Articles and News

Luxury Jewelry and Watch Brands’ Digital Savvy Makes Big Gains, But What Do Customers Really Want? | October 30, 2013 (0 comments)

New York, NY—The luxury jewelry and watch industry is finally starting to embrace digital commerce, not just grudgingly put up with it. And new research shows what customers really want most from their online jewelry shopping experience. Hint: it's surprisingly simple!

For the first time since its inception, L2’s ThinkTank’s Digital IQ index for the jewelry and watch industry shows that more than a quarter of luxury jewelry and watch brands rank as “gifted” or “genius” at digital marketing, and half support e-commerce. Compare this with only two years ago, when the only jewelry brand even to earn a “gifted” ranking in 2011 was Tiffany, which came in 19th out of 64 luxury specialty retail brands. The next highest that year was Cartier, which came in 43rd, and Swarovski at 45th, both ranking “average,” and the rest went down from there. Now, even Rolex--which L2 previously cited for lack of digital savvy--has upped its digital game.

But this year, Tiffany, Cartier, and Swarovski—still the top three —are all ranked as “genius” in the Digital IQ index for the jewelry and watch industry, while the “gifted” category now boasts 17 brands. 19 brands scored “average,” which in previous years would have been considered a very good ranking in this industry. But there’s still work to be done: the 2013 ranking showed 16 brands whose digital efforts remain “challenged,” and 23 whose digital efforts are still “feeble.” Digital IQ scores were calculated 40% by website, 25% by digital marketing efforts, 20% by mobile, and 15% by social media.

What customers really want online. In one way, the digital naysayers who said online shopping would never work for the luxury jewelry industry because touch and feel is what matters most in the purchase were right: touch and feel is essential. But they were dead wrong is assuming that technology couldn’t measure up. From high-definition photography to virtual try-on, the technology exists to replicate the in-store experience online.

Online shoppers are 64% more likely to make a luxury purchase after watching a video of the product, according to L2’s research. Showing pictures of the product in multiple colors, finishes, and configurations can literally triple online sales, while showing 360-degree views ups the conversion rate by 20%. And don’t even think about skimping on photography: 70% of consumers say detailed images are an important factor in their decision to purchase or not.

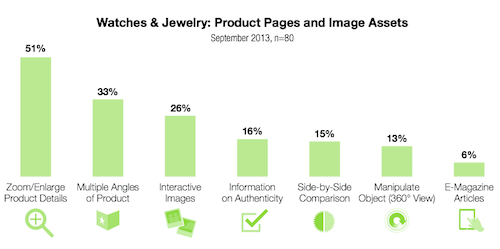

In this respect, jewelry and watch brands still fall short. L2 says that while half offer close-up images on their pages, only a third present multiple angles, just a quarter provide interactive content, and less than a fifth have tools to compare between two or more competing options.

Jewelry and watch brands also need to improve their ability to seize the moment—although half the brands studied now offer e-commerce, once the decision is made (or almost made) to buy, customers are often left with few other options to consummate the transaction, says L2, especially if they have questions and need interactive support. Fewer than half of jewelry brands offer dedicated phone support, call back services, or appointment bookings for online shoppers.

51% of luxury jewelry and watch brands in the L2ThinkTank 2013 Digital IQ study offer the ability to zoom or enlarge a product on their websites. One third offer multiple angles to view a product, one quarter the ability to interact, 16% information about authenticity, 15% offer side-by-side comparison views, 13% allow users to manipulate the object for 360 degree views, and 6% offer an e-magazine article about the product. Chart: L2Thinktank.

E or F? Active participation in social media like Facebook is of course essential for luxury marketers, but don’t neglect email. According to L2’s findings, email gets double the customer response rate of social media or blogs.

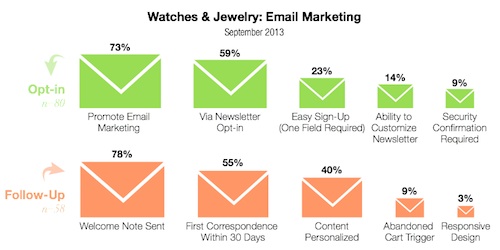

While almost three-fourths (73%) of brands provide an opt-in to an email newsletter, barely more than half send a welcome message (apart from a standard automated welcome response) within a few weeks of sign-up. And only five of the 80 brands evaluated followed up an abandoned shopping cart with an email query.

L2's study shows good participation in email marketing among luxury jewelry and watch brands: 73% actively promote their email marketing. 78% will send a welcome note when someone signs up, and more than half send a first correspondence within 30 days. But very few (9%) will ask about an abandoned shopping cart or send other behavior-triggered followups.

In terms of social media, even notorious holdout Rolex finally jumped in. The brand launched a Facebook page in April, harnessing existing communities online already centered on the brand.

In terms of social media, the jewelry industry already enjoys much higher engagement rates than other luxury goods categories, so the good news is that consumers want to interact with jewelers in that space. Facebook still reigns, with 96% of luxury jewelry brands having a presence there. YouTube is a close second, with 93% of brands having a presence there, followed by Twitter (89%) Pinterest (74%), and Instagram (71%). Less popular are Google+, with only 53% of luxury jewelry and watch brands having a presence there, and Tumblr has just about tumbled out of the picture, with only 14% of luxury jewelry and watch brands having presence there.

It should be noted, however, that although Instagram rank higher than Pinterest in total community size, this is due in part to a huge number of Swarovski followers skewing the total. In many critical areas of measurement—including median community size, engagement, and number of brands with 10,000 or more followers—Instagram has overtaken Pinterest.

While a recent survey of luxury Swiss watchmakers shows they perceive social media as necessary but risky, L2 founder and president Scott Galloway points out that a brand’s reputation is already being discussed online—not being there doesn’t mean it isn’t happening, it just means you aren’t part of the conversation.

Click here to download an excerpt of the report and watch a video summary.