Articles and News

GOLD BUBBLE STILL COMING BUT STOCKS WON’T PREDICT PRICES | April 11, 2012 (0 comments)

Merrick, NY—If you've been trying to anticipate the price of gold by tracking its relationship to the Dow Jones Industrial Average, don't, because experts say it doesn't matter.

Gold prices and the Dow recently have seemed to move in tandem, making it very tempting to base market predictions for one on the behavior of the other. But investment experts generally believe the two don’t have a long-term symbiotic relationship and any impression they might give of one is just a fling, not a marriage.

“The stock market is spooked by day-to-day events, but gold tends to move more on the long-term outlook,” says Ken Gassman, a longtime financial analyst for the jewelry industry.

“Markets are not logical in the short term, but emotional. Fear and greed are the main drivers behind any liquid asset in the short term, including gold and stocks, says Przemsylaw Radomski, founder, owner, and main editor of Sunshine Profits.com, a website offering information and professional support for precious metals investors.

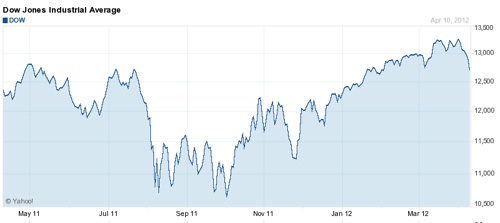

“The relationship between gold and the stock market is quite complex. It’s positive, negative, and even neutral—all at the same time—depending on the perspective that one takes,” Radomski told The Centurion. For example, looking separately at the yearly charts for both gold and the Dow, the two appear to be aligned: both moved up since April 2011 and both markets saw corrective moves, but overall both ended the period slightly up from a year ago.

The Dow Jones Industrial Average from May 2011 through April 10, 2012. Photo courtesy Yahoo! Finance.

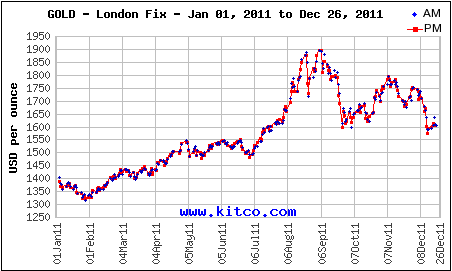

Spot gold prices for 2011, above, and 2012 so far, below. To compare with the Dow Jones chart above, use the line pattern beginning in May through December 2011 on the chart above, and move to the chart below, using the entire line pattern, to compare with the 2012 portion of the Dow chart. Both gold charts, courtesy Kitco.com.

But, says Radomski, there were times during that 12-month period when the two markets moved precisely in opposite directions: for example, from July 2011 through the end of August 2011 (i.e., coinciding with the debt ceiling battles in Congress). During that time, gold rallied strongly while stocks declined significantly. (Editor’s note: Given gold’s historical position as a safe haven and the Dow’s skittishness about any uncertainty in Washington, that’s not a surprising side effect of the political wrangling and subsequent downgrading of U.S. creditworthiness taking place at the time.)

But a few months later, in early October, stocks soared without similar action in gold, and in December, gold went down while stocks finished the month higher.

Now, literally in the past few days before press time, Radomski points out that gold is going up while stocks are going down.

“Gold declined along with stocks during the first week of April, however, taking the previous 30 trading days into account, the two still moved on average in the opposite direction. This suggests that declines in the general stock market will not necessarily be bearish for the precious metals sector,” he said.

The bottom line, Radomski said, is that there are periods when gold moves along with stocks and there are periods when gold and stocks move in the opposite directions. It seems the [recent] period of positive correlation has ended, and it's not certain when it will be back.

“It’s one of the things in life that can be described by Heraclitus' quote, ‘the only constant is change,’” he said.

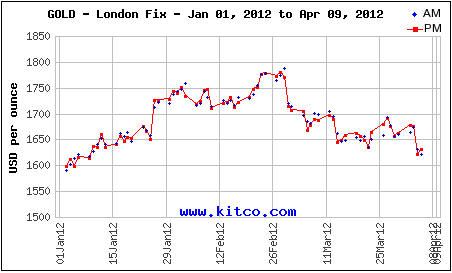

Above is a chart showing the correlation between gold and the S&P 500, laid on top of one another. Gold is the blue line, the S&P is black. Source: Goldratefortoday.org.

