Articles and News

At $234 Billion, The Super-Rich Account For 19% Percent Of All Luxury Spending | December 03, 2014 (0 comments)

Singapore—Some 211,275 super-rich households spent $234 billion on luxury purchases last year, accounting for 19% of all global luxury spending, according to data just released by research firm Wealth-X, in its 2014 World Ultra Wealth Report. The report was compiled in conjunction with financial services firm UBS.

In a press interview, Wealth-X president David Friedman said luxury brands shouldn't look at what is being spent, but at untapped potential. He noted mass-affluent consumers continue to pull back on spending, yet luxury goods companies still are not taking advantage of the additional spending power super-rich present. The report showed that share of luxury expenditures by Ultra High Net Worth (UHNW) families increased from 17% to 19% from 2012 to 2013, with the average UHNW individual spending upwards of US $1 million on luxury goods and services annually.

Travel/Hospitality topped spending at $45 billion, followed by automobiles at $40 billion, fashion (apparel and accessories) at $28 billion, and jewelry/watches and art tied at $25 billion. Private jets totaled $23 billion in the report, followed by yachts at $22 billion, home and wines/spirits both at $8 billion and beauty at $4 billion.

The Wealth-X report shows that despite being about 0.004% of the world's population, this targeted group accounts for 35% of all luxury watch and jewelry purchases, 28% of all home purchases, 22.5% of all travel/hospitality spend, 20% of all luxury apparel, 14% of all luxury accessories, and 9% of all luxury cars. The report also found the super-rich own an average of 2.7 properties, and some 30% (more than 70,000) of UHNWs have at least one residence outside their primary business country.

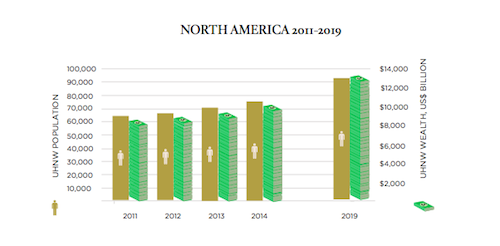

UHNW’s tend to stick together. On average, each UHNW individual’s social network includes at least seven other UHNW peers, at least one of which is a billionaire. 91% are married, 4% divorced, 3% single, and 2% widowed. On average, they have 2.2 children, 1.9 grandchildren, and an extended family of five, including spouse, parents, in-laws, and siblings. North America has both the largest UHNW population and wealth. Apart from having the world’s biggest economy, the United States, UHNWs are attracted to the region’s stable institutional infrastructure and world-class educational facilities. North America is often a frontrunner when it comes to the development of new and rewarding economic opportunities, such as high tech. In hard times especially, many UHNW individuals gravitate toward the world’s largest economies, which they believe will be safer than emerging markets, particularly with respect to luxury real estate investments and other such long-term capital placements. For example, the IPO of Chinese e-commerce giant Alibaba took place in North America, and almost a quarter of all UHNW individuals with residences abroad own property in North America. Such trends are expected to continue, thereby ensuring the continued clout of North America in the world’s ultra affluent landscape.

Projection of Ultra-High Net Worth individuals (UHNWs) in North America through the end of the decade.

The United States remains the country with the largest UHNW population and wealth in the world; almost one third. It alone has a larger UHNW population and wealth than any of the regions around the world, even Europe. This year, U.S. UHNW population continued to swell, adding more than 4,000 new individuals—more than the entire UHNW population of Australia, the 11th largest UHNW country. This growth was in no small part due to the strong performance of the country’s equity markets: the S&P500 surged by 21.4% during this period and unemployment also decreased.

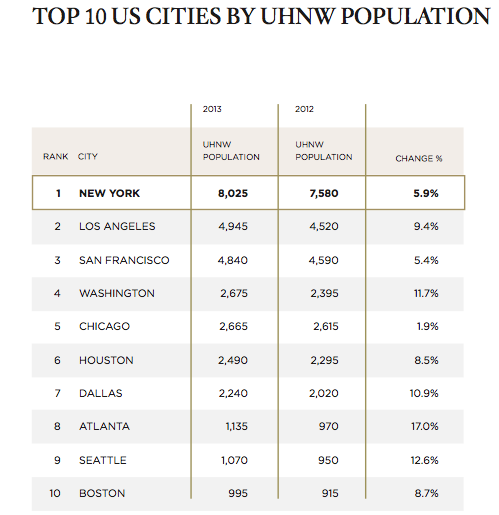

The United States’ economy accounts for a third of the world’s total wealth, and of that wealth, 12.5% is held by UHNW individuals. In some other regions, namely the Middle East and Latin America, the percentage share of national wealth held by UHNW individuals is greater relative to their total populations; however, the United States’ UHNW population holds the largest absolute amount of global wealth. New York has the largest UHNW population in the world; if it were a country, it would be the seventh largest in terms of UHNW population size. The continued dominance of New York can be largely attributed to the city’s status as the financial capital of the world. This role further enhances the city’s attractiveness to other industries, as proximity to developed capital markets is a particularly important factor for businesses looking to achieve further growth.

San Francisco overtook Los Angeles in terms of UHNW population this year, indicating the growing importance of the city as a hub not only for technology entrepreneurs, but as a center of wealth accumulation. Over a quarter of San Francisco’s UHNW population is involved in the technology industry, but as wealth in this sector accumulates and spreads, other sectors such as real estate and finance grow in importance as well.

Last year, LA outranked San Francisco for UHNW individuals, above. 2014's survey says San Francisco has pulled ahead.

For more information, click here.

Top image: economictimes.indiatimes.com