Articles and News

How The COVID-19 Pandemic Revealed Structural Weaknesses in The Diamond And Jewelry Industry | August 05, 2020 (0 comments)

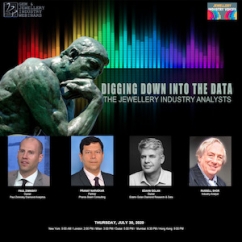

London, UK—CIBJO, The World Jewellery Confederation, last week hosted the latest webinar in its Jewellery Voices series. This edition, titled Digging Down Into The Data, featured four top analysts in the diamond industry: Paul Zimnisky, Paul Zimnisky Diamond Analytics; Pranay Narvekar, Partner, Pharos Beam Consulting; Edahn Golan, Edahn Golan Diamond Research & Data; and Russell Shor, diamond and jewelry industry analyst for Roshem Ventures. The moderator was Edward Johnson, GG. Here were some of the key takeaways about diamond demand, cash flow, and using data to improve business:

Edward Johnson: The COVID crisis has had a devastating effect on the diamond and jewelry industry. What key findings became evident during the pandemic?

Edahn Golan: The entire diamond industry rests on the shoulders of retail, and retail in all industries suffered serious blow. Retailers are sitting on certain inventory, so there’s no need to pull from wholesalers, or manufacturers, all the way up the pipeline. Some are sitting on stockpiles of billion dollars worth of goods. My outlook is that [consumer purchasing] will start at haphazard and slow pace till the holidays, and cash flow is an issue all the way up the pipeline.

Russell Shor: The industry was in severe contraction even before this. Lab business is way down. Diamond mining companies used to be a license to print money. If you go back 15 years ago, Bain was predicting a supply gap that was going to push demand up and that model was used to produce new mines like Snap Lake and Victor that are not viable now.

Rough prices declined before the COVID crisis. The COVID crisis just pushed the problems all the way up pipeline. Plus bank financing—always key to quick recovery before—is a little more than half what it was a few years ago. Banks were generous--or one might say overly generous--but we don’t have that cushion now. I don’t see retail pulling it up very quickly. So I think we’re going to have a long uphill row to hoe.

Encouragingly, retail in the States hasn’t been that bad. Independent jewelers have all had decent sales and online is way up according to a couple of surveys. [But] the mall jewelers are having problems.

Paul Zimnisky: Apart from the physical closure of jewelry stores around world, the industry nature is global and the supply chain quite large, which made B2B quite challenging. Looking at rough supply, there’s been a significant impact. I forecast the global supply this year will be the lowest since the 1990s.

Pranay Narvekar: It’s all about liquidity and how you manage that and manage your whole business. The Indian government allowed some extension of payables, which allowed the diamond industry to manage [financial] positions. August is typically slow anyway. I think people will start to see or have seen some movement in polished, to get ready for [the holiday] season, so it could go either way.

Johnson: Let’s look to the past to try and project the future.

Golan: Look at what happened after 9/11, another noneconomic issue or force that created economic breakdown. Or the tsunami, or the Fukushima earthquake in 2013, and other events. And 2008, of course. What we see is a decline in diamond activity starts very early on but the demand for diamond jewelry bounces back very quickly, mostly by bridal purchases. People feel they are under threat and that they should take life seriously and move forward and not delay expressing love, or weddings.

I recall what [AGS jeweler] John Carter said in the first [CIBJO] webinar: “Love isn’t quarantined. People are wanting to celebrate relationships even during quarantine.” And in Japan in 2013 there was a triple disaster in March—and imports of polished diamonds hit a record high. One-quarter of people were displaced without a house but still went ahead with marriage.

The diamond industry has a lot to look forward to if it’s smart in preparing for it by producing marketing materials that fit the time and that target those that can and will spend. Of course there are caveats: people are especially worried about going into malls. About 75% of Americans say they’re ok with walking into a small shop, but 50% are concerned about visiting malls.

Johnson: Much has been said with relaunch and rebrand of the Natural Diamond Council. How do we as industry develop that desire for natural diamonds and, most importantly, how do we pay for it?

Shor: The train left station on Real Is Rare. That’s about competing with lab-growns. But we have to do more. We talk about life’s celebrations, but we also have to talk about how diamonds connect us to the earth. That message reaches all ages, but especially Millennials and Gen-Z.

Three quarters of American consumers do take sustainability into account when making purchases and in their lifestyle, and more than half are taking active measures—such as reducing waste and buying fair trade products—so it’s a huge issue among people buying jewelry, because they’re educated and affluent.

We need to start now. We have an audience that’s shut in so people are a bit of a captive audience and looking at social media more. So we have to get the message out, but the question is who’s going to pay for it. This industry is famous for pointing fingers and saying “he’ll pay for it.”

Golan: If there’s a possibility of local governments to ensure that their economies are protected from the ills of the lockdown, and are doing their best at renewing economic activity as well as economic confidence, that can help. Without it consumers will not go into stores and spend for a $3000 item. Instead, they’ll save the money and wait till they’re more confident. The diamond industry has to take care of the diamond industry, but governments have to take care of their economies.

Johnson: Can we discuss the importance of data?

Golan: Every modern business needs to be able to look at information in a dispassionate way. The ability to use business analytics and big data, gives all businesses tools to improve their ability to compete in market, provide accurate pricing, and provide what consumers really want in market.

A mom-and-pop operation with $2 million sales can’t afford $100k in data analytics, but they can supply data to companies that analyze it. You’ll find out you’re spending more for a product or something than you should be. Why pay an extra five or 10 percent and be less competitive? The data is available and if you have access to it, it will do wonders for your business if you use it.

Zimnisky: As an analyst, I want as much empirical data and anecdotes as I can get. Data is the science, and filling in missing part is the art.

Narvekar: Our companies are very good at using data but what they’re not good at is sharing that data and using it as a group. People think it’s very valuable, but the value coming out of pooling it is more than they imagine. And they still refuse to pool that data. We just don’t do enough to share and use that data.

Next up: Financing, lab-grown diamonds, sustainability, and more.