Articles and News

HOT STUFF: WHAT WILL SUPPLIERS HAVE AND RETAILERS WANT IN LAS VEGAS? | May 05, 2011 (0 comments)

Merrick, NY--With the JCK Show and Couture shows less than a month away, The Centurion asked retailers, manufacturers, and top trend spotters what’s going to be hot in Las Vegas this year.

People are spending money again, says Wolfgang Mockel of Antonini, based in Milan, Italy. Slowly but surely they’re coming back, though he sees more progress in the East than on the West coast.

“At trunk shows what’s selling isn’t just the $2,000 to $5,000—it’s $20,000 and up,” he says. In Las Vegas, Antonini will bring the Porto Cervo collection introduced in Basel. It’s 18k rose gold, with either amethyst, chalcedony, and iolite, or pink quartz, smoky quartz, rhodocrosite, and white agate. Retail price points range from starter pieces like a $1,790 pendant or $1,880 ring, to a $13,000 necklace at the top of the range.

“Response has been phenomenal,” says Mockel. “Every store says ‘I love it’ so I hope that translates to orders at Couture!” In Basel, he said, preference was equally divided between the cool iolite or warm rhodochrosite groups.

Antonini's Porto Cervo collection comes in cool tones, left, with amethyst and iolite, or warm tones, right with smoky quartz and rhodochrosite, both in 18k gold with white agate.

For retailers, the key word is “new,” whether it’s a specific product or a general category, or just wandering to see what might inspire. Retailers told The Centurion their goal for the shows this year is to find things to add an element of freshness, not just to reorder proven sellers.

Matthew Rosenheim of Washington, DC-based Tiny Jewel Box says his goal is to find some small boutique designers or lines to augment the existing lines he already carries.

“Fortunately, our core group of designers is doing very well,” he says. “We’re looking for boutique lines or looks that can add newness, but we’re not looking for a huge line.” He also needs some fashion looks on the high end, but “we’re not strongly categorical in that we want diamonds or color or pearl; we just want to add some newness.”

Business at the store has been steady, he says, even through some of the recent tough times. “We’re situated well. We’re in a wealthy niche in a fairly stable, affluent market.” Whatever one’s views may be about the size of the U.S. government, jobs do exist around it and that’s been what has carried the retailer through the recent recession, says Rosenheim.

Scott Wickam of Goldsmith Gallery Jewelers in Billings, MT, is eager to see new pieces being introduced by Hearts On Fire. He’s also targeting some lower price points for bridal.

“Bridal is where it’s at for us, especially in the new store,” he says of his second, 7,500-sq. foot door, recently opened in a lifestyle center. He’s selling one or two engagement rings a day, and about 60% of his merchandise is bridal or diamond.

Wickam has always been a “one-carat and up” jeweler, but the new store especially is drawing a younger customer base and he wants be sure he has plenty to offer them.

“I’m looking for nice goods under $3,000,” he says. He’ll consider ¾ carat, even 60 pointers if they’re good, to target these customers, who typically are in their early 20s and can’t yet afford larger. But he won’t be going below ½ carat—that category, he says, he’ll still leave to the mall stores.

Ironically, where sterling silver has been a saving grace for many retailers, it’s been a weak spot for both Goldsmith Gallery Jewelers and Tiny Jewel Box.

“We haven’t seen our core customer trade down,” says Rosenheim. He has experienced an absence of the aspirational customer, but even they are coming back, he says. Washington is an important market for the female self-purchase customer, and they’re starting to come back. Still, he says, for all customers, most of his purchases now remain occasion driven, rather than “see it, want it, buy it.”

For Rosenheim, newness is important, but controlling margins—even in the face of $1500 gold and rising diamond prices—is even more important.

“Montana’s pretty basic. It’s diamonds and watches. The silver craze didn’t hit here,” says Wickam. “Pandora’s about as far as it gets [in silver].” But he’s considering putting in the upscale John Hardy collection, and he’s done well enough with Pandora that he had to bring in two associates just to handle it.

“We want to pamper everyone who comes in and give them the full experience, but we also need our experienced diamond and bridal salespeople to be available to help those customers,” he says.

Ronda Daily of Bremer Jewelry in Peoria and Bloomington, IL, is heading to Las Vegas with a disciplined plan, following a complete change in how her stores are merchandised. In some respects, remerchandising has allowed her to trim her “need to buy” list, though she does plan to look for new things at the show.

She plans to ask her top 30 vendors, “just show me what’s new,” and hit the show floor looking for eye-catching pieces that still will play well to her fairly conservative clientele. Yes, it really does have to play in Peoria. In particular, she thinks delicate, layer-able gold station necklaces would be a good addition that fits the bill, and she’s on the hunt for some.

Daily takes full advantage of the networking that surrounds any show, finding out as much off the show floor as on it. Everyone passes along tips and finds, she says—“Did you see so and so? Go see it; really cool stuff.”

With the merchandising changes in her stores, a silver and diamond bracelet now might nestle alongside a 9 ct. total weight diamond bracelet, in the same case. It looks quite nice, and, more importantly, the store is better at filling price points, she says.

“Before, if a customer wanted a $500 diamond bracelet, it was hard to find something [gold] that didn’t fall apart, but we didn’t think about a nicely made one with silver and diamonds.” Even if it was already in the store, it was in the silver case so it wasn’t top of mind in terms of diamond bracelets. But now it is. As a result, she’s finding that many of the price points she thought she needed, she already has.

“Unless it’s a designer name that has to be merchandised on its own, we’re merchandising by color. Maybe for other retailers it’s something they’ve always done, but hey, I feel like I thought of something!” she laughs.

The other trend she’s noticed recently at trade shows is a willingness on suppliers’ part to give early-pay or pre-pay discounts.

“When people ask what terms you want and you ask what about a discount if you’re going to pay in 15, 10, or even 5 days, or pre-pay, that changes everything,” she says.

Manufacturers are responding to the demand for new. For example, the Henderson Collection by Lecil will be introducing a brand-new sterling silver and enamel group called The Firenze Collection.

It will follow the same concept as the firm’s 18k Venetian Collection, but at lower price points for a wider audience. The Firenze Collection is made in the same factory as the Venetian Collection.

A blue sterling and enamel bracelet from the Firenze Collection.

Color—a trend the firm has been observing for some time—is the central theme of the new collection, using a hybrid glass/resin enamel that is crack, dent, and scratch resistant, with nearly 170 degrees of flex, says Ann Gieser. It will be done over sterling silver for the collection, with F-G/VS diamonds set in 18k gold.

Included will be bracelets, pendants, earrings, rings, and necklaces, all with a lifetime warranty. It replicates the look of the firm’s 18K bracelets at a fraction of the cost, says Gieser.

Wholesale prices for the collection begin at $325.

In terms of color trends, Gieser says white seems to be coming back in the firm’s gold line, but for enamel, greens, nude/light pink, and purple/lilac tones are frequently sought by buyers.

Versatility continues to be important, says Yvel’s Isaac Levy. Retailers want details that give customers multiple looks in one piece, like removable dangles on earrings, or signature clasps that allow a long necklace to also be split apart into a shorter neck and bracelet. Baroque pearls or unusual gems add newness.

Baroque pearl and diamond drop earrings from Yvel.

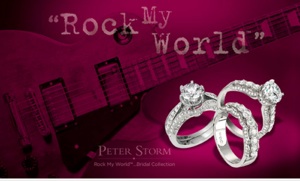

But product—while obviously key—is only part of the equation, says Anne Storm, president of Peter Storm Designs.

“What retailers have been asking for is strong events and dynamic viral marketing,” she says. Her firm answers the need through its tie-in to the music world, which she says retailers adore. “We have held Rock My World events which created great buzz our retailers have capitalized upon.”

The Rock 'n Roll theme is very popular with Peter Storm clients, who can register to win music memorabilia from Anne and Peter Storm's personal collection.

In Las Vegas, the firm will build on the Rock My World program begun at Centurion, including a drawing for retailers to win signed rock ‘n roll memorabilia from Peter and Anne Storm’s own collection. In Las Vegas, retailers can enter to win guitars from the Police, Bon Jovi, Santana, AC/DC, and Johnny Cash, and signed LP’s including Bruce Springsteen’s Born To Run, Michael Jackson’s Man In The Mirror, the Rolling Stones’ Beggars Banquet, John Lennon’s Imagine, among many others.

The firm also just launched its new website, www.peterstormjewelry.com, its new Facebook page launches in July and promises interactive elements and constantly changing news.

Product-wise, the designer has expanded his Naked Diamonds collection, with the addition of color. A ring from the collection is pictured at the top of this page.