Articles and News

Economy Poised to Turn Corner in 2011 | December 13, 2010 (0 comments)

San Francisco, CA—In its 2011 Economic Outlook report, Wells Fargo Securities’ Economics Group predicts the turning point has come for the American economy. For the year ahead, says the report, we will see slow but steady sustained growth, reflecting the influence of continued improvements in consumer and business investment as well as the turnaround in residential and commercial construction.

.png)

Wells Fargo’s economists never were part of the “double-dip” or “V-shaped” camps, but the report emphasizes that each recovery is unique and each, rather than returning to a norm, creates a new normal.

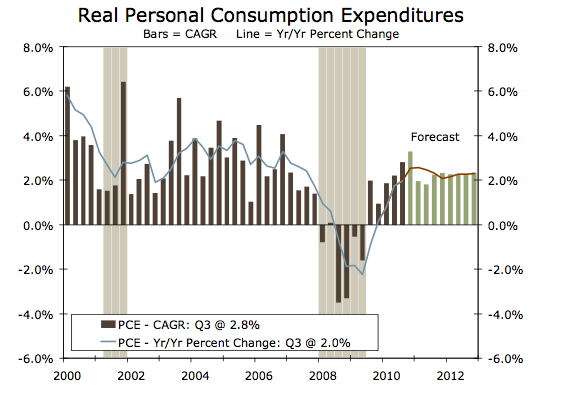

Consumer spending, representing the majority of aggregate demand in the economy, will benefit from a streak of positive (!) employment reports by mid-2011, lower unemployment rates, and rising real personal income. Here is a chart depicting Wells Fargo's forecast consumption:

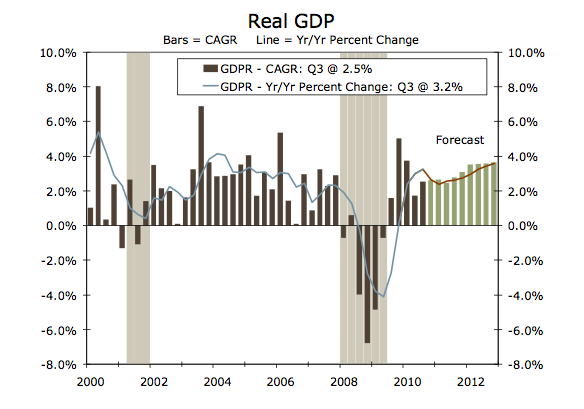

While spending will not be as strong as in the past corresponding phases of earlier recoveries, it will be positive nonetheless. Personal income is up 4.1 percent year-over-year compared to a decline of 2.1 percent last year at this time. In part, this reflects a year-to-date gain of over one million jobs as well as gains in employment in many of the higher paid professional services fields. Positive momentum in consumer spending would be further boosted by the extension of the Bush-era tax cuts and the two percent reduction in the payroll tax. Overall, this means that consumer spending will continue to improve gradually, in line with the employment picture. Here's the chart showing Wells Fargo's forecast growth for U.S. GDP:

Wells Fargo’s economists also expect trends in commercial and residential real estate, two areas of the economy that have been significant drags on headline growth, to turn positive for the first time since the beginning of the recession. Despite being near record lows, housing starts will begin to gain momentum. The turnaround in housing is largely attributable to gains in employment, consumer income, as well as favorable demographic trends. Meanwhile, mortgage rates remain low and housing affordability remains high. Though broadly positive, these trends do not reflect a return to the boom years, however.

Commercial real estate should begin to contribute to growth by the second half of 2011. Leasing has picked up, rents are rising or stabilizing, and sales have increased. Demand for high-quality properties in choice locations remains exceptionally strong, which has helped pull prices higher for non-distressed deals. That said, there are still plenty of troubled projects that need to be disposed of, and prices for distressed projects are likely to fall further once lenders become committed to cleansing their portfolios.

The full report is available online here.