Articles and News

Luxe, American Style: The New Mindset Of Affluent Consumers | September 10, 2014 (0 comments)

Stevens, PA—While the emerging luxury markets like China may make news with their rapid growth, the U.S. luxury market is still the world's largest by many times over, says Unity Marketing, the Stevens, PA-based luxury market research firm. But luxury is culturally specific, and what appeals to luxury customers in London, Paris, Tokyo, or Hong Kong is not necessarily what will sell in the United States. A new style of American luxury is evolving, and affluent consumers are redefining how they express, live, and buy luxury, says Pam Danziger, president of Unity Marketing and author of a new report on the state of the American luxury market. It’s not the same market it was before the recession.

According to Boston Consulting Group statistics, there were 7.1 million millionaires in the United States in 2013, nearly three times the number in China (2.4 million).

But it’s not just about the millionaires. The top 20% of U.S. households (24 million), with annual income of $100,000 or higher, represent 50% of the nation’s income and 40% of all consumer spending. Regardless of consumer goods category, this group spends twice as much or more as the average middle-class customer. Bain/Altagamma, in its 2013 Luxury Goods Worldwide Market Study, estimates sales of personal luxury goods in the United States outranked the next largest market, Japan, more than three times over.

"The United States is without doubt the most important market for luxury goods and services," says Danziger. The amount of income needed to reach affluence has leveled off in recent years, too, but in order to thrive, luxury retailers still must understand some key fundamental shifts that have happened in the market since the recession:

Affluent austerity. Austerity is the mood of today's American affluent consumer. It doesn’t mean they won’t spend—the rise in luxury goods sales proves they will—but it does mean that how they spend has changed, possibly forever.

In a word, Yankee practicality rules.

Unity’s Luxury Consumption Index (LCI) is derived from surveys conducted every three months among 1,250+ affluent U.S. consumers, about their attitudes toward their personal financial situation and their luxury spending and purchase habits.

The LCI still shows that while consumers’ financial confidence differs depending upon where they fit into the economic pyramid, across the board there is a shift toward more conservative, back-to-basics spending, says Danziger.

This is most evident among the mass affluent, a group Danziger has dubbed the HENRYs (high earners, not rich yet). Their $100,000 to $249,900 incomes are high enough to afford some luxury but not enough to fully insulate them from economic ups and downs. They are expressing austerity by trading down to less premium brands and shopping destinations, saving their luxury indulgences for an occasional experience and opting for mass-to-premium brands, not luxury, for day-to-day purchases.

Higher-income affluents ($250,000+) feel more secure, but their spending has shifted toward inconspicuous consumption. They favor invisible luxury brands, such as Goyard or Fischer Voyage (image, top of page), as opposed to the ones everybody knows and recognizes, such as Louis Vuitton or Gucci. They are also buying luxuries for the home (fine art, furniture, high-end kitchen appliances) to enjoy in privacy or with guests to whom they serve luxury wine and spirits. And they often order online where deliveries come by Fedex and they won't be seen carrying Barney's, Saks, or Neiman Marcus bags.

Danziger’s findings echo others who have noticed a shift in consumer perception of some luxury brands. Recent articles in both Time and The Wall Street Journal say the word has become overused and meaningless at best, or, worse, code for “ripoff.” But the growth of premium bridge brands like Michael Kors, Vince, and Kate Spade (at the expense of tonier labels like Louis Vuitton) is proof that where there’s smoke, there’s fire.

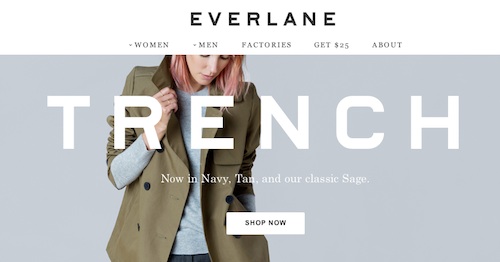

Pared-down style. The austerity trend also profoundly impacts the brands and styles affluent Americans favor. Dovetailing with the shift toward invisible luxury brands, there is a marked trend toward practical, simple, and plain design, vs. gaudy, showy, or ostentatious—and it doesn’t all have to be high-end. Examples of high-end brands these consumers seek include names like Fischer Voyage and The Row; popular affordable choices include Everlane and Warby Parker.

