Articles and News

BRIDAL JEWELRY: A SNAPSHOT OF SALES BY METAL | July 31, 2011 (0 comments)

New York, NY—Earlier this year, the Platinum Guild International polled independent and small chain jewelers to gauge how well the metal was performing in relation to other bridal jewelry for the second half of 2010. PGI shared some of their findings exclusively with The Centurion. Here are some of the figures:

Platinum accounts for slightly less than 1/3 of all bridal jewelry sales. Not surprisingly, stores who participate in PGI’s Preferred Partner program sell more platinum than jewelers who aren’t part of the program, but white gold still accounted for 53% of all jewelers’ bridal sales in the second half of last year.

Among all jewelers responding, 30% of their bridal jewelry sales for the second half of 2010 were platinum, 10% were yellow gold, 2% were palladium, 3% tungsten, and 1% titanium, for a total of 99% of respondents.

Among PGI partner stores, platinum sales rose to 41% of total bridal sales, while both white and yellow gold declined to 44% and 8%, respectively. Sales of other metals were relatively unchanged. Sales of alternative metals rose slightly among those jewelers who are not PGI partners and are not identified as prospective partners for future PGI programs.

Platinum and diamond engagement ring here, by Verragio. At top left, diamond solitaire set in platinum is by Kwiat.

Comparing year-over-year performance of platinum jewelry, 43% of respondents saw an increase—slight, at 1.1%—but an increase nonetheless. 29% reported a drop in platinum sales, and 26% reported year-over-year sales were even. Among partner stores, the percentage of jewelers increasing platinum sales jumped to 56%, and the overall increase itself jumped to 5.5%. Approximately half of all jewelers surveyed reported no change in the number of couples considering platinum for a bridal purchase vs. 2009; 30% said more couples in their store were considering it and 21% said fewer were.

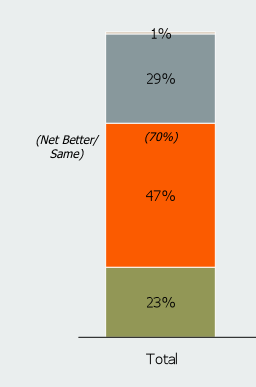

Comparing the performance of platinum to the competitive set of other bridal jewelry, 47% of all jewelers reported no change from the previous year. 23% said platinum improved more than other categories; 29% noted a decline. Again, figures were higher for PGI partner stores—33% said platinum sales improved more than other categories.

47% of total jewelers responding to PGI's survey said in terms of sales in latter 2010, platinum jewelry performed about the same as other bridal jewelry (orange). 23% said it outperformed other categories of bridal jewelry (green), 29% said other categories were stronger (gray) and 1% didn't know.

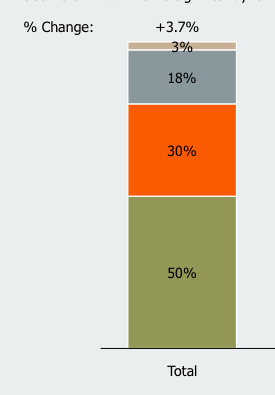

50% of jewelers surveyed expected to see an increase in platinum sales this year; however, as of the time of the survey earlier in 2011, only 27% said they planned to increase their platinum inventory. Among all jewelers, 50% of platinum sales are special order. That figure dipped slightly for partner stores; 46% of their sales are special order.

Half of all jewelers surveyed (both PGI partners and non-partners) said they expect platinum bridal jewelry sales to increase throughout 2011, though at the time of the survey only 27% planned to increase inventory to accommodate a potential gain. 30% of all jewelers responding expect platinum bridal sales to remain equal with 2010, and only 18% expect a decline. 3% did not know.

The price of platinum ($1,783 at press time, between $1,750 and $1,800 at the time of the survey), was considered a positive attribute by some respondents (29%) and a negative by 65%. Those who found price to be a positive attribute cited the narrowed spread between the price of platinum and gold (approximately 8% at survey time), and also that its very expense made consumers consider it to be more valuable. Among all respondents the average price of a platinum semi-mount was $2,777; among PGI partner stores that figure jumped approximately $300 to $3,075.

For entry-level pieces, among all jewelers the average price reported was $1,237 but partner stores reported an average sale of $1,342, a difference of $105. 70% of all respondents reported their entry platinum pieces sold through during the year; 65% reordered.

More than ¾ of respondents price mounting and center stone separately, vs. one whole piece.