Articles and News

For Better Jewelers, It’s A Strong Holiday So Far | December 05, 2018 (0 comments)

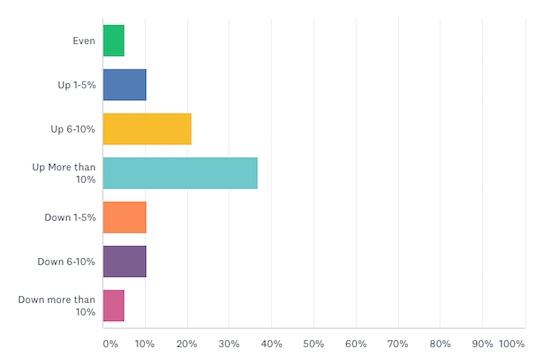

Merrick, NY—Luxury jewelers are finding plenty to be merry about so far this holiday season. In The Centurion 2018 Holiday Sales Success Index spot-check survey of better jewelers, for the first full week of the holiday season, 37% of respondents reported sales gains of more than 10% over the same week last year. Another 21% reported sales up between 6% and 10%, and 15.5% said sales were either even or the increases were modest—between 1% and 5%.

26% of respondents, however, are experiencing a slow start to the season: 21% reported sales have dipped slightly (between 1% and 5%) or moderately (between 6% and 10%) off the same week last year. Only one respondent said sales this week were off more than 10% over the same period last year, but acknowledged the comparison was against a major $65,000 diamond sale that happened during the same week last year.

How Was Your Business For The First Full Week Of The Season, Compared To Last Year?

In the broader retail picture, the National Retail Federation reported that the Thanksgiving weekend period (encompassing Thanksgiving Day to Cyber Monday, November 29) saw slightly fewer shoppers and a slightly lower total spend than 2017, but at press time the organization still is holding to its prediction of a 4.8% increase in sales for the total holiday season. NRF didn’t break out jewelry sales figures, but a Diamond Producers’ Association survey, conducted in November, found that more than 53 million Americans (21%) have plans to purchase a diamond between Thanksgiving and Valentine’s Day. Men and Millennials are most likely to purchase one in that period, says DPA’s research.

The better retailers represented by Centurion’s study over-index for diamond sales compared to DPA’s research. Among respondents to the Centurion Holiday Sales Success Index, more than 56% say diamonds are their strongest seller so far this season. That figure includes all diamonds: engagement and bridal as well as fashion. Other strong categories for Centurion retailers so far have been colored gemstone jewelry and watches.

Colored gemstone jewelry has been a good seller this season. Madame Butterfly necklace, Bellarri.

DPA’s study found that of Americans who plan to buy a diamond, more than 20 million (37.7%) plan to buy a diamond engagement ring. For the second week of the season, bridal is tracking lower than diamond fashion among better jewelers--only 17.6% of Centurion respondents reported engagement and bridal as their top sellers so far this holiday, and the remainder cited diamond fashion product (including diamond stud earrings.)

But DPA’s research also shows a disturbing concern for jewelers: as lab-grown diamonds become more widely available and consumers become more aware of them, they’re also becoming more confused about them. The survey confirmed that there is clear confusion (44%) among diamond purchasers about the differences between natural diamonds and laboratory-created diamonds, including value, rarity, physical growth structure, and origin.

DPA’s Grant Mobley, a gemologist and diamond expert, says, “Diamonds shine especially bright this year. Consumers, especially Millennials, are seeking ways to share authentic, emotional and lasting symbols of love with the special people in their lives.” But he warned about the increasing confusion at the counter and the need for clear education, both among consumers who need to do their homework, and for jewelers to be able to educate consumers clearly about the differences.

Related: Exclusive Interview! DPA’s Grant Mobley On Millennials, Diamonds, And “Deals”

But DPA found that more than seven in 10 consumers (71%) became more likely to buy a natural diamond as they learned the differences between those and lab-grown, and more than 78% are more likely to consider buying a mined diamond after learning about the positive social, economic, and wildlife conservation impacts of the diamond industry. DPA lists these key education points between natural mined diamonds and laboratory-created diamonds:

- Natural diamonds are significantly more valuable than laboratory-created diamonds.

- Each natural diamond is rare because it is unique and authentic; laboratory-created diamonds can be made in unlimited quantities.

- Natural diamonds can take millions or even billions of years to be created in the earth; laboratory-created diamonds are typically made in two weeks.

- Natural diamonds and laboratory-created diamonds have easily detectable differences in their physical growth structures.

- The diamond industry supports 10 million jobs around the world and contributes $8.4 billion a year to African economies.

- Investments by the diamond industry protect vulnerable wildlife around the world, including thousands of caribou, grizzly bears, and elephants.

- 99.8% of diamonds on the market are certified conflict free through the Kimberley Process.