Articles and News

Men Say Diamonds Equal Luxury While Women Cite Furs, Cashmere | November 06, 2013 (0 comments)

New York, NY—If men are from Mars and women are from Venus, how can a luxury jeweler target both successfully?

According to the Shullman Research Center, even a simple choice of words matters. In a survey of approximately 1000 affluent consumers, Shullman Research asked respondents to identify words they associate with luxury. Among all affluent adults, the following words universally were associated with luxury or luxurious things: quality, hotel, nice, fancy, money, comfortable, fine, best, cars, expensive, rich.

But among women, the choices of words reflected a more personal or tactile experience, while among men, the words were more specific to items—and evoked more skepticism.

Women used the following words to describe luxury: house, beautiful, pampered, furs, home, fabric, relaxing, wonderful, quality, cashmere, travel, soft, elegant, love, indulgent, suggesting their views of luxury often revolve around something that is either very caring and personal (pampering, relaxing, home, etc.) or very nice to touch (fur, cashmere, fabric, soft, etc.)

But affluent men responded with these words: value, top, leather, diamonds, waste, overpriced, amenities, happy, Mercedes. In short, the product must be high quality to justify the price.

“Luxury is in the eyes of the consumer, and it’s very category specific,” said Shullman in a presentation at the Luxury Interactive Conference, held September 24 in New York. A video of his presentation can be seen here.

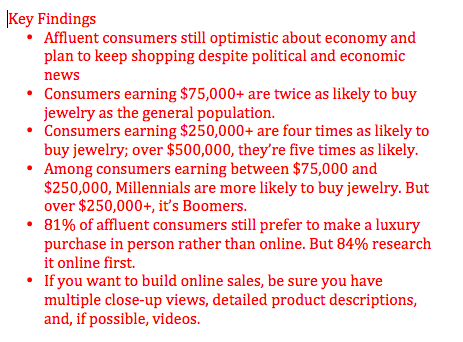

But not to worry—despite the word association, fine jewelry is a category women love, he reassured The Centurion. The Shullman Luxury And Affluence Monthly Pulse Fall 2013 found that among affluent women in households with $250,000+ and $500,000+ annual incomes, fine jewelry is one of the products they plan to buy in the next 12 months. More women than men in these two income categories also plan to buy or lease a luxury vehicle and, overall, they generally plan to outspend men. 83% of women surveyed plan to make a luxury good purchase in the next 12 months, vs. 69% of men in the same income brackets.

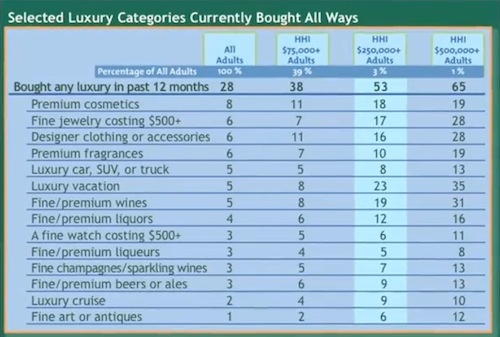

Jewelry is desired: Shullman Research's findings show fine jewelry was the second-most purchased luxury goods category among all adults (left column) in the past 12 months. But among the most affluent (far right column), it competes heavily with premium wine and luxury vacation.

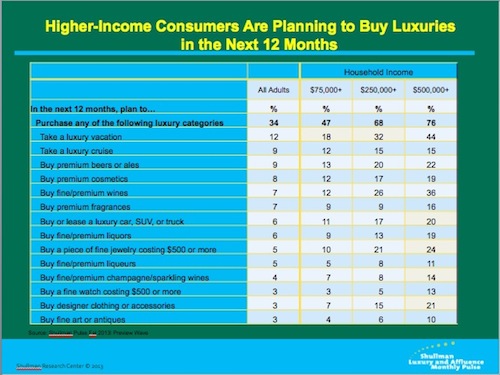

Higher-level affluent men, on the other hand, plan to take a luxury cruise, and when the entry-level affluent category is added, ($75,000+ income) along with 500 additional interviews of representative national adults (including non-affluent), the answers favor a cold one: most men plan to purchase premium beers and ales, liquors and liqueurs, and champagnes in the next 12 months.

If you have it, they will come. Shullman’s survey also reaffirms that affluent consumers remain optimistic overall about the economy, even despite all the recent political and economic news.

“They’re still planning to shop,” he says. And when it comes to buying fine jewelry, the probability rises with income. Consumers with income over $75,000 are twice as likely as the general population (U.S. median income is $51,017) to buy a piece of fine jewelry costing $500 or more. When income gets above $250,000, they’re more than four times likely than the general population to buy jewelry, and those earning $500,000 or more are almost five times as likely to buy jewelry than the general population. For fine watches, the differences are less pronounced: entry level affluents ($75,000+) are no more likely to buy one than the general population; mid-level affluents ($250,000+) are only slightly more likely to buy one, but once income gets into the half-million sphere, watch out: this group is more than four times likely to buy a fine watch than the general population.

By age, fine jewelry is one of the key items that Millennials in the $75,000+ income group plan to buy, more so than older consumers in this income group. But when income goes above $250,000, it’s the Baby Boomers who plan to do the most heavy jewelry purchasing.

The purchase intentions for fine jewelry (ninth row) rise sharply with income. But intention to purchase a fine watch (third row from bottom) don't leap until income hits $500,000.

That’s all reassuring, but what will get them into your store? Shullman says it’s critical to understand the huge difference between how affluent consumers go about researching a purchase vs. how they actually make it—and that’s where stores like luxury jewelers have an advantage.

“Many luxury marketers talk about ‘shopping’ as if it’s one single experience, but it’s really two components when you talk to the consumer,” he said. Not surprisingly, consumers overwhelmingly prefer to research purchases online (84% of respondents) rather than do in-person legwork (10.25% of respondents.) And despite inroads from mobile, the overwhelming digital preference still remains a traditional computer.

But when it comes to the actual purchase of a luxury item, consumers still prefer a store. While fine jewelry was one of the top luxury categories that affluent consumers have bought online—it ranked second behind premium cosmetics—81% of all adults surveyed prefer an in-person purchase for luxury items, vs. 41% who prefer an online purchase. That figure jumps to 92% among consumers with income over $500,000, with only 61% of those preferring to buy online.

As income increases, so does the desire for personal service—more good news for luxury jewelers. Among all adults, including mainstream shoppers, being able to avoid a salesperson was listed as one of the advantages of buying online, but to the wealthiest consumers (HHI $500,000+) it’s not an advantage and they actually seek out service. Interestingly, Shullman also found no significant differences between Millennials and older consumers in this regard.

“[It] surprised me. I expected much more of a preference, especially in buying luxuries, among Millennials to use their digital device, but we didn’t see it yet. It may come, and I suspect as things evolve they’ll be the first, but right now we aren’t seeing a significant difference,” he said.

And there are people who just love to hunt. The experience of shopping for them remains as important as the purchases they make and it’s what keeps them coming back, says Shullman.

“Are things evolving? Clearly. Do this two or three years from now, the numbers will change, but again, the in-person experience, depending on who you’re dealing with, will still be a primary way of doing it,” he said.

As to what will get luxury consumers to buy online, Shullman’s findings dovetail with the most recent report from luxury digital consulting firm L2 ThinkTank: digitally replicate the experience of shopping in person. That means providing as much detail and good close-up views of the product as possible, immediate response to calls for information, free shipping, free returns—and, again, videos featuring the product.

Top image: raymondleejewelers.net