Articles and News

L2’s Digital Watch And Jewelry Index Shows Industry Hiccups | December 23, 2015 (0 comments)

New York, NY—After five years of unprecedented growth, luxury digital marketing analyst L2 Inc. sees some uncertainty hanging over the watch and jewelry industry. In its latest Digital Index for the watch and jewelry category, L2 says more than 40% of Swiss watch executives expressed some pessimism about the category’s economic outlook.

This year, the number of executives who feel that smartwatches are a competitive threat to the established industry more than doubled—25% said so in 2015, vs. 11% in 2014. Indeed, while sales of the Apple watch are below initial expectations, they’re still racking up impressive gains against traditional luxury watches. In jewelry, well-documented imbalances in the diamond sector continue to plague the industry at all levels of the supply pipeline. (Editor’s note: A separate study by Bain & Co. attributes the diamond slowdown to China, which also is driving the downturn in luxury Swiss watch exports.)

But industry executives are finding that market growth online is coming slowly and brand equity that took decades to build does not automatically transfer online. Of major brands, 10 control 40% of global sales in the sector; however, online, the top 10 brands control nearly 75% of all traffic to brand destinations. But only three brands—Tiffany, Rolex, and Omega—show up on both lists, suggesting that challenger brands can attract a hefty share of online attention. Moreover, says L2, the number of affluent consumers that could identify a favorite jewelry brand has declined from 58% a decade ago to about 40% today. L2 says that online search widens parameters so that brands matter somewhat less than they did before.

Another trend is the increasing presence of gray market sites showing up in searches. While brand destinations still account for 53% of the first three organic search results—compared to 14% for discount or gray market sites—market share for the gray sites jumps as consumers execute deeper and more detailed searches. Further, those sites also dominate the product listing ads that come up in searches, but as more jewelry and watch brands do offer e-commerce, those are increasingly showing up in the ads as well, says L2.

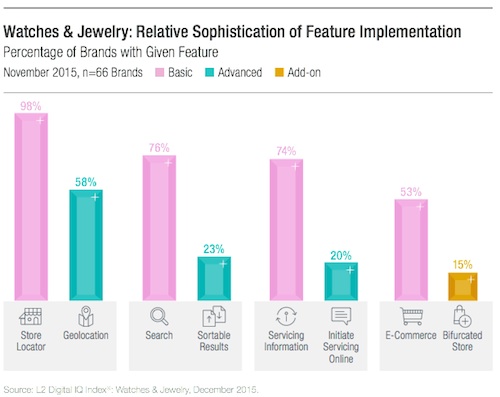

L2's findings show that while more and more luxury jewelry and watch brands are e-commerce enabled, the number of those brands whose sites offer advanced features like geolocators and sortable results still is relatively small. Chart: L2

L2’s Digital IQ Index groups brands into five score categories: genius, gifted, average, challenged, and feeble, according to their digital presence. Four attributes count toward each brand’s score: website and e-commerce capabilities account for 40% of its score; digital marketing, 35%; mobile and tablet compatibility, 15%; and social media, 10%. Here are the 2015 L2 rankings of jewelry and watch brands’ Digital IQ:

Genius: Tiffany & Co. and Cartier

Gifted: Alex and Ani, David Yurman, Pandora, Shinola, Swarovski, Chopard, Van Cleef & Arpels, TAG Heuer, Montblanc, Piaget, De Beers, Tissot, Bulgari, Hearts On Fire, Breitling, Rolex, IWC Schaffhausen

Average: Trollbeads, Victorinox, Longines, Citizen, Jaeger-LeCoultre, Harry Winston, Links Of London, Officine Panerai, Omega, Ippolita, Movado, Baume & Mercier, Hublot

Challenged: Audemars Piguet, Mikimoto, Vacheron Constantin, Boucheron, Chaumet, Georg Jensen, Hamilton, Rado, Raymond Weil, Faberge,́ Pomellato, Bell & Ross, Forevermark, Ebel, Patek Philippe, Zenith

Feeble: Blancpain, Bulova, A. Lange & Söhne, Graff, Jaquet Droz, Breguet, Roger Dubuis, Tudor, Fred, Frederique Constant, Ulysse Nardin, Shamballa Jewels, Buccellati, Girard-Perregaux, Glashütte Original, Jeanrichard, Wellendorff, Giampiero Bodino.