Articles and News

GIA GEMFEST BASEL FOCUSES ON LUXURY GEMSTONES: TREATMENTS, PEARLS, AND DIAMONDS | March 13, 2012 (0 comments)

Basel, Switzerland—GIA's GemFest Basel, held Sunday, March 11 during the Baselworld fair, addressed some troubling issues in the high-end diamond and gem sector. Presentations during the two-hour seminar covered gem treatments and nomenclature, identification of natural vs. nucleated pearls from the Pinctada maxima oyster, and an overview of some of the major diamonds, both fancy and white, that GIA has evaluated recently.

Russell Shor, GIA senior industry analyst, was the moderator for the afternoon. He opened the session with an overview of key issues in all three sectors.

In the diamond sector, key issues and changes include the acquisition of De Beers by Anglo American and its subsequent new management, “cheap” Zimbabwe rough creating havoc, the rough market in general becoming a free-for-all, and tighter financing and law enforcement scrutiny. The diamond world is in “reset” mode, says Shor.

In the colored stone sector, Shor highlighted world politics, such as the potential lifting of the US/EU ban on Myanmar stones, the coup government in Madagascar continuing to restrict gem exports, some political issues in Thailand, and governments’ general probing of gemstone financing.

In the pearl market, the key issues include farmers adjusting to oversupply, a resurgence of high-end pearls being produced in the Middle East, and current fashion making colored pearls popular.

Regarding supplies of high-end pearls from the Middle East, Shor says this is a “back to the future” moment, as that’s where the center of the pearl industry used to be centered.

Finally, Shor addressed the many changes the Internet has wrought and how it has reshaped the jewelry industry. Not the least, of course, is the availability of information to everyone, including consumers (and subsequent shaving of price and margin), but also it gives business an opportunity to have worldwide clientele, and it increases the potential for fraud.

But what hasn’t changed, said Shor, is demand for natural, untreated gemstones, which is extremely high, a resurgence and strong growth of natural pearls, and demand for the best qualities of both colorless and fancy color diamonds.

Shane McClure, GIA director of identification services, began by discussing lead glass filled rubies. GIA has been reporting on that treatment since 2003, he said, but it’s still a big issue. Identification—a flash effect, large gas bubbles and large flattened gas bubbles—is not the problem, but disclosure is. The GIA laboratory has found the lead glass rubies even in costly, high-end jewelry, said McClure. The frequency of observation has led to GIA changing its report disclosure policy to “manufactured product” with a comment that it’s made of lead glass and ruby.

A lead glass filled ruby.

Diffusion treated sapphire is also still an issue, said McClure. GIA continues to see beryllium treated sapphire and also has been observing an increase in titanium diffused sapphires again, along with sapphires treated with both materials.

McClure also discussed some new issues with opal, particularly some first claimed to be from Kenya, then later from Mexico—but laboratory investigation finds the material to be consistent with dyed opal from Ethiopia.

Issues also have arisen around jadeite and gem origin nomenclature. First, said McClure, the lab encountered a group of stones thought to be jadeite that may potentially not be. GIA is addressing options, which include calling it omphacite (recognizing the mineral group), expanding the gemological definition of jadeite, or reconsidering the definition of the term “jade.”

In terms of origin, GIA recently has encountered a number of Sri Lankan stones being called “Burmese” by major labs. This poses a problem because a gem’s origin can have a profound effect on its value.

Next, Ken Scarratt, GIA managing director of Southeast Asia and director of its Bangkok, Thailand, lab, discussed identification criteria for detecting natural vs. cultured South Sea pearls.

“Given that Pinctada maxima is used extensively for pearl culture as well as being fished in the wild, and often the microradiographic evidence proving—or disproving—the true origin is open to interpretation, such questions are to be expected,” he told the audience. By comparing pearls from both wild and hatchery P. maxmina shells that both have and have not been operated on during the culturing process, as well as employing various technologies such as microradiography and micro CT scanning, GIA is better able to observe minute differences in each kind of pearl, leading to better identification with less room for interpretation.

Pinctada maxima with a pearl--is it natural or cultured? Photo: GIA

Lastly, John King, chief quality officer for GIA, discussed recent diamond activity at GIA’s laboratories. Longstanding trends, such as historic diamonds, auction diamonds, rare colors, treated colored diamonds, synthetics, and highlighting inclusions, are still current, he said.

He led the audience through some of the more famous diamonds that GIA has been involved in evaluating, such as the Princie Diamond, the Wittelsbach-Graff, the Hope, the Bvlgari Blue, the Elizabeth Taylor, and more.

Next he highlighted some diamonds made famous not by provenance but by the sheer magnitude of its auction value. Among those were a 6.04 ct. fancy vivid blue flawless emerald cut that sold for $7.98 million ($1.32 million per carat) at Sotheby’s in 2007, the Vivid Pink, a 5 ct. stone that sold for $2.1 million per carat in October 2009, and the Graff Pink, a 24.78 ct. fancy intense pink sold at Sotheby’s Geneva in November 2010. It fetched a whopping $45.6 million, a world record price for a gem at auction.

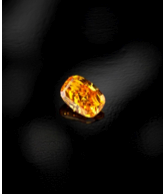

King also highlighted a number of less famous, but equally impressive stones from the auctions, such as the Mandarin Orange, a vivid yellow pear, and more.

Among the rare colors of diamonds recently passing through the lab were a fancy vivid pinkish orange, a fancy vivid purple, a fancy vivid green, and a fancy vivid blue-green. Among treated stones, some unusually large specimens included a brownish-yellowish-orange, an orangey pink, and more. He also showed examples of two stones that were cut to maximize, rather than reduce or eliminate, inclusions.

Top image: The 4.19-carat Mandarin Orange, a fancy vivid orange diamond that fetched $2.9 million. Photo courtesy GIA.