Articles and News

IT’S ALL ABOUT FASHION: 58% OF STORES GROW FSP CUSTOMER BASE | August 31, 2011 (0 comments)

Merrick, NY—In the August 18 edition of The Centurion Newsletter, we highlighted the findings from a recent Wall Street Journal article titled “Jewelry Style Waits for No Man.” It said increasing numbers of affluent women buy costly jewelry as a fashion item for themselves, “just because,” rather than to mark a special occasion. The Centurion Newsletter did a spot-check of retailers to compare how female self-purchase (FSP) sales among better independent jewelers compare to the boutiques and large retailers that were interviewed by the Journal, and found that more than half (58.3%) of respondents also have noted an increase in the number of women buying fine jewelry for themselves.

“Absolutely!” says designer Erica Courtney, who describes herself as a “girl’s girl” when it comes to fashion. “It’s totally fashion, even if it’s $30k,” she says of her colorful, lushly feminine jewelry, pictured left. Even when it comes to diamonds, women buy. Men still like to buy the big important diamond, she says, but if a piece has lots of little diamonds used as a design element, women view it as fashion, not as a special-occasion purchase—even if the price tag is comparable to a single big diamond.

As noted in August 18’s Centurion Newsletter, the Journal’s findings aren’t exactly new news—FSP has been a viable, if underplayed, segment of the fine jewelry market since the late 1980s. Indeed, the Centurion’s findings show that close to 60% of respondents report that more than half of their unit sales—often as much as 80%—are coming from female customers.

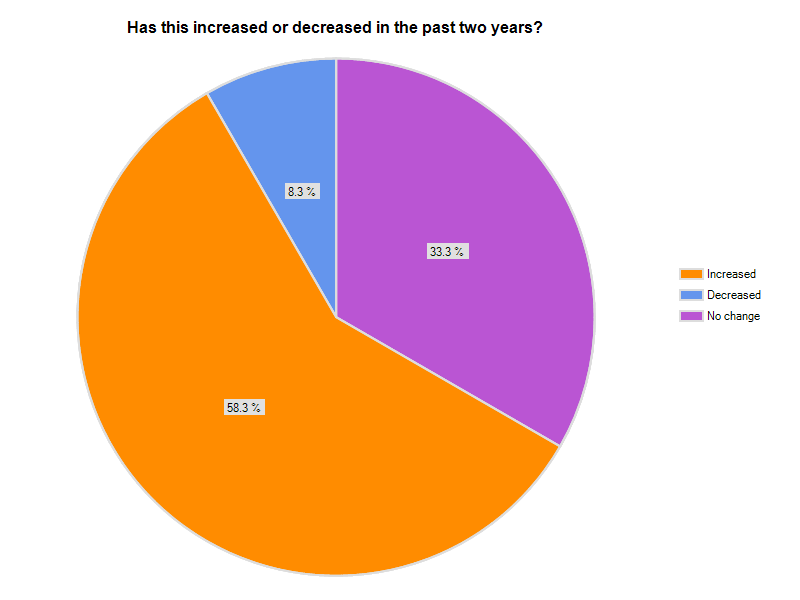

Among respondents to The Centurion’s spot-check survey, 58.3% said they’ve seen an increase in female shoppers in the last two years (orange slice, below). About one-third say the number has held steady (purple slice), and only 8.3% (blue slice) noted a decrease in female self-purchase sales.

41.6% of respondents to the Centurion survey say approximately 30% of their sales are FSP. 33.3% say it’s the majority of their business—from 70%-80%—and 25% say it amounts to between 40% and 60% of their business. Condensing figures, this means that well more than half of the respondents to the Centurion survey—58.3%—attribute more than half of their unit sales to women shoppers.

But a few of the reader responses to the Journal article are worth examining, as they reveal both great potential and some frustration with the shopping experience.

Writes a reader named Elaine Chen, “A real issue here is that jewelry stores have not stayed up to speed with the changes in women's lifestyles and in fashion overall. With handbags and shoes routinely topping four figures now, self-purchase of fine jewelry simply on a fashion basis becomes a much easier sell, but it's not a sell many jewelry stores are making.

“I'm a dream customer for jewelry stores—a single professional female who personally spends $10K or more a year on jewelry—but I hardly ever shop at them due to designs that are often stodgy, lack of transparency around prices—often done to conceal HIGH prices—and an unwelcoming atmosphere. Instead, I make the majority of my purchases online from sites like eBay, Gilt, Portero, and Ross-Simons as well as from auction houses. If I window-shop in order to check out jewelry in person, I'll do it at a department store rather than a jewelry store.”

While Chen was the only one of the five female commentators who expressed frustration with the shopping experience, previous research shows she’s not alone. When the former Diamond Promotion Service conducted a landmark survey of jewelry shoppers about five years ago, the results gave the industry a disappointing “C” grade for the shopping experience. The key finding of that study—which sampled both men and women—was that while consumers do want fine jewelry, they don’t necessarily always want to buy it from a jewelry store.

Top turnoffs? Exactly what Chen complains about: lack of price transparency, perceived high price, and unwelcoming atmosphere. While not the case in many jewelry stores, it’s clear that some, at least, haven’t made any progress in the five years since DPS’s widely published study came out in the industry.

One change that may help alter that perception is what retail anthropologist Paco Underhill calls a transition from “nose-to-nose” to “hip-to-hip” selling. It’s been a trend in luxury retail in general, but for jewelers, he suggests changing to freestanding vitrines that open from either side instead of traditional showcases that open only from the back, so the sales associate can work side by side with the customer instead of putting the physical barrier of the case between them.

