Articles and News

Is Your Store Creating Wealth For You? Begin with the End in Mind, Part Two | October 25, 2017 (0 comments)

Omaha, NE--Is your retail business helping you with your future wealth and retirement requirements or is it just providing you with a job? Your retail business is a tool to help you achieve your living and wealth needs both now and in the future, so it is important to remember that the return on your business investment comes over and above your ‘market’ income each year.

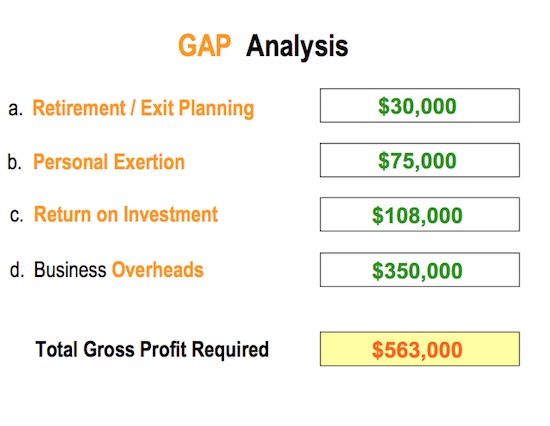

In Part One of this series designed to help you ensure your store is working for your future, we examined how to determine all the possible gaps in your business's ability to generate surplus wealth over and above the owners' salaries. Now that you have established the amount of Gross Profit you need (see GAP Analysis below) we need to calculate the difference between your current annual Gross Profit and your required annual Gross Profit, this difference being ‘The Gross Profit Gap.’

In the example shown, the store requires a total of $563,000 of Gross Profit to satisfy all of the owner’s expectations. (Refer to part 1 of this article for a full explanation and requirements):

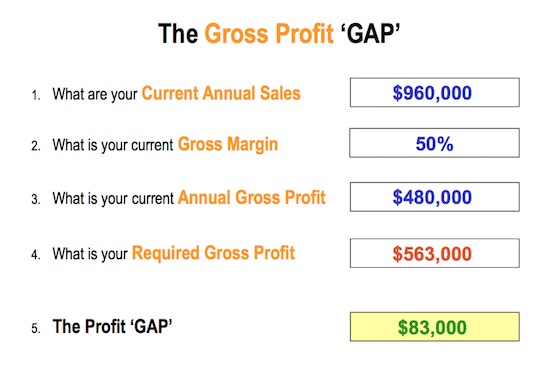

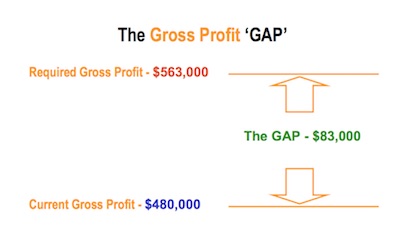

See below for an explanation of the ‘Gross Profit Gap.' In this example, the store has annual sales of $960,000 and at a 50% gross margin is producing annual gross profit of $480,000 … $83,000 less than the $563,000 needed according to the new GAP analysis. (Note: We will talk about how to ‘Bridge the Gap’ in a later issue.)

Action Steps:

- Using the example template above, calculate the gap between your current and required Gross Profit.

- Decide what gross margin you believe you will achieve this year. Note: If it is currently less than 55% you have plenty of room for improvement!

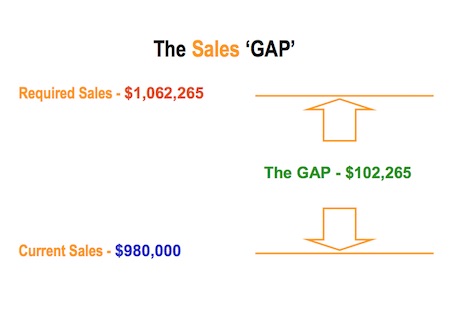

Congratulations on successfully completing Step 2. The next step is to calculate your Sales ‘GAP.’ This step is to convert your gross profit target into a Sales target and then contrast this with your current sales; this difference being ‘The Sales Gap.’

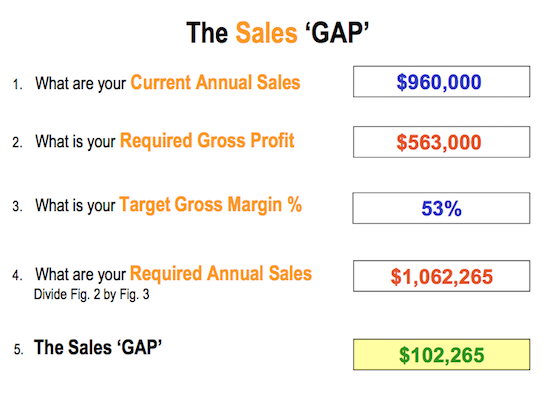

Based on the need to increase gross profit by $83,000, we have several strategies available to us. One such strategy is to increase gross margin, so in this example I have worked on the assumption that margin will increase from 50% to 53%. Therefore, to increase gross profit by $83,000 at a 53% margin we only need to increase sales by $102,265.

So now we have a meaningful sales budget that will genuinely meet the owner’s needs and we can start to develop specific strategies to achieve it.

Important: If you intend paying commissions or bonuses based on sales, then you need to allow for these in your original GAP analysis; i.e., if you pay bonuses for achieving your new sales target of $1,062,265 and those bonuses have not been budgeted for, then in reality you are eating into the profits you need for retirement, return on investment, and so forth. (We will discuss how to introduce highly effective ‘Profit Sharing’ incentives based on the GAP analysis in a future issue.)

Action Steps:

- Using the example template above, calculate the gap between your current and required sales.

- In preparation for dealing with ‘how to bridge the $102,265 Sales GAP’, please establish your sales KPI’s (key performance indictors). There are only two of them namely Quantity of Sales (the number of items you sold last year) and Average Retail Value (the average value of each item sold last year). Note: A typical U.S. store is doing 5,000 sales a year at an average value of $200, i.e. 5,000 x $200 = $1m in gross sales. Once you know what your KPI’s are, we will discuss various strategies for increasing them and thereby ‘bridge’ the $102,265 GAP.

Only now can you answer the question, “how much inventory do I need to achieve my sales budget?”

This concludes our two-part series on knowing what you need to have in place, to retire successfully and with ease. Please reach out if you would like more personalized advice on your retirement plans.

The Edge Retail Academy is a highly effective jewelry industry consulting company that provides customized strategies for retailers and vendors to increase profits, optimize growth, reduce debt, create profitable inventory solutions, build effective teams and enhance brand loyalty and profitability. The Academy is committed to helping jewelry businesses improve their bottom line while reducing uncertainty and stress. Edge Retail Academy software and the unique talent pool of their business advisors provide real world knowledge and advice for guaranteed results, all on a “no-contract” basis. www.edgeretailacademy.com.