Articles and News

EXCLUSIVE! L2’S SCOTT GALLOWAY TELLS HOW TO SURVIVE A JEWELRY INDUSTRY EARTHQUAKE | October 24, 2012 (1 comment)

New York, NY—The luxury jewelry and watch industry is about to undergo a “tectonic shift” that’s going to put independent jewelers at great risk, says Scott Galloway, founder of L2 ThinkTank, a research firm focusing on digital innovation in the luxury market.

But in an exclusive interview with The Centurion, he identified the one unbeatable strategy that will ensure survival for luxury independent jewelers in a digitally-dominant retail landscape. Hint: it’s not customer service.

L2ThinkTank has just completed its 2012 Digital IQ Index for the luxury jewelry and watch industry. While only digital leader Tiffany scored “genius,” the jewelry and watch industry as a whole—which Galloway took to task last year for its digital laggardness—will see huge change in the near future as e-commerce morphs from a primarily discount-driven focus to a venue for luxury brands to sell full-price goods online and via mobile devices.

Once again, Tiffany is the top-ranked jewelry and watch company for digital excellence.

Galloway, in his introduction to the 2012 jewelry and watches study, compares the coming changes to a war brewing. Like Europe before WWII, he sees certain incidents as markers: most notably, the increase in vertical marketing by luxury brands. For the first time ever, he noted, in 2011 Compagnie Financière Richemont (which owns such brands as Jaeger-LeCoultre, Van Cleef & Arpels, and Cartier), registered more than 50% of its sales from vertical channels. He points to firms ranging from behemoth LVMH to designer Ippolita, whose fashionable jewelry is rocketing her to favorite status among consumers, opening standalone branded stores, and believes these shops are the first steps for an industry that is ripe for e-commerce.

The number of brands in the study that sell online has increased from about one-third last year, to nearly half this year. But while some industry behemoths like Rolex and TAG Heuer still have not launched e-commerce—yet—other signs Galloway sees pointing the way for increased brand distribution online include:

- The industry’s predominance of independent retailers who have limited investments in technology,

- Increased material costs shaving retailer margins ever thinner

- Robust industry growth and consolidation

- A shift from online being predominantly a discount channel to being a full-line luxury channel,

- The transformative impact of tablet computers. Jewelry brands registered 11% of e-commerce sales from tablet devices in 2011, with a conversion rate between one and a half to two times that of PC’s, says Galloway.

- Luxury fashion houses such as Louis Vuitton and Hermès that have a fine jewelry and/or watch division see the category as fertile ground and may seize the opportunity before jewelry brands have a chance to establish themselves.

“Luxury, which is traditionally high-touch, is moving to low-touch,” Galloway told The Centurion. “The number-one cited reason why luxury customers shop online is to avoid the salesperson. It’s not value, price, or convenience—it’s that they don’t want to deal with a salesperson.”

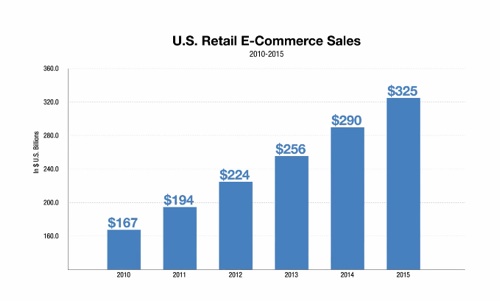

Full-price online sales of luxury goods have increased 25% in the past year, says L2.

This is especially true of the Millennial generation that grew up with a screen in front of them, he says. They want a seamless luxury experience that isn’t interrupted by humans. In a luxury hotel, for example, they want to simply arrive at a room that is exactly the way they want it, without having to go through the check-in process. Similarly, with a jewelry or watch purchase, the velvet case, security guard, and glass of champagne delivered on a silver tray is the experience a Boomer customer expects but a Millennial customer finds off-putting, he says.

What about the fact that man is biologically wired as a social animal? Are we all going to become hermits who hide behind a screen and interact only in the virtual world? No.

“Sure, we’re social. We want to spend time with family and friends. We don’t want to spend time with the guy who’s trying to sell us a watch,” he says.

Digital impact goes far beyond the website, says L2. Brands that are e-commerce enabled experience 50% higher year-on-year growth than brands that are not, and they also boast 1.5 times as many Google searches as brands that don’t sell online.

Though fully 80% of the brands in L2’s Luxury Jewelry and Watch Index still are classified as “average” or below, there has been noticeable progress in the years since the firm began studying the category. For example, says the report, almost half the firms now use paid search, up from a small percentage three years ago. All but Rolex and Patek Philippe have a Facebook presence, 85% have a Twitter presence, and about half have a Pinterest presence.

E-commerce growth rates from 2010 to now, with L2's projections to 2015.

