Articles and News

NEW SURVEY FINDS AMERICA’S AFFLUENT OPTIMISTIC AND READY TO SPEND; All THEY NEED IS A NUDGE | May 09, 2012 (0 comments)

Alpharetta, GA—Affluent Americans feel significantly more optimistic than they did six months ago, according to the American Affluence Research Center, which polls the wealthiest 10% of U.S. households twice yearly. In the Spring 2012 Affluent Market Tracking Study, the composite Affluent Consumer Expectations 12-month Economic Outlook Index rose 27 points from the fall 2011 survey. The ACE is the average of respondents’ 12-month outlook in three areas: business conditions, the stock market, and household income.

“With all the negative news in the media, there’s a risk that retailers will get down in the dumps or think their business is about to go down. But affluent consumers are feeling better and lots just need a gentle nudge [to spend],” says Ron Kurtz, president of the AARC.

Respondents’ assessment of current business conditions rose 38 points from last fall, to its highest level since fall 2007, just before the start of the recession. 15% more respondents rated conditions “positive” than in last fall’s survey, while 22% fewer respondents than last fall rated conditions as “negative.” Even last fall’s somewhat disappointing numbers still showed affluent consumers felt better about economic conditions than they did during the recession, Kurtz told The Centurion.

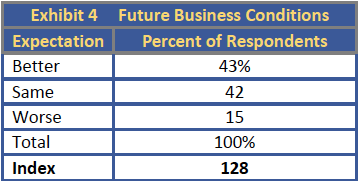

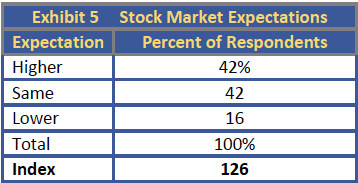

The affluent also feel more confident about the future: the index for future business conditions rose 37 points over the fall 2011 survey. These findings are consistent with other recent polls conducted by such organizations as The Conference Board (March index), Gallup, Bloomberg, and others. 42% of AARC respondents also anticipate the stock market will be “better” (i.e. higher) in 12 months, with another 42% predicting it will stay about the same. Only 16% predict it will be lower than present. (Note: At press time, the Dow Jones Industrial Average was 12,855, up 5.15% from the start of the year and about 1,200 points from its all-time high of 14,164 in October 2007.) But respondents generally seem to feel they personally will be better off—the index for expected change in after-tax personal income rose 14 points above the Fall 2011 survey.

The AARC's findings show 43% of respondents expect business conditions to improve over the next 12 months. 42% think conditions will remain the same, and only 15% think they'll get worse.

The AARC survey reconfirms that the wealthiest Americans are the least affected by external forces, but aspirational luxury consumers remain wary. Among respondents, those most likely to have favorable opinions of both present business conditions and future expectations fell in the higher (over $200,000) annual income group and have higher investible assets ($1.5 million or more, vs. less than $500,000).

Respondents to the AARC survey this spring were equally divided as to their views of the stock market's likelihood of going up, vs. staying the same. But only 16% predicted an overall drop over the next 12 months.

When asked about any expected changes in their spending plans over the next 12 months, the index for all 17 categories increased from the fall 2011 survey. The increases (i.e., number of respondents who said they plan to spend more) for most categories were modest, but four categories showed double-digit growth: vacation travel, dining in upscale restaurants, collectibles, and political contributions. (Editor’s note: given that 2012 is a presidential election year, one can hypothesize that the political contributions index will drop significantly after the fall elections.)

Jewelry needs a push; legacy could be key. The index for fine jewelry and watches rose five points from the previous survey, but tracked significantly lower than travel, entertainment, home durables (including furniture, electronics, and appliances), and charitable contributions.

61% of respondents indicated they would spend either the same or more for fine jewelry and watches this year as last year, while 40% said they will spend less for the category (totals are greater than 100% due to rounding). By contrast, 85% of respondents plan to spend the same or more on domestic vacation travel this year than last, and 75% plan to spend the same or more on international vacation travel.

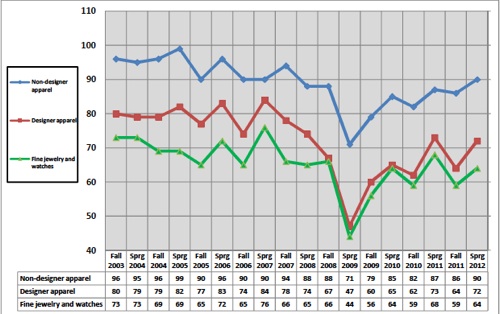

The AARC has tracked fine jewelry and watch purchases since 2003, as shown in the chart below. Both the jewelry and designer apparel categories have rebounded since the worst of the recession, but remain down overall from earlier spending levels. (Editor’s note: the AARC chart does not ask about jewelry price, only about spending intentions.)

The green line shows the historical index for fine jewelry and watch purchases among the affluent, starting with Fall 2003 to the far left, through Spring 2012 at far right. It rose 4% since the Fall 2011 survey, to a spot only slightly below pre-recession levels. Note the designer apparel category (red line) fairly closely parallels the jewelry line, while non-designer apparel (blue line) performs above both categories.