Affluent consumers are seeking understated, under-the-radar luxury brands like Fischer Voyage leather goods, above, or high quality, no-fuss brands like Everlane, below. Fischer Voyage's "Prairie" bag is shown top of page.

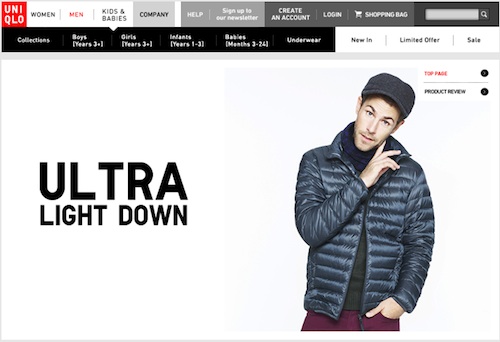

Many, though not all, of these brands sport a “Made in America” pedigree. Last year's “It” coat in New York City was the $70 Uniqlo Ultra Light Down jacket, says Danziger. This year the coat—and the Japanese label—is going to be bigger than ever, as the trend spreads across the heartland (and the company adds more stores), she says.

Last year's "It" coat for men and women alike was the $70 Uniqlo ultra light packable down jacket.

Luxury jewelry customers tend to be more of the higher-level, $250,000+ affluent, who are more secure financially and certainly have the money to spend, Danziger says. Jewelry has an inherent advantage over other luxury goods in that it has both an emotional factor and an intrinsic value that can justify its price as an investment, even if the customer isn’t specifically buying it as such.

But in a political climate where income inequality is a major issue, affluent consumers don’t want to be seen as part of the elite 1%.

“There certainly are occasions where they want to dress up, and then they will wear the massive diamonds. But for everyday, they want to be more low-key. Joe Namath can get away with wearing a fur coat every day, but most ultra-affluent consumers want to tone it down and don’t want to be that flashy,” Danziger told The Centurion.

Millennials want their own brands. The Millennial generation—born from 1978-2000, with the leading edge of the cohort at 34 reaching middle age and their peak income years—are looking to brands that capture their unique mood and spirit. The brands favored by their Baby-Boomer parents' generation won't do.

"Heritage luxury brands need to reinvent themselves for this younger generation. They need to be introduced in a new and fresh way to this younger generation and not be stuck in some time warp from the last century." Danziger points to the Saint Laurent brand, now under the direction of the Gen-X Hedi Slimane, as an example of a luxury brand creating an on-ramp for Millennials.

"By dropping the ‘Yves’ from the [Saint Laurent] brand name and opening a new flagship store on Rodeo Drive, Slimane is keeping the YSL edge, but reinterpreting it for a 21st century rock 'n roller," Danziger says.

Having an on-ramp for Millennials is critical for luxury jewelers who want to survive after the Boomers are gone.

“Luxury jewelers need to consider who their customers are—and who they aren’t, yet. Even if many Millennials are walking in your door, how many are walking past your door and never coming in?” asks Danziger.

While the news is full of Millennials burdened with student debt and unable to find adequate career positions, it isn’t all of them. And Millennials that had some exposure to luxury in the past, who grew up in an upper-middle class household or who have made luxury purchases, are more likely to buy luxury in the future.

“It’s important to provide an on-ramp for them,” emphasizes Danziger. But that doesn’t necessarily mean cases full of cheaper product; it also means having an experience they want. One thing Millennials do have in common with the Boomer and Gen-X predecessors: many find jewelry stores intimidating. Luxury jewelers need to figure out what will break down the barrier for their individual stores.

“Both Hearts On Fire and Tiffany have done it very well, but very, very differently,” says Danziger.

How they shop. Affluent consumers are much more selective, much more pragmatic, much more demanding, and much more careful about what luxuries they buy and how much they spend. Online, mobile, flash sales, and social media all have flourished since the recession and are powerful forces creating huge disruption in the luxury market. Discounts and special offers matter too.

Further compounding the shift is a political climate that is more focused on income inequality, driving affluents to eschew the excesses associated with the “1%” and embrace brands that emphasize what smart shoppers they are. The old ways of marketing luxury won’t cut it with a hyper-competitive market and value-oriented affluents.

To purchase copies of Unity Marketing’s latest reports about the new affluent mindset, click here and here.