Articles and News

Good News For Jewelers: New Study Shows Affluent Spending Up And Consumers Want Luxuries That Last November 24, 2015 (0 comments)

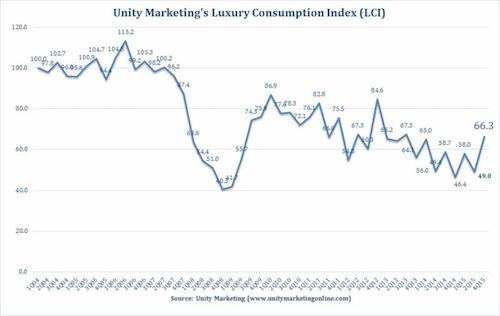

Stevens, PA—There’s more good news for marketers and retailers targeting affluent customers this holiday season. Unity Marketing's most recent affluent attitude and purchase behavior survey shows that affluent consumers increased their average three-month spending on high-end or luxury goods and services by 3.2% overall and, even better, consumer confidence among affluents rose 17.3 points as measured by Unity’s Luxury Consumption Index (LCI). This is the single biggest jump since Q4 2012.

The findings come from a survey conducted in October 2015, tracking 1,200 affluent consumers' high-end and luxury purchases for a three-month study period. The findings were compared to results from a similar period in Q4 last year.

"Finally, we can bring some good news to brands that depend upon the out-sized spending potential of the affluent consumer segment, the top 20% of U.S. households based on income," says Pam Danziger, president of Unity Marketing and lead researcher in the ACTS study.

"Affluent consumer confidence in fourth quarter 2015 posted the strongest uptick we've seen in the past three years. Since affluent spending on luxuries are purely discretionary, their feeling of confidence in their financial status is essential to getting them to loosen their purse strings, which they did over the past three months."

Unity Marketing's historical Luxury Consumption Index shows a sharp uptick in confidence among affluent consumers.

Contributing the greatest boost to affluent spending this quarter was a 29.6% quarter-to-quarter increase in spending for high-end home luxuries. Danziger says the rocketing increase in home furnishings fits perfectly with affluents’ focus on gaining the greatest return on their investment in spending.

“Buying a new handbag or outfit gives a momentary thrill, but once the newness wears off, it is just another thing in the closet. But investing in home improvements, like redesigning the closet or new kitchen appliances, is something that greatly improves the quality of your everyday life,” she says.

Affluents also are investing in collectible personal luxuries that hold value, Unity’s findings show. In the personal luxury space, affluent consumers also picked up the pace of spending on investments in jewelry and watches, both of which have inherent value, while spending on more disposable luxuries like clothing, fashion accessories, and beauty posted a decline.

Personal electronics, and wine and spirits also posted increases in spending in the Unity study.

"Luxury is a state of mind, not a brand or a price point," Danziger comments. "With improved confidence in their financial status, affluents are choosing to spend where they get the greatest return on their investment as measured by improvements in their quality of life or that promise to hold their value.

"Brands need to position their product offerings around meaningful and measurable improvements they deliver to affluent's luxury lifestyle. They have to deliver meaning to the customer, which today is measured by the enhanced lifestyle experiences they offer," she concludes.

Danziger will host a live webinar on Wednesday, December 16 at noon to review the latest survey and discuss how best to reach today’s more value-driven luxury consumer. The session costs $500 and will last approximately 50 minutes. Participants don’t have to join the live session; it will be recorded for later listening plus they will receive a copy of the presentation for study.

Separately, in the broader retail picture, Wells Fargo Securities also forecasts a merrier holiday season for retailers this year. Its annual Holiday Sales Outlook predicts a 3.4% increase in holiday sales this year, and Wells Fargo economists expect the average holiday shopper to spend more money this season.

“Economic conditions and consumer confidence continue to improve as we head into the holiday shopping season,” said Wells Fargo economist Michael Brown. “The National Retail Federation’s holiday spending survey found that the average holiday shopper is expected to spend 0.4 percent more per person than they did last year.”

Eugenio Aleman, another Wells Fargo economist, said the bank expects overall retail sales to rise 2.6 percent in the fourth quarter, compared to the same period last year.

“We anticipate a happy holiday season for retailers and consumers alike.”

As part of holiday sales, Wells Fargo economists are seeing the most sales strength in furniture and home furnishings, clothing and clothing accessories. They also are seeing strength in non-store retailers, which includes online retailers. Some of the weaker sectors compared to last year includes automobiles, electronics and appliance stores.

Top image: Rahaminov fancy yellow diamond ring