Articles and News

As Gold Comes Down, Will It Crash Below $1,000? October 15, 2014 (0 comments)

London, United Kingdom—Gold has been on a downward slide for most of 2014, and the bear market is predicted to continue. But will it break the all-important $1,000 barrier and return to prices of three digits instead of four?

According to the latest metals report from London-based Natixis, precious metals markets are still watching anxiously for signs that the world’s major central banks might begin to normalize monetary conditions. Meanwhile, prices of industrial (non-precious) metals for the second half of this year continue to be determined by fundamentals of supply and demand for each metal.

What will happen to exchange rates, asset prices, as well as other countries’ economies, when U.S. interest rates finally begin to rise? These questions may soon be answered as the U.S. labor market begins to tighten and the Fed begins to contemplate a renormalization of monetary conditions, says Natixis. The outcome will have a profound effect upon precious metal markets, held as a safe-haven store of value. Here are there predictions:

Gold. From a high in March, the price of gold has been steadily declining—save for a short rebound in July—and in September prices breached the $1,200/oz mark. Behind this drop has been a strengthening U.S. dollar throughout Q3, while gold consumption in both China and India—traditionally high consuming markets for gold—also has been weak and investment and central bank demand has remained limited.

Events in the United States are expected to exert the biggest impact on gold prices. As the US economy improves, investors’ need for a safe haven dissipates. With this improvement comes a strengthening dollar. These factors are expected to have a mildly negative effect on gold prices over the forecast horizon.

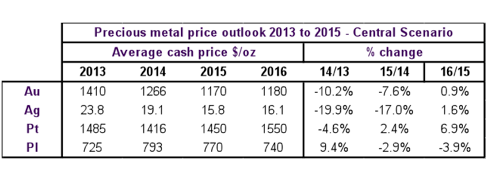

On the producers’ side, there is a risk that miners may return to hedging future output if gold prices threaten to fall below cash costs of production. Due to aggressive cost cutting by gold producers, all-in sustaining costs of production have fallen to somewhere around $960/oz. But many mines still are operating at higher costs that could potentially need hedging. This represents a potential source of supply in the market, which could help to accelerate any decline in prices. Natixis’s base forecast is that gold prices will average $1,170/oz in 2015 and $1,180/oz in 2016.

Silver. So far this year silver prices have fallen 10%. The strong correlation with gold meant that the price of silver dropped as a result of a stronger dollar and U.S. economy. Although silver mine supply is increasing, the drop in silver prices has led to a contraction in supply of silver scrap. Based on a positive outlook for the U.S. economy and additional downside risks attaching to silver prices, Natixis forecasts an average silver price of $15.8/oz in 2015 and $16.1/oz in 2016.

Platinum group. Both the platinum and palladium markets were affected this year by the prolonged strikes in South Africa, which curtailed mine output. Additionally, the turmoil in Ukraine drove palladium prices to their highest level since 2001. Fundamental demand for both metals has been noticeably weak this year, especially for platinum.

Over the last two years, supply-side issues have been the main drivers behind the price of platinum. Along with frequent strikes in South Africa causing supply cuts, falling prices forced producers to cut back output at their higher-cost operations. Since the end of the strikes in July, the price of platinum has plunged because of extreme weakness in demand. At current low prices, there could be an increase in Chinese platinum jewelry demand once again, especially if the platinum/gold price ratio continues to fall. Natixis forecasts platinum prices rising to $1,450/oz in 2015 and $1,550/oz in 2016, and palladium prices rising to $770/oz in 2015 and $740/oz in 2016.

Here's a look at recent and predicted prices from Natixis: