Articles and News

EXCLUSIVE: FOREVERMARK CEO TELLS THE CENTURION STRATEGY AND GROWTH WILL CONTINUE AS PLANNED | November 09, 2011 (1 comment)

Johannesburg, South Africa—After more than three-quarters of a century of ownership, it was announced last week that the Oppenheimer family has sold its stake in De Beers to mining company Anglo American PLC for $5.1 billion in cash.

The transaction will increase Anglo’s holdings in the diamond company to as much as 85%, though the Botswana government, which currently is a 15% shareholder, has the preemption right to increase its holdings to 25%. It has until the completion of the sale—approximately nine months—to decide, says Stephen Lussier, CEO of Forevermark.

But suppliers and retailers of the company’s Forevermark diamond brand--just launched this fall in the United States--are anxiously awaiting developments that may change the strategy of the program they signed up for. In an exclusive interview with The Centurion, Lussier says there’s no reason to worry.

The Centurion: Even though the announcement of the sale was made less than a week ago, do you anticipate that Anglo-American will want to make changes to the Forevermark program?

Lussier: No changes! That’s the first things we want to do is assure jewelers that they can feel confident. The main reason is that Anglo American is not a new buyer or owner; they’ve already had 45% ownership in the company since 2002 (when De Beers went private), and De Beers and Anglo were sister companies for 75 years before that. They’ve been on our board and they approve our business plan every year.

The Centurion: Is there any chance the whole sightholder system might change down the road?

Lussier: Cynthia Carroll (CEO of Anglo), spoke to De Beers at our leadership meeting on [last] Friday. She reassured us that Anglo totally understands diamonds are not a commodity like coal, and that we have a unique industry distribution system for them. That’s part of what Anglo is buying.

The Centurion: Is there any feedback yet how Forevermark sell-through is tracking in the United States?

Lussier: It’s too early. Our focus has been working with the diamantaires and retailers to have the stock in place by Thanksgiving for holiday sales. This isn’t a promotion; it’s a long-term brand building. You’ve got to start somewhere, but we’re building the business over time and it’s just beginning.

The Centurion: How many retailers in the United States will be Forevermark retailers?

Lussier: We expect to finish the year with 200. On a global basis, we have 700 (mainly in Asia and India) but there should be 200 U.S. retailers going into 2012. Ultimately there may be 400-500.

The Centurion: Are American jewelers onboard with your marketing strategy, which for the first time doesn’t include television? We’ve spoken to some who were disappointed there was no TV, at least for the fourth quarter.

Lussier: We’re happy with the marketing plan. We understand that some retailers may look back at De Beers [old marketing efforts], but when you’re building an up-market brand it’s different. Tiffany doesn’t do television, and we’re in that space. Some retailers will use TV in their markets, but we think it’s best to do a luxury, aspirational marketing strategy.

The Centurion: We understand it will be focused mainly on print and digital. Was the digital or mobile aspect a hard sell for the jewelers, many of whom are not yet fully convinced of its effectiveness?

Lussier: We are using more digital than we’ve ever used. Digital is self-selecting; you’ll only see it if you’re the target audience. In a way, it sounds weird, but the more effective you are, the fewer people will see it, but those are the ones you want.

Digital is new, but we have data that shows it’s really successful both for brand building and for customer engagement. For a product category like ours that’s an infrequent purchase, that’s important. People don’t buy diamonds often, but when they do they’re really interested and engaged. Digital takes time and builds over time; TV is something everyone sees. Digital is all about narrowcasting. If you can get someone to watch a five- minute video about the joy of your brand, vs. the 20 seconds they see on TV, that’s a lot more engagement than regular media delivers.

The Centurion: But wasn’t the point of the TV ads to get more people to think about buying a diamond?

Luissier: We have two targets. The first is the bridal market, and we do everything we can to search out those who are getting married within the next year. When people are going to get married, there are certain behaviors they engage in and we are tracking those behaviors online.

The other category is the gift purchaser, which tends to be a heavy user of diamond jewelry. We try to build a profile of this customer based on other interests they may have, so we can track them.

The Centurion: Is that where the print comes in? The ads are out already.

Lussier: We have a very strong fourth quarter print campaign, starting with upscale women’s and general interest magazines and later shifting to men’s interest. We’ve overspent for the launch, but I think we’ll stay there to build following among that audience.

The Centurion: What’s your fourth-quarter ad spend to launch the Forevermark brand, and how does that compare with the old De Beers holiday advertising?

