Articles and News

Diamond Update: Polished Prices Fall Again; New Group Creates Fancy Color Diamond Value Index April 07, 2015 (0 comments)

Polished Diamond Prices Fall Again In March

New York, NY--Polished diamond prices continued their decline in March as trading volumes were restricted by weak demand. According to the latest figures from Rapaport, diamond market sentiment was weak throughout the entire first quarter. Jewelry retailers avoided large inventory purchases and buying was focused on satisfying specific demand to fill existing orders.

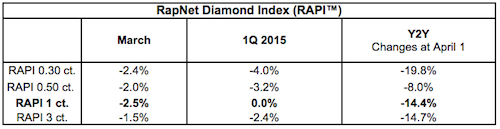

The RapNet Diamond Index (RAPI) for one-carat, laboratory-graded diamonds fell 2.5% in March. RAPI for 0.30-carat diamonds declined 2.4%, while RAPI for 0.50-carat diamonds dropped 2%. Even bigger stones dropped: the RAPI for three-carat diamonds fell 1.5% as well during the month.

Year on year, the incremental declines have added up to a significant price dropoff since the second quarter of 2014. During the first quarter of 2015, RAPI for one-carat diamonds was flat, but remained 14.4% below prices of one year ago.

According to the Rapaport Monthly Report for April 2015, Reducing Inventory, retailers were largely absent from the market during the first quarter of 2015. Polished dealers were focused on buying polished rather than on manufacturing rough as they sought to deplete their polished inventory. Manufacturers have lowered their polished diamond production by approximately 30% by volume and 50% in value terms since the Diwali holiday in October 2014.

Rough demand further deteriorated in March. Sightholders refused approximately 30% of their allocated supply at the De Beers March sight, which closed with an estimated value of $500 million after refusals. De Beers’ prices were largely unchanged. ALROSA also reduced its supply and maintained stable prices at its March contract sale. Trading on the secondary market is weak as profit margins from rough are slim.

Jewelry retailers have refrained from their usual first quarter buying, despite initial positive reports about gem-set jewelry sales during the Chinese New Year festival. As wholesale polished diamond demand is expected to remain weak during the second quarter, manufacturers are hesitant to ramp up production. Reduced supply is expected to stabilize the market and create shortages, which will help future demand.

This chart from Rapaport shows the steady decline in diamond prices since last year.

"Rough buyer price resistance is rational and healthy for the market as it protects cutter liquidity and profitability, while reducing oversupply of diamonds during a period of relatively weak polished demand,” says Martin Rapaport, chairman of the Rapaport Group. “Sightholders have done the right thing by refusing to overpay for rough to keep future allocations of rough diamonds. Mining companies are encouraged to lower rough prices to levels that ensure reasonable manufacturer profitability and a sustainable diamond trade,” said Rapaport.

New Organization Offers Valuation Data For Fancy Color Diamonds

Ramat Gan, Israel—The Fancy Color Research Foundation was established last year in response to demand from retailers facing challenges in valuation and trading of fancy color diamonds. FCRF was founded by Eden Rachminov, author of The Fancy Color Diamond Book and winner of the NCDIA Education Award, and its board of advisors includes James R.W. Pounds of Dominion Diamond Marketing, Ishaia Gol of Ishaia Trading Corp., and Ephraim Zion of DEHRES.

FCRF’s goal is to create greater transparency around fancy color diamond values across retail, wholesale, and mining channels, and promote an understanding of the valuation process of fancy color diamonds. Members from across the diamond and jewelry industries are invited to join and receive the following benefits:

- Full access to a wide breadth of research data and analysis collected over the past decade.

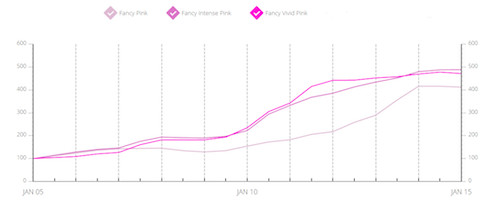

- The Fancy Color Diamond Index, developed by the Foundation from proprietary access to tens of thousands of fancy color diamond transactions since 2005 and updated on a quarterly basis. The Index is a first-of-its-kind tracker of changes in the market prices of yellow, pink, and blue diamonds, the three most commonly traded fancy color categories (“market price” is defined as a wholesale transaction taking place in one or more of the global diamond trading centers). The Fancy Color Research Foundation oversees proprietary prevalence and pricing data aggregation and production of the index, while a third-party, New York-based audit firm reviews the development of The Index from the various data points gathered.

- Real-time updates on auction results, analysis of sales and educational tools released by the Foundation

- Publications such as the Fancy Color Diamond Book, an upcoming publication on valuing fancy color diamonds, and additional online tools.

Example of a chart from the Fancy Color Research Foundation showing values of various hues of pink diamonds.

Reception has been highly positive, say founders, with one prominent, high-end retailer registering memberships for 20 retail locations.

In addition to publishing The Index, The FCRF is developing and publishing a series of practical tools, targeted at retailers, says Pounds. The Foundation is an independent, non-profit organization formed to promote fair-trade, ethics, and transparency in the fancy color diamond sector.

For information and applications for membership, visit fcresearch.org.