Articles and News

L2’S FIRST LUXURY JEWELRY/WATCH STUDY IDENTIFIES BEST ONLINE PERFORMERS IN THE CATEGORY | October 19, 2011 (0 comments)

New York, NY—L2 ThinkTank, a research and consulting organization that focuses on digital leadership, on Tuesday released the results of its first category-specific study of the luxury jewelry and watch industry’s performance in the digital arena. L2’s founder Scott Galloway came down hard on this industry earlier this year when he was one of the featured speakers at the GIA International Gemological Symposium, calling it one of the worst digital laggards in the entire luxury sphere.

Good news: the new study shows some progress is being made, even in a short time. But the sector still has some distance to go.

"We have seen some progress over the past 12 months, although it has not been as profound as in other luxury categories such as fashion and beauty," said Daniella Caplan, lead researcher for the jewelry/watch study, in an exclusive interview with The Centurion.

"Where the category is doing well is in the close-knit communities they are able to develop online. Watch and jewelry brands have some of the highest interaction rates on Facebook, averaging 0.27% when fashion and beauty average only 0.1% and 0.06% respectively," said Caplan.

A previous L2 study conducted in August compared the jewelry and watch sector to other comparable luxury retail categories. L2’s lead researcher for that study, Veronique Valcu, told The Centurion in September that the sector's extremely high levels of user-generated content shows tremendous desire on consumers’ part to engage with jewelry or watch brands--and tremendous opportunity for the entire jewelry and watch sector to seize in capturing more customers through online presence.

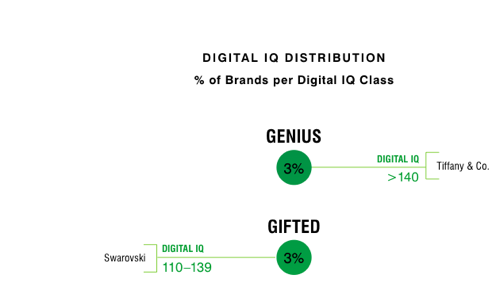

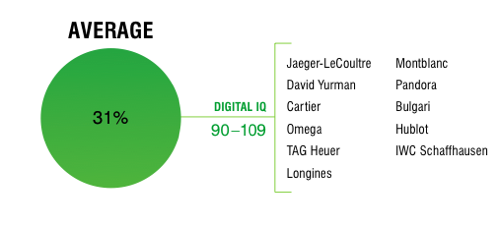

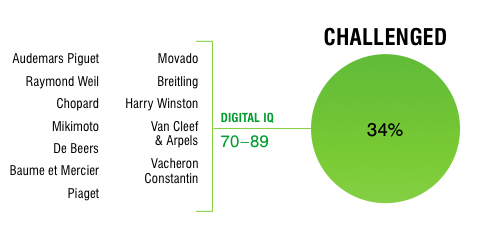

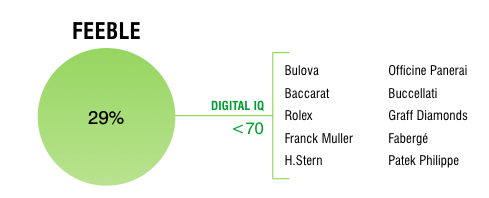

The isolated jewelry/watch study indexes the top 35 brands in terms of digital presence. Only two brands, Tiffany and Swarovski respectively, were rated either “genius” (the top ranking) or “gifted” (second-best ranking.) Nearly two-thirds of brands were judged either “challenged” (next-to-worst) or “feeble” (worst). By comparison, more than 40% of other specialty retail brands were ranked as “genius” for their digital efforts.

Tiffany and Swarovski were the only two companies in the luxury jewelry/watch sector to get scores in the Genius or Gifted category of L2's Digital IQ Index.

