Articles and News

Precious Metals Report: Prices Back Under Control, Only Gradual Increases Coming October 02, 2013 (0 comments)

London, UK—Gold prices dropped 20% since the beginning of 2013, triggered by two separate events in the second quarter, but long-term the price should stabilize around $1,200 an ounce, according to the Natixis Metals Review, published earlier this week.

In mid-April, the Cypriot government announced it would sell 13 tons of gold as part of an EU bailout package; and in June, the U.S. Fed indicated that it would seek to taper quantitative easing (QE), a stance it has since moderated. Additionally, sales of gold from physically backed exchange-traded products (ETPs) have added a new source of supply, which also contributed to lower prices.

Looking ahead to 2014 and 2015, Natixis analysts believe events in the United States will have the biggest impact on gold prices. For the past four years QE has been the biggest force supporting the price of gold, but as the economy continues to improve, gold prices are facing further declines as interest rates rise and the need for a safe haven dissipates. This may divert investors to equities and higher yielding assets; indeed; as the price of gold has dropped by over 20% this year, the Dow Jones rose by 17%. (Editor’s note: There is no long-term symbiotic relationship between the Dow and gold; they may move in tandem or in opposition based on a variety of external factors.)

Further selloffs from ETPs would place additional downward pressure on the price of gold. With 1,950 tons of gold still held by physically backed ETPs, there is substantial opportunity for divestment, leading to an increase in supply at the expense of what had been a substantial source of demand.

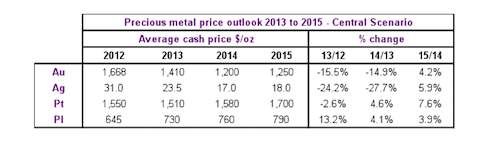

Under this scenario, the French-based investment bank estimates gold prices dropping to lows of around $1,170 the ounce over the next six to 12 months, and averaging $1,200 the ounce in 2014. As has been noted in previous reports in The Centurion, Natixis concurs that the cost of production precludes prices dropping much below $1,200, and from a base of $1,200 it predicts a slow rise to about $1,250 in 2015.

Silver. Silver prices have remained strongly correlated with gold, moving more or less in tandem. Although silver prices have dropped 8% more than gold, it could have been much lower had investors resorted to selling silver held in physically backed ETPs. For 2014 and 2015, Natixis expects continued correlation between gold and silver prices, with investor demand expected to remain the most important driver for silver prices.

Currently around 20,000 tons of silver are held in physically backed ETPs—a substantial amount, considering that silver output in 2012 was around 32,600 tons, according to the Silver Institute. If investors move out of silver into equities or higher interest yielding products, this could potentially turn physically backed silver ETPs into a source of supply, applying downward pressure to prices.

Industrial demand still accounts for more than half of total demand for silver, but an improvement in the U.S. economic outlook represents a very specific risk to silver prices in 2014 and 2015, given that U.S. investors have been one of the principal groups of investors purchasing the metal over the past few years. Taking all of these factors into account and as the global economy steadily improves, Natixis forecasts silver prices averaging $17 an ounce in 2014 and rise slightly to an average of $18 an ounce in 2015.

As shown in this chart, French investment bank Natixis predicts only a slow, gradual rise in precious metal prices over the next few years.

Platinum group metals. During the first half of 2023, PGM prices were broadly correlated with gold and silver, falling in line with gold and silver prices in April after Cyprus said that it would sell its reserves of gold, and suffering between May and June on expectations for QE tapering. For the remainder of the year, the PGM market is likely to continue to suffer, though Natixis expects improvement and higher prices in 2014 and 2015.

On the supply side, tensions between miners and producers are likely to remain high for the forseeable future. The South African government has been unable to resolve the core economic issues facing the country and the whole situation is making foreign investment unattractive in the mining sector. From the demand side, European car sales reached a record low in September should improve on the back of a local economic rebound as austerity measures are relaxed modestly. Increased automobile demand from Europe, coupled with a reduction of mined platinum supply, should help platinum prices reach $1,580 an ounce in 2014, followed by $1,700 an ounce in 2015.

In palladium, the supply side will suffer similarly, as South Africa produces 35% of the metal. But Russia should be able to ramp up supply should South African palladium output drop. From the demand side, Natixis expects that in sales of new cars in developing countries will grow at a quicker pace in the next few years, and strong automobile sales in the United States will also help the palladium price. Gasoline-fuleed cars remain the most popular, which means palladium is needed for autocatalysts. Taking this into account, Natixis expects palladium prices to average $760 an ounce in 2014 and $790 an ounce in 2015 as growth in automobile demand accelerates.