Articles and News

BY THE NUMBERS: HOW PRESTIGE JEWELERS’ BUSINESS STACKS UP SO FAR IN 2011 | November 22, 2011 (0 comments)

Merrick, NY—With a variety of consumer indexes showing better retail spending than expected and tracking increases in what affluent shoppers plan to spend for holiday this year, The Centurion did a quick spot check among better jewelers to see how their business has progressed throughout the year and how those figures compare to the general marketplace.

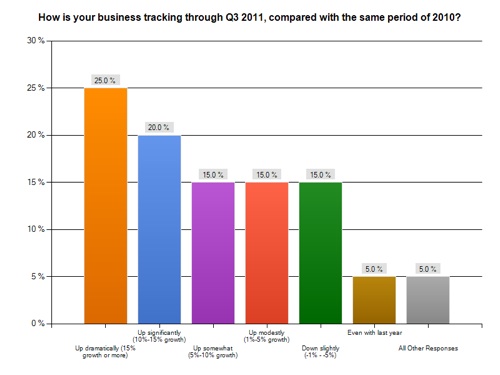

Good news: For most prestige jewelers, the year has been strong. As the chart below shows, the greatest percentage of respondents (25%, orange bar), say their business for the third quarter of 2011 jumped 15% or more over the same period of 2010. 20% of respondents posted gains between 10% and 15% (blue bar), and 15% each reported slight to moderate increases (purple and red bars). But 15% also reported a slight decline in Q3 sales over last year (green bar) and 5% reported sales were even with last year. Likewise, only 5% of respondents reported anything more than a slight decrease.

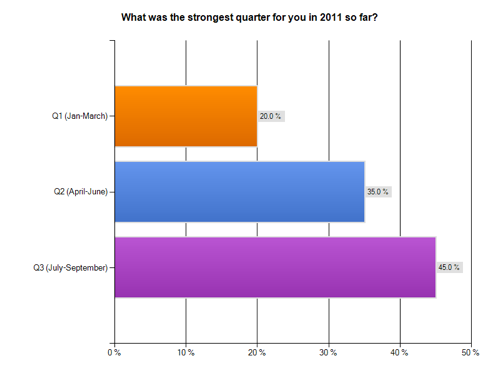

More good news, the year has grown progressively stronger. 20% of respondents say their strongest quarter was January through March; 35% posted their best results from April through June, and 45% say their best quarter was July through September so far, and are entering the holiday period optimistically.

45% of respondents to The Centurion's spot check of business through Q3 2011 say the third quarter was their strongest. 35% did best in the second quarter, and 20% did best earlier in the year.

Best selling products this year included bridal jewelry and colored gemstone jewelry, with 29.4% of respondents each indicating this as their best category. Within the colored gem jewelry category, it should be noted that some jewelers specified their strongest sales were in designer goods, while one said it was for gems other than the Big Three, ruby emerald, or sapphire. 17.6% of respondents said sterling silver jewelry was their strongest category so far this year, and 5.9% each cited other categories of diamonds, including loose, large, unspecified diamonds, and diamond earrings. Also checking in at 5.9% each, respondents cited custom jewelry, fashion jewelry, and, specifically, Pandora.

Top selling price points remain a little lower than prestige jewelers might like. Among our respondents, one-third said their best-selling price category is under $1,000. Another one-third report strong sales across a wide range of prices, with as much as a $5,000 spread. 26.6% say their strongest sales are between $1,000 and $2,000, and only 6.6% each say their strongest sales are between $4,000-$6,000 or between $5,000 and $10,000.

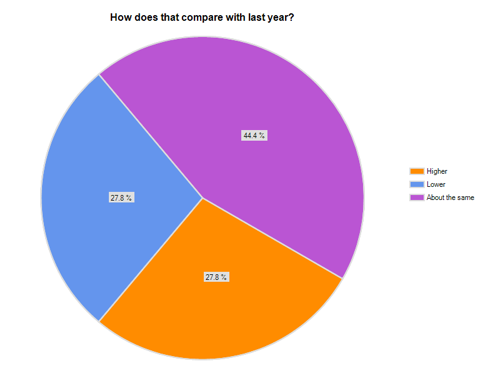

For 44.4% of respondents, (below, purple slice) there was no significant difference between their best-selling price points this year against last year’s figures. But more than a quarter—27.8%—saw their most popular price point rise since last year, and an equal number said less expensive products are selling better this year than last (blue and orange slices).

Jeweler calling! Finally, The Centurion asked about jewelers making house calls. While it’s probably safe to say it’s more common among jewelers than doctors (77% of respondents do it at least occasionally), for most, meeting a customer at home is not a regular occurrence.

16.7% of respondents do it on a regular basis, saying it’s something that sets their business apart from the competition. Writes one, “It started when a sales rep would have something remarkable in the store for such a short time that it made more sense to go to the person’s house than gamble on whether they would think it worth the effort to put themselves together and drive downtown in a hurry.” It’s a trick that works almost every time, he says, and he’s sold more $20,000 bracelets in people’s homes than in the store.

Other jewelers say they do it for the usual reasons: a special customer, special request, or special occasion, and convenience and privacy. But for most, it still remains a pretty rare occasion. And for some—16.7%—it’s not something they’ve ever done or ever plan to do.

Next week: What’s hot in holiday products and promotions among respondents.