Lussier: We don’t disclose our budget for competitive reasons, but it’s very strong.

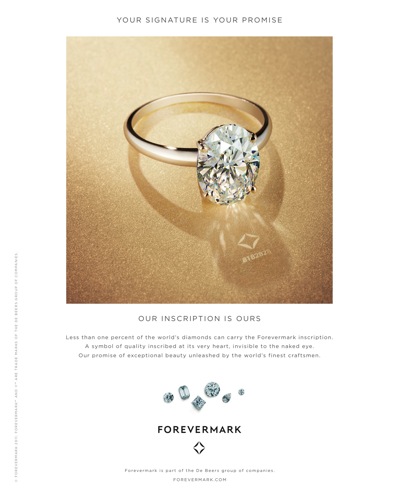

One of the Forevermark print ads emphasizing the quality of the diamonds.

The Centurion: Changing the subject, we know one quality is one of the key points of the brand, and another is that it’s responsibly sourced. But if jewelers emphasize the responsibility of Forevermark, isn’t it going to make customers wonder about the origins of their other, non-Forevermark diamonds?

Lussier: It’s an area of equal concern to us! Many of the non-Forevermark stones in stores also are De Beers stones. But we’ve now done Forevermark distribution in Asia for a while, and we’ve seen no customer resistance to non-inscribed stones. Forevermark doesn’t make the non-Forevermark stones questionable.

The Centurion: Are Asian consumers as focused on social responsibility issues as Americans?

Lussier: In Japan they are, and that’s one of our large markets. In China they tend to focus more on quality of the stone. But Forevermark goes beyond the basics, beyond just Kimberley compliance. It’s focused on the proactive; it’s not saying there’s something wrong with the other stones. Perhaps one of the best examples of being proactive was on the Today Show this week, where Matt Lauer is touring Zambia and discusses the Forevermark stones. It’s a good example of diamonds going well beyond the Kimberley Process. (Watch the Today segment here.)

The Centurion: One of the diamond workers in the segment report says 85 cents of every dollar earned from diamonds goes back into the Namibian economy—highlighting, for example, the Julius Klein factory and others where Namibians work as cutters, sorters, etc. Lauer says there is a 50/50 partnership with the Namibian government. Is it also a shareholder like Botswana that has an option to acquire more?

Lussier: No. There’s a 50/50 investment and profit sharing both there and in Botswana, but they [the Namibian government] didn’t also purchase shares in the De Beers Group like Botswana did.

These partnerships are a successful thing for us. These countries’ natural resources are their wealth, and otherwise they’d argue why allow us to work there? The government uses the revenue stream to build sustainability, so that when the diamonds are no more, we aren’t walking away from a ghost town. People will have skills and education that are transferable, either to other mining industries or other industries. Management skills, entrepreneurial skills, business skills are transferable to any industry, not just mining.

Our challenge is going to be that over the next 20 years the size of the African workforce will double. The number of jobs needs to double.

The Centurion: That's a challenge, because a mining town when the mine runs out is often not a pretty picture.

Lussier: I know. I come from Schenectady, NY, which used to be the corporate headquarters of GE. When GE moved its headquarters to Connecticut, the town of Schenectady basically fell into depression afterwards, and it took a long time to get out of it. But Americans are more mobile. It’s not so easy in Africa to move across borders, so our challenge is going to be how to use the natural resources to keep the economic wealth within the country.

Sidebar: The End of the Oppenheimer Era

“Everything has changed, yet nothing has changed,” said Forevermark CEO Stephen Lussier of the Oppeneheimers’ exit from De Beers. It’s the end of an era, but Anglo American has sat on De Beers’ board and approved its business strategies all along, so it’s not like an outsider is taking over, he told The Centurion.

Nicky Oppenheimer stepped down from the Anglo board earlier this year—the first time an Oppenheimer family member hasn’t sat on the board—and analysts say the decision to sell was linked, at least in part, to questions about his succession. Oppenheimer’s grandfather, Ernest, founded Anglo in 1917, and took control of the fledgling De Beers in the 1920s. His son, Harry, and grandson, Nicky, built it into a powerhouse that at one time controlled a major portion of the world’s diamond supply. Today it controls about one third of the market, according to an article on Bloomberg.com.

No management changes will be made before the deal is completed and Philippe Mellier, the French auto executive recently brought on as De Beers’ CEO, will remain, the article said.