Among men’s watches, not surprisingly, more than 95% of respondents said sport watches are a top seller. Dress watches were next, followed by dive watches. Luxury, diamond, and novelty watches also have appeal. For women’s watches, fashion and dress watches are the strongest categories, followed by diamond and sport watches. A small percentage of jewelers (8.3%) said their female customers preferred men’s or unisex styles, but relatively few (4.2%) cited luxury watches as a strong category for women.

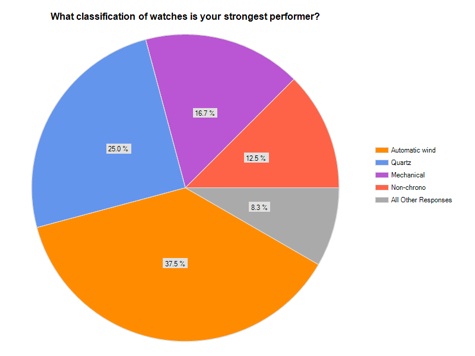

Luxury watch buyers prefer automatic wind most of all (orange slice), say 37.5% of retailer respondents. 25% of respondents said quartz watches (blue slice) are their top performers, followed by mechanical (purple slice, 16.7% of respondents), non-chrono models (red slice, 12.5% of respondents), and all other, gray slice.

Respondents were asked to identify the top three best-selling materials in the category.

- Respondents unanimously (100%) listed stainless steel watches among their top three bestsellers.

- 40% listed 18k yellow or white gold in their top three.

- 25% listed rose gold as one of their top three sellers.

- 25% also listed gold plated white or yellow.

- 15% listed gold plated rose

- 10% listed stainless and 18k combinations

- 5% each said that 14k gold, titanium and other contemporary metals, or plastic and other novelty materials were among their top three best-selling styles.

- Sterling silver or platinum were not ranked by any jewelers as best-selling watch materials.