While the study’s authors acknowledge the category has some unique challenges in building or selling brands online—such as gray markets, counterfeiting, limited pricing transparency, and retailer conflict—there really isn’t a choice but to up the ante online because that’s where consumers do their research before buying. Yet less than half the brands studied link to a retail location where the customer can buy the product, and only one-third offer any kind of pricing information online. Only Tiffany offers the option to order online and pick up in-store, and only Tag Heuer links to authorized online retailers.

While jewelry and watch brands may never do much direct online commerce, L2 says the category should emulate luxury automakers and how they use the digital space to push customers through to the brick-and-mortar purchase.

“As less than 30% of the brands studied are e-commerce enabled, they should focus on trying to drive commerce through the current channels available to them,” Caplan told The Centurion. She suggested brands implement features that could encourage conversion, such as in-store pickup, enabling user reviews, links to authorized online retailers, and including social plug-ins on product pages.

Additionally, though the jewelry/watch category has extremely high social engagement, their communities are smaller than other categories, so growing reach is important, she said. Lastly, she emphasized the importance of digital marketing practices such as search and email. Fewer than 50% of the brands are purchasing their own keywords, and discounters, flash-sale sites, and e-tailers are taking advantage of their inactivity.

“If users are searching for you online, do not give them a reason to go somewhere else!” she said.

Should retail jewelers push the brands to improve their digital mojo? "In fashion we see some excellent partnerships between brands and their retailers," said Caplan, citing as a recent example the "f-commerce" Kate Spade tab featured on Neiman Marcus's Facebook page, which both introduced the brand's new collection and drove users to purchase.

"There is a mutual goal here, especially in a category so heavily reliant on third party retailing," Caplan said.

Here’s how jewelry and watch efforts were evaluated:

- Website counted for 35% of a brand’s total digital IQ score. Within this segment, the site’s functionality and content accounted for 75% of its grade; 25% from how well it translated the brand online.

- Digital marketing represented 25% of the total score. This included the brand’s search, display, and email marketing efforts.

- Social media made up another 25% of the total digital IQ. This included a brand’s presence on major social media platforms, its community size, content, and engagement.

- The remaining 15% of a brand’s digital IQ score came from its mobile capacity, including compatibility, optimization, and marketing on smartphones and other devices.

The top 10 performers in the luxury jewelry and watch category were:

1. Tiffany & Co.

2. Swarovski

4. David Yurman

5. Cartier

6. Omega

7. Tag-Heuer

8. Longines

9. Montblanc (tie)

9. Pandora (tie)

Despite being among the top 10 performers in the jewelry/watch study, these firms were ranked just "average" in terms of digital IQ, according to L2's criteria.

Conversely, the bottom 10 (from lowest to highest) were:

35. Patek Philippe

33. Graff Diamonds

32. Buccellati

31. Officine Panerai

29. H. Stern (tie)

29. Franck Muller (tie)

28. Rolex

27. Baccarat

26. Bulova

Only one of this list, Vacheron Constantin, made it to "challenged" status, the rest were judged "feeble" in terms of digital efforts.

Key findings from the luxury jewelry/watch digital IQ study were:

- Just 29% of the category had any e-commerce capability. But L2 says that in a segment where third-party distribution is not going away any time soon, there are too many missed opportunities to drive consumers to offline retail.

- All but three of the brands have a presence of Facebook, with an average of more than 200,000 fans each. Also encouraging is that mobile site adoption rose from just 7% in 2010 to 39% in 2011. Brands also are beginning to move away from Flash-heavy sites (see this article in The Centurion about why Flash doesn’t show up on search engines), and toward more streamlined, easier-to-navigate experiences.

- Some of the industry’s most iconic brands—Rolex being first among them—are among the worst performers online. Cartier, with its YouTube channel launch and updates to its iPad app, is one of this year’s biggest improvements; however, it still only ranks “average” on the Index.

- Although Google is a valuable door-to-store, says L2, fewer than half of the jewelry and watch brands in the study purchase their own brand keywords, and therefore don’t appear in the top three paid ads of search pages. Instead, discounters and flash-sale sites are buying up those spots, so the only appearance of the brand at the top may be for discounted merchandise.