Articles and News

Industry News: Melee Prices Continue To Rise; GIA Classes Set For AGS HQ; Bidz.com Shutters; More July 09, 2014 (0 comments)

Rapaport: Melee Prices Up, Caraters Dip Slightly

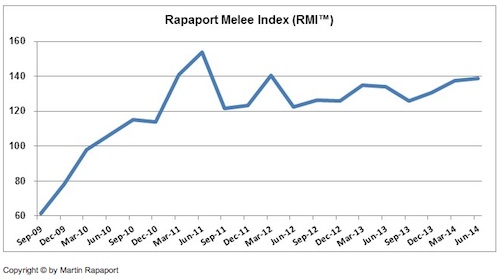

New York, NY—The Rapaport Melee Index (RMI) for small diamonds increased by 1% to 138.78 during the second quarter of 2014. Year on year the index is up 3.4% from its level of 134.24 in June 2013. But the RapNet Diamond Index (RAPI) for one-carat certified polished diamonds fell 0.5 percent during June and RAPI for three-carat diamonds declined 0.7 percent during the month.

Other smalls were up: the RAPI for 0.30-carat diamonds rose 0.5 percent and RAPI for 0.5-carat diamonds increased 0.3 percent.

Polished trading slowed during Q2, following a strong start in Q1 when retail jewelers replenished their inventory after the Christmas and Chinese New Year seasons. Diamond buying subsequently focused on filling specific orders during the second quarter. The JCK Las Vegas show signaled steady U.S. demand for commercial-quality diamonds, strong demand for inexpensive piqué diamonds, but relatively weak demand for fine-quality and larger size stones. The June Hong Kong show disappointed diamond dealers and reflected a cautious Far East market.

However, despite the slowdown, market sentiment remained relatively positive in June.

The Rapaport Melee Index shows that while smalls have come off their peak of June 2011, prices have more than doubled since Q3 2009.

“Market prices stabilized in Q2 after a very robust Q1. While prices for certain qualities softened due to slower trading, small melee sizes realized very strong and even record high prices in June as companies sought to fill orders. Trading in the summer is expected to be seasonally slow with anticipated increased demand and liquidity towards mid to end of Q3,” said Ezi Rapaport, director of global trading for the Rapaport Group.

Profit margins remain tight for diamond manufacturers, rough prices were stable in June, and trading on the secondary market was steady. Despite liquidity concerns, rough demand is firm as manufacturers maintain steady operating levels at their factories. The market is expected to remain quiet in July and August as dealers in Antwerp, New York, and Ramat Gan take their annual summer vacations. Expectations have increased for the July India International Jewellery Show (IIJS) as sentiment in India’s domestic market has improved since the May election of a new government.

Read the full Rapaport Monthly Report, "2Q Slowdown," at www.diamonds.net/report or email: specialreports@diamonds.net.

GIA Lab Classes To Be Offered At AGS Headquarters

Las Vegas, NV--The American Gem Society will offer two GIA laboratory classes at its Las Vegas headquarters in September. The classes to be offered are Diamond Grading and Colored Stone Grading, and are specially priced for AGS members who need more Titleholder requirements or you or your staff education.

Colored Stone Grading will be offered September 10-12, for a cost of $972. Diamond Grading will be offered September 15-19, for a cost of $1,100. AGS Way scholarships are available for RJ/RS candidates who take the Diamond Grading Lab class at AGS. For information, call Melissa Spence 866-805-6500 Ext. 1034, email: mspence@ags.org.

Emmy Kondo Joins World Gold Council

New York, NY—The World Gold Council has appointed Emmy Kondo to a strategic business development role on its jewelry team. Kondo’s focus will be on the online community LoveGold, on jewelry market development across the world. Based in Chicago, she will report to Sally Morrison, managing director of jewelry, in the Council’s New York office.

Kondo previously was vice president of strategic planning for the Forevermark brand and instrumental in its launch. Prior to De Beers, she spent more than10 years at J. Walter Thompson in New York, where as a planning director she was responsible for De Beers’ marketing with its “A Diamond Is Forever” theme and also with other consumer brands like Ragu and Thermasilk.

Outbid: Bidz.com Shutters

Los Angeles, CA—After boldly predicting it would hit $1 billion in sales, e-tailer Bidz.com is out of business. The jewelry auction site—which grew from a chain of pawnshops in 1998—at one time regularly posted more than $100 million in annual sales from moving 15,000 pieces a day, mainly closeouts with opening bids of $1.00. In 2007, it began trading on the NASDAQ, and all seemed well with its $187 million in revenues and $18 million in profits. But by 2012 things had gone south and the company issued warnings about its future before going private, according to a report on JCKOnline. The hammer went down on its web sales on June 12.