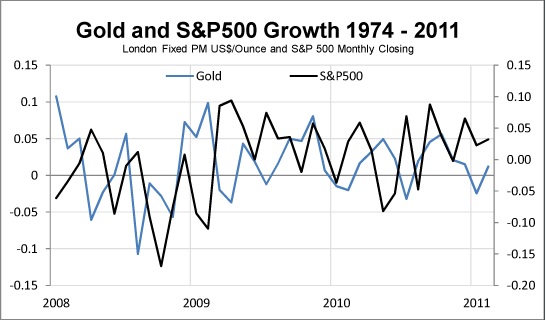

This is a portion of a correlation matrix calculated by SunshineProfits.com. The gold/S&P line is in the middle, and note the constant change in correlation from positive (green arrows) to negative (red arrows) to neutral (yellow arrow).

Sell jewelry, not gold. Jewelers need to focus on selling jewelry, not gold, says Gassman. Too many luxury jewelers get tangled up in the “investment” idea, and that’s bad.

“I continue to admonish jewelers: don't use the word ‘investment’ and ‘jewelry’ in the same sentence!”

The price of gold is something that most consumers don't watch, Gassman says. Or, at least, they watch it far less than they watch the Dow Jones index. The bottom-line total of their investment portfolio is far more likely to affect whether they feel like spending or pulling back than whether gold is over or under $1,600.

Even when they are buying jewelry, says Gassman, the jeweler should focus the customer's attention on the look of the piece, not how much gold is in it or how good of a deal they’re getting because the price tag on the piece is based on last year’s gold price.

“What’s a jeweler going to do when the price of gold pulls back? Tell the customer she’s overpaying for the piece because the jeweler's cost is based on gold content at last year's higher price? Jewelers need to sell jewelry, not gold!” he emphasizes.

The “B” word. No gold conversation today would be complete without asking if the current price is indicative of a bubble. Radomski believes it isn’t—yet—but at some point in the future it probably will be. Just because the price of an asset goes up doesn’t mean it’s in a bubble, he says. Bubbles, as discussed in this previous article in The Centurion, show a parabolic increase in price, which gold has not yet displayed.

“Bubbles form when a given investment becomes very popular with the general public, markets move sharply higher without corrections and when fundamentals are no longer in place. This is clearly not the case for the gold market,” Radomski says. The stock market isn’t in a bubble either, he adds—it’s still below the 2007 high.

What to watch. Gassman says predicting the price of either gold or stocks is like predicting the weather, and warns jewelers to avoid anyone who promises a “foolproof” method.

But there are ways to be better informed about the gold market. On the industry side, stay up to date about any issues that affect supply and demand, such as emerging markets, shopping trends, or mining developments.

The Thomson Reuters GFMS Gold Survey 2012, released Wednesday, suggests gold is likely to climb to the $2,000 mark by the end of 2012.

Philip Klapwijk, Thomson Reuters’ global head of metals analytics, advised short-term caution on gold price.

“The low $1,600s came as little surprise and it’s quite possible we’ll see a push even lower, perhaps below $1,550 in the next month or two.”

Despite that, Thomson Reuters is bullish for the medium term. “We could easily see last September’s record high being taken out, and a push on towards $2,000 is definitely on the cards before the year is out, although a clear breach of that mark is arguably a more likely event for the first half of next year,” said Klapwijk.

Many of the factors expected to fuel investor interest this year were present in 2011 as well, but one of the main drivers of this reversal during the year may be new fears over Eurozone sovereign debt, with Spain set to be the new principal area of concern. Another concern is whether the U.S. recovery will begin to falter, forcing the Federal Reserve into taking additional monetary policy measures, along with loosening in China, India, and Brazil. (Editor’s note: As of last week, the Fed had declined to pump more money into the economy.)

In jewelry, says the GFMS survey, global fabrication fell by 2% last year, but emerging markets drove demand up. In the West, there was a major rise in jewelry scrap, as sellers were motivated by high prices and the ease of recycling. Mine production grew 3% in 2011, representing the third year of gains.

Apart from industry indicators, Radomski says there are two main types of indicators of future gold movements: analysts’ opinions and investment tools. Precious metals market analysts all study the current situation in an attempt to predict the future moves of prices. What differs is how they go about it. All examine a wide range of potential price drivers to try to pinpoint the ones that will most likely influence price at a given moment in time. But some rely on technical analysis, others on fundamental factors, and still others on quantitative analysis or intuition. Some mix these or other tools, while others rely solely on one.

It is considerably hard to find two similar precious metals analysts and two identical forecasts, and analysts cannot always be right—though some may turn out to be more accurate than others, Radomski says.

In addition to analysts’ opinions, there are investment tools that objectively and precisely measure market developments, such as the RSI (Relative Strength Index), which often provides reliable buy and sell signals, and some aspects of technical analysis like Fibonacci retracement levels indicate how low can gold go during a correction.

Radomski believes it’s best to combine both quantitative methods (tools) and qualitative ones (analysts’ opinions) to make an informed decision.

Top image: Bullionstreet.com