Kurtz attributes the drop more to consumer life stage than finances. Quite simply, most of America’s affluent consumers skew older, and are in or entering a stage in life where they begin shifting spending to experiences, rather than objects. The average age of AARC respondents—who are qualified strictly according to wealth, requiring a minimum net worth of $800,000—has edged up two years since the survey’s inception, Kurtz says. It now stands at age 58.8 years.

“In our survey, younger respondents, though still affluent, tend to have less wealth; they’ve had less time to accumulate net worth. Our highest levels of wealth are among older consumers—and by your late fifties, you’ve finished acquiring things,” says Kurtz. “And certainly after age 60, acquisition is no longer a priority,” he told The Centurion.

That said, Kurtz believes jewelers still have plenty of opportunity to sell to this demographic: emotion remains a powerful purchase motivator even for people who have everything they want. The key, Kurtz says, is to tap into two separate emotions that are common at this life stage: one, the usual love and appreciation of a spouse, but two, the chance to pass along the piece to the next generation.

Don’t underestimate the value of that aspect, he says. And not only does he speak from a position of an expert in the field, he has personal experience with it, too.

“My wife goes out and buys pretty much whatever she wants [in clothes], so I was at a loss as to what to buy her for gifts. Now I always buy art or jewelry, because eventually it will go to our children,” he says. “Knowing it will go to your kids, you can’t put a price on that.”

Forget about frugality. While pundits predicted in 2009 that recession-driven frugality was going to become a permanent change in consumers’ attitudes, post-recession shopping behavior is proving otherwise. While some consumers have indeed altered their spending habits—either by choice or circumstance—they are in the minority among the affluent.

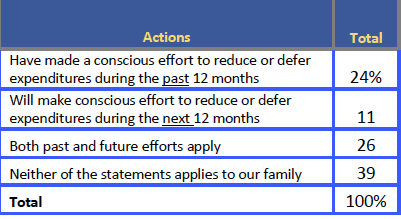

About 37% of respondents to the Spring 2012 survey said they plan to reduce or defer expenses this year—a figure that has been largely unchanged since 2010. But that figure also means 63% don’t plan to reduce or defer spending.

About one-third of respondents to the AARC survey said they never changed their spending habits since the recession began, further proof that it didn’t affect those with real money. And about one-quarter of the respondents who did change their spending habits when the recession began (presumably lowering them) say they don’t plan to return to pre-recession spending. Still, that leaves 75% of affluent consumers who presumably are willing to spend again. Furthermore, says Kurtz, the “stealth wealth” phenomenon that got so much publicity during the recession, simply doesn’t resonate with the truly rich.

The status seekers who either disappeared or went underground during the recession were largely the aspirational “mass affluent,” he said, whereas the truly wealthy haven’t changed much over decades of observing them: they spend carefully, save aggressively, are not conspicuous consumers—and never have been.

The table above details affluents' spending habits. The percentages show how AARC survey respondents answered the question "Please indicate which of the following statements apply to you and your family."

These are exactly the kind of affluent consumers who insist on value, and especially love an extra reward. 81% of respondents to the AARC survey belong to some kind of customer loyalty program, and on average, each belongs to about 10 different programs. About 5% of respondents belong to 25 or more loyalty programs, and more than half (54%) of the respondents who belong to loyalty programs say those programs do entice them to spend more with the company than they would have otherwise. (The survey named 14 categories of loyalty programs, including airline, hotel, department store, credit card, and more.) American Express, both alone and jointly with warehouse retailer Costco, was rated the best loyalty program by respondents.

“[Affluent] customers expect some kind of perk or benefit for the business they’ve given a company,” says Kurtz. But that perk doesn’t necessarily have to be material, he says. Sometimes all they want is recognition and acknowledgment of their business.

Most luxury jewelers already offer small perks as a matter of course, such as free cleaning and inspection, free delivery, or other benefits, but for those who would like to develop a larger loyalty program, Kurtz suggests collaborating with noncompeting retailers in town. That way, he says, it’s easier to reward customers a jeweler might only see once or twice a year.

A smaller, but still significant percentage—47%—of respondents subscribe to daily deal or coupon sites; of those, Groupon was the most popular. But daily deal sites tend to be used more often by respondents with lower levels of wealth, Kurtz told The Centurion, with participation declining as net worth rises. Also, he noted, they’re also most frequently used for service purchases, including travel, rather than product purchases.

Separately, figures from the 2012 Survey of Affluence and Wealth in America, conducted annually by American Express Publishing and the Harrison Group, show luxury spending by America's affluent--defined in that survey as household income above $100,000--will rise approximately 3% in 2012. Jewelry and watch spending is expected to change little in either direction, according to this report's findings. The report also describes the "real one percent", who are typically of middle-class origin, with middle-class values, and their entrepreneurial spirit not only led to their own success but also fuels job creation.

“It’s not dismal out there!” Kurtz emphasizes. Retailers have to keep promoting, and keep encouraging consumers. “The affluent are able and willing to spend. But sometimes they just need a gentle nudge.”