But simply being digitally savvy isn’t going to level the playing field for independents, says Galloway. “Everyone thinks that if the little guy is smart, he can get online and do just as well as the big guys. That’s not true. There’s a huge investment that needs to be made, and the little guys simply can’t compete,” he told The Centurion.

The big guys just have more and more power, especially as they consolidate more and more brands—and they’re looking for more and more direct-to-consumer growth.

“Third-party retailers will not fully disappear, but they are becoming less critical to brands, who are investing more in their vertical distribution and relying less on third parties for sales,” adds Adrienne Ronai, who was the lead researcher for the jewelry/watch study. “Brands are gaining the upper hand in their relationship with third-party retailers, and many smaller players might not be able to withstand this power shift.”

Further, she adds, in a world where consumers are becoming increasingly comfortable with traveling to make their luxury purchases (high numbers of Chinese and Brazilian tourists travel to the US and Western Europe to buy luxury items), the advantage that third-party retailers once had by being local could begin to deteriorate.

“All the big brands have stated goals of more direct-to-consumer sales. I don’t know any brand that has a goal of less direct selling,” says Galloway of the prestige watch and jewelry category. He says the luxury jewelry and watch category “feels like the fashion category did four years ago. Everyone said nobody is going to buy apparel online without touching or trying it. Now it’s the fastest-growing category.” Right now, its digital performance is still substandard but not for long. And, he adds, when Rolex and TAG do begin selling online, it’s going to be Katie-bar-the-door.

As margins are squeezed by rising materials cost, watch brands are seeing more opportunity for profits by cutting out the middleman; i.e., the retailer. And the retailer can’t compete with a branded store or site that’s selling the full line of product and providing a superior luxury experience.

“Because of concerns about discounting and gray-market goods, the jewelry and watch industry really tried to keep e-commerce at bay,” he says. But those days are over and the category is about to be disrupted in a major way.

In the early days of branded brick-and-mortar stores, most retailers found their sales of a given brand went up, not down, when a branded store opened in the area. In the short term, says Galloway, this works because it’s extra exposure and extra advertising. But in the long term, the more outlets there are for a brand—whether digital or brick and mortar—simply means the more competition there is for the retailer selling it.

So what can a luxury jeweler do to survive and thrive in such an environment?

In a word, differentiation. Just like the department store category has had to turn to private label and exclusive goods to survive, luxury jewelers need to get away from the big corporate conglomerate brands and focus on niche designers, smaller brands that emphasize independent jeweler distribution, exclusive product, and merchandise they can brand with their own store name. In other words, go back to the way jewelers used to do business.

“What’s old has become new again,” says Galloway. “The lifeline for jewelers is going to be self-branded, unique, differentiated merchandise. It’s almost as if they need to reposition themselves as artisans, not just retailers.”

L2’s 2012 Jewelry/Watch Digital IQ Index: Who Scored What

The Digital IQ score was 40% based on the effectiveness of a firm’s website (ease of navigation, checkout, product pages, etc.); 30% on its use of digital marketing (search, blogs, ads, email); and 15% each on mobile and social media.

Here were the rankings:

Genius, score of 140 or higher: Tiffany, which was ranked #1 with a score of 157. A brand with a genius score has reached a level where its digital competence is a point of competitive distinction, says L2. Indeed, despite recent struggles with lower sales overall, Tiffany has earned kudos from a number of sources for its digital innovation.

Gifted (scores between 110-139): L2 says these brands are experimenting and innovating, and their digital presence is strong, complementing the brand image and other marketing efforts. Brands achieving that ranking in the 2012 study include: Swarovski, David Yurman, Tissot, Cartier, Montblanc, Pandora, De Beers, Victorinox, Pandora, and Swarovski.

Brands with “average” scores (between 90 and 109) have digital presence that’s functional but predictable. Brands L2 puts in this category include: Jaeger-LeCoultre, Movado, Nixon, IWC Schaffhausen, Longines, Omega, TAG Heuer, Baccarat, Van Cleef & Arpels, Hearts On Fire, Piaget, Georg Jensen, Rolex, Bell & Ross, Bulgari, Harry Winston, Hublot, Breitling, and Audemars Piguet

“Challenged” (scores between 70 and 89) brands’ digital efforts are inconsistent, lacking inspiration and utility, says L2. Efforts may be siloed across platforms. Brands that fell into the “challenged” category were: Chopard, Raymond Weil, Mikimoto, Boucheron, Ippolita, Citizen, Bulova, Roger Dubuis, and Patek Philippe.

At the bottom of the list, brands whose digital efforts are “feeble,” scoring fewer than 70 points, were: Vacheron Constantin, Baume & Mercier, Zenith, A. Lange & Söhne, Franck Muller, Officine Panerai, Vestal, Graff, H.Stern, and Buccellati.

Watch an L2 video about the jewelry and watch category here.

All photos: L2ThinkTank