Articles and News

Hertz Hasenfeld Disputes Rapaport’s Pessimistic View of the Diamond Market April 12, 2022 (0 comments)

New York, NY--In a blunt statement emailed to his clients and those in the diamond trade, Hertz Hasenfeld, president of Hasenfeld-Stein, a New York-based diamond manufacturer and wholesaler, disputes Martin Rapaport’s recent statements that polished prices are under pressure, the diamond market is sluggish, sentiment is weak and dealers have been cautious when trading polished diamonds.

Rapaport made these statements in his regular RapNet Diamond Index report and his TradeWire reports, both widely read in the industry.

Hasenfeld told Centurion that within 15 minutes of sending his email, he received about 50 enthusiastic responses echoing his thoughts. “I’ve never experienced such a rapid and enthusiastic response.”

Below is his letter disputing Rapaport’s recent statements:

The Better American Retailers’ Market is as strong as ever

Martin Rapaport has been right more often than wrong for the past few years. He also has a much broader view of the market than I do, as I deal in a very specific segment of the diamond spectrum; while he covers the full market.

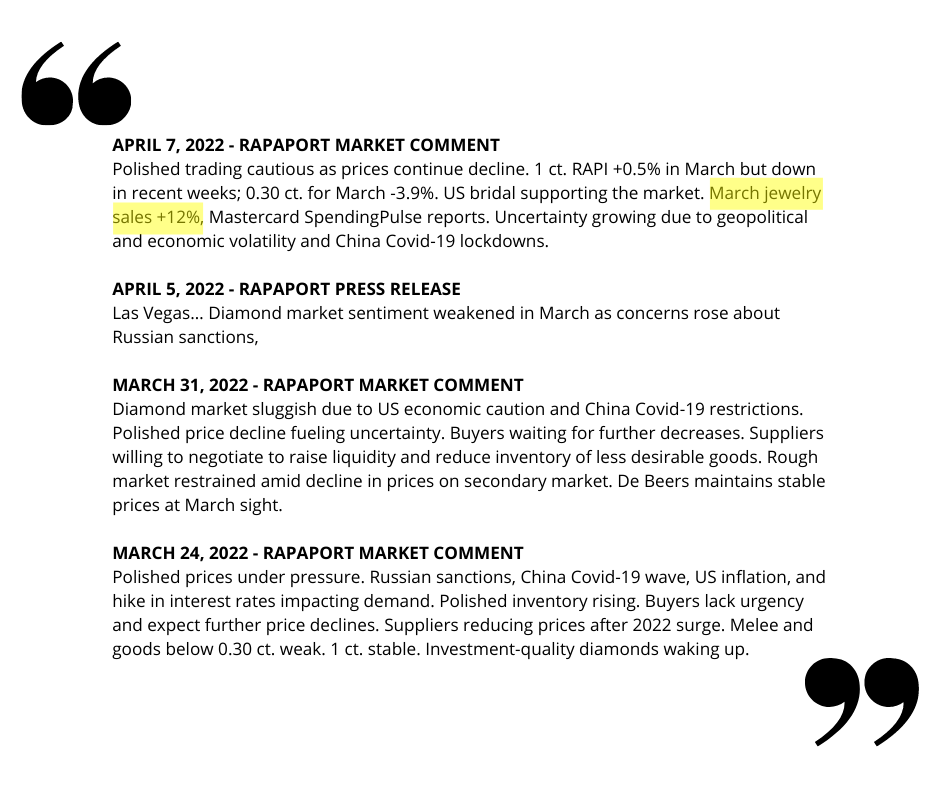

Rapaport statements summarized by Hertz Hasenfeld in his email. Image source: Hasenfeld-Stein

Broad Market vs. Specific Markets

For the past 4 weeks, Rapaport has been very negative about demand and prices. As it relates to the goods that I manufacture and sell, I think he has been wrong.

If his comments refer to other areas that I am not seeing, he should be more specific and let his readers know which areas have gone down, and which haven’t.

Prices are NOT falling for Rounds .50 – 2.99 D – J VS – SI. In fact, I think prices have inched up every week this year through March. The prices are stable and I do not see any weakness in this area at all.

Neither has demand fallen. Any stone manufactured in the above area has a buyer ready to pounce.

Talking down a market is just as dangerous and wrong as talking it up. I don’t have the bully pulpit he has, but I do feel the obligation to stand up to the negative comments about the market that are being unjustly spread, hence this email.

Rough is still very HOT

Rough premiums have fallen. They were well into double digits throughout January and February. They are currently in the high single digits.

In the BC (Before Covid) era, if rough boxes were trading for List (DTC price) +4%, Rapaport would call the rough market very strong. Today, you can't find any box of 2 carats + for even a +7%, yet he calls the rough market weak.

Once again, I see no weakness. As an active rough buyer, I haven’t seen any real finds in months and I can’t fathom why he calls the rough market weak.