Articles and News

Mined or Manmade, Diamond Consumers Want Third-Party Verification Of Responsible Origins | October 23, 2019 (0 comments)

Austin, TX—Consumers are increasingly demanding to know the origins and ethics of the products they buy. But are they willing to trust a diamond or jewelry company’s own claims or is it essential to have a third-party verification? (Left: Artisanal diamond diggers in Africa.)

A recent study by MVI Marketing sought to understand how much jewelry consumers trust a company’s self-reporting on ethics and origin, vs. insisting on third-party verification. Not surprisingly, it found that consumers feel better having verification—but the scores were fairly consistent across both mined and lab-grown stones, suggesting that consumers don’t always think lab-grown is a panacea for the ills the category tries to tie to mining. The study was conducted in September among 1506 U.S. and Canadian respondents ages 23-55. 47% of the respondents identified as Millennials and all respondents had purchased fine jewelry within the past year.

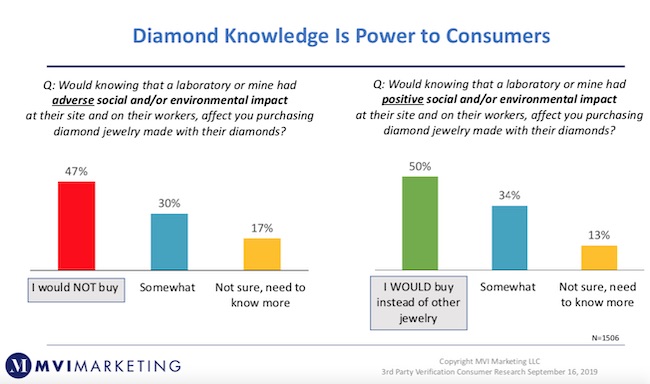

Knowing that a diamond jewelry company—either mined or manmade—had a positive or adverse impact on the environment and/or its workers drove consumer purchase intention for that product. 50% said knowing a lab or a mine had a positive social impact would drive their purchase of that product over other jewelry, and 47% said knowing the company had a negative impact would prevent their purchase of that product over other jewelry.

This study did not address differences by shopping channel, but Liz Chatelain of MVI Marketing told The Centurion that shoppers at independent jewelers and mall chain jewelers typically are the ones most interested in origin and chain of custody.

“This is also when most engagement rings are sold,” explained Chatelain. “Engagement rings receive the most questions about the origin of the diamonds.”

Consumers also feel better knowing that an independent third party is verifying the social and environmental claims of diamond companies, regardless of origin. For the most part, diamond and jewelry companies rely on self-reporting, but 89% of consumers surveyed said having a third-party verification of a mined diamond’s country of origin and social/environmental compliance was “very” or “somewhat” important. For lab-grown diamond companies, that number was only slightly lower, at 86%.

Overall, consumers’ confidence in a diamond product (of any kind) was more than two times greater when a company’s ethical and environmental claims were verified by a third-party source, and an overwhelming majority said that whether it was mined (86%) or lab-grown (84%), they’d choose a stone that was certified sustainable over a non-certified one. 67% of respondents said they’d be more loyal to a brand or retailer that sold such stones, vs. 22% who said “maybe” they’d be more loyal as a result.

“When jewelry is seen by shoppers tagged with third-party verification icons, this should really make an impact,” says Chatelain.

But money is where the proverbial rubber hits the road. More than half (54%) of consumers said they’d be willing to pay more for responsibly mined or sustainable lab-grown stones, but the majority of those (34%) said it’s worth about 5% additional premium, while only 20% said they’d be willing to pay a 10% premium. Numbers stayed fairly consistent for other criteria (see chart).

Chart source: MVI Marketing

It’s no secret that consumer interest in sustainability is growing in general, and other product categories are rising to the call. For instance, Shaw Flooring has a section of its website dedicated to sustainability. And luxury automaker Mercedes-Benz is incorporating sustainability into its CASE program of cars for the future. It’s going to impact jewelry as well: the question isn’t if, but when.

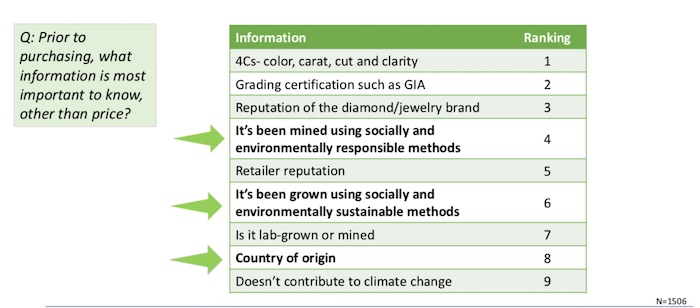

Still, although important, it’s not the number-one issue when consumers were asked by MVI to rank the information they most want to know about a diamond other than price. The Four C’s and a grading certificate such as GIA still ranked #1 and #2, respectively. Responsibility issues were ranked #4, #6, and #8.

Chart source: MVI Marketing

For more information, visit mvimarketing.com.