Meanwhile, Journal reader Randall Horton, responding to the comments of a male reader who admits he’s old-fashioned but maintains that fine jewelry is more meaningful when it’s a gift, wrote of the very substantial pieces she’s bought for herself. (Note: edited for length, read her full response here):

“My husband has gifted to me some amazing, pedigreed pieces. I love these because of grace of the giver and his love for me, but also because they are fine examples of the jeweler's art. But I also have other baubles I bought to celebrate milestones in the growth of my business, such as a pair of '50s Seaman Schepps shell earrings and his original rosewood-and-gold link bracelet; a Belle Epoque sapphire-and-diamond ring; and a diamond en tremblant brooch from the turn of the last century. These are not insubstantial pieces and they represent people, places and events that I also treasure. They may not trigger the sentiment of my husband's gifts, but to diminish what they represent shows a lack of understanding of the power and joy that can come from a woman celebrating her professional success. Both will remind my daughter, and hopefully her daughter one day, of me, my husband, and our lives. Some of them represent love, while others represent the good fortune of a hard-working businesswoman with a passion for old pieces and an educated eye! Those with which I have rewarded myself are not diminished because I purchased them. To my daughter, these pieces actually may be the more valuable: she watched me build my business and knows what is possible when a woman's education and hard work jump through a window of opportunity.”

Horton clearly buys very high-end pieces, as do many other women. Respondents to the Centurion survey were equally divided about the question of whether there is a magic tipping point of price where a woman feels she needs to consult her husband or family first before spending the money. 50% said no.

Among those who said yes, the most common tipping point is in the $2,000 to $3,00 range. One jeweler did observe—not surprisingly—that the tipping point is lower for married, stay-at-home women than for working women.

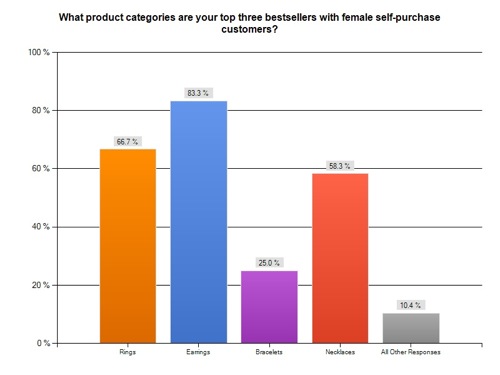

Jewelers report earrings are the most popular female self-purchase category (blue bar), followed by rings (orange bar), necklaces (red bar), bracelets (purple bar), and all other product categories, including watches, pearls, brooches, and gift accessories.

Any jeweler who wants to attract women needs to start with one very simple basic: a full-length mirror. Yes, she wants to see the full effect, not just her neck and ears! Underhill also suggests if possible, offer a full dressing room so that she can bring in that special outfit she’s trying to accessorize. Chairs and refreshments also are essential, he says—noting that in many cultures, customers expect to be offered refreshments as an opening gesture.

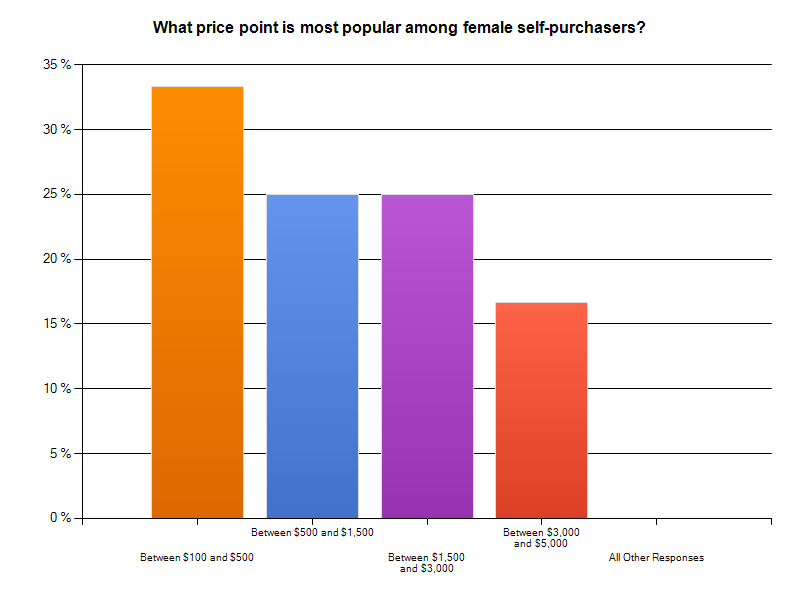

33% of respondents say their top-selling fashion jewelry price point is $100-$500 (orange bar), which can compete with entry brands of better handbags or shoes. 25% say their strongest sellers are between $500 and $1,000 (blue bar), also a prime sweet spot for bags and shoes. 25% of respondents say their best selling female self-purchase price point is between $1,500 and $3,000 (purple bar), and 16% say it's between $3,000 and $5,000.

Jewelers who want a fashion customer also need to take some risks on fashion trends, says Courtney. Often, she says, jewelers at a tradeshow are drawn to her newest designs, but then when it comes time to write the order, they drift back to what’s safe and proven. But it’s not that hard to stay on top of fashion trends, she says.

“Look around. If you’re selling 16-inch necklaces but everyone’s wearing them down to here”—she points to her waist—“then of course they’re going to sit in the case.” American women today also typically focus on one area at a time, or at most two; they rarely pile on a matched suite of jewelry. They’ll wear the big ring, and maybe also big earrings, but not with a big necklace at the same time, she explains.