Articles and News

Defining ‘Premium;’ The Top Luxury Jewelry Search; And Are Millennials Worth The Effort? | April 06, 2016 (0 comments)

Merrick, NY—Luxury, prestige, and premium are words that seem interchangeable but really have different meanings, especially when it relates to a market segment. Pamela Danziger, president of Stevens, PA-based Unity Marketing, says the dictionary definition of premium is something of greater or superior quality.

“A brand is considered premium only when consumers believe it is worth the price; they’re willing to pay more for a product when it has that ‘x-plus’ factor that makes it unique,” she says. Some specific tangible and intangible attributes that give a product a sense of greater worth include the sensual experience of holding or using it; a backstory, quality, authenticity, quality, and intrinsic worth.

Premium is a pinch of luxury, a tablespoon of prestige and a lot of style, says Danziger, and marketing a premium brand demands thinking through every facet of the brand experience, down to its packaging, customer service, and company culture. Read more here.

Danziger will further discuss the nuances of each category and how consumers relate to them during an upcoming seminar at with Marc Rosen at LuxePack New York, a luxury packaging show set for May 11-12 at Pier 92 in New York City.

Separately, a new study by Karus Chains reveals that the most popular women’s designer jewelry product searched for online is Cartier’s Love Bracelet (top of page), which garners more than 350,000 online searches per month and far exceeds any other specific luxury jewelry product’s search metrics. The second-most searched item--a Tiffany engagement ring—garnered only 85,630 searches, compared to the 353,840 for the Cartier bracelet.

In terms of overall designer jewelry brand searches, however, Pandora outranked Cartier by more than two to one. Karus’s research shows Pandora garners 2.8 million searches per month, compared to Cartier’s one million.

Karus’s study examined both designer and non-designer jewelry; the number-one most searched item online by women still remains an engagement ring (not brand-specific), which generates about 14 million searches per month. Interestingly, however, the second-most searched item among non-branded fine jewelry, diamond earrings, garnered 287,520 searches per month, a solid 70,000 fewer than the Cartier Love Bracelet.

Here’s an infographic that outlines the key findings from Karus’s latest study; you can read more here as well.

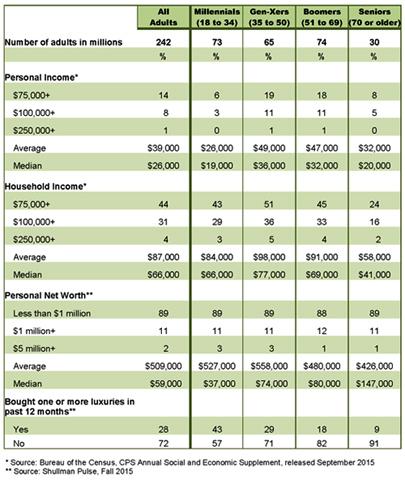

Lastly, recent findings from Shullman Research re-evaluate the definition of “affluent” consumers, and underscore an earlier point Danziger made about Millennials’ true luxury influence still is several years off.

In this article for Mediapost’s Engage:Affluent blog, Shullman breaks down income levels for Millennials, Gen-X, Boomers, and Seniors (70+). In terms of raw earning power, Gen-X (age 35-50) wins, but with 12% fewer of them than either Millennials or Boomers, they tend to be overlooked.

Millennials do buy more luxuries than the other demographics, but Shullman says those tickets typically are lower, and that a marketing strategy that focuses only on Millennials may backfire. While there’s much to be said about capturing consumers while they’re young and building brand loyalty as they mature, Shullman cautions that in 10 years their lives, needs, and purchase drivers will look very different. Target them now, yes, he says, but for immediate returns don’t neglect the consumer that really has the most cash: those 55 and over.

Read the full articles here and here.

This chart, by Bob Shullman of Shullman Research for MediaPost Engage:Affluent, shows the breakdown of affluent consumers by age, income, net worth, and propensity for luxury spending.