Articles and News

ONLINE ADVERTISING: NARROW AND DEEP GETS BETTER RESULTS FOR LUXURY THAN FAR AND WIDE | November 07, 2012 (0 comments)

New York, NY—With the possibilities of the digital world endless, how can a luxury jeweler break through the din to really capture the attention of affluent, likely customers?

Go where it’s quiet, says Tom O’Regan, chief revenue officer of Martini Media, a digital ad agency that specializes in niche consumer publications online. These very targeted special-interest publications offer audiences that are small in number but with big passions and big wallets.

“Rich people have very little time, and when they do they to want to spend it pursuing their passion, whether that’s sailing, golf, yachting, horses, whatever,” says O’Regan. The best place for a luxury marketer to get noticed by this audience is in their “happy place,” i.e., while they’re involved with or reading about their favorite hobby. For example, some of the niche titles Martini has worked with include Tennis.com, World Golf Tour.com, The Daily Meal.com, Auto Trader Classics.com, Kiplinger.com., Lexis Nexis, Gayot.com, Fodors. com, and more.

More and more luxury companies are rapidly increasing their investment in digital marketing, though the category lags slightly behind mass marketers overall in online spend, says O’Regan. But a recent study shows that even before the end of 2012, many top luxury brands plan to increase their investment in digital advertising.

The Luxury Brand Advertising 2012 Outlook study polled 345 top luxury brands, as well as their marketing agencies. Brands stretched across a wide variety of luxury categories, from automobiles to travel to jewelry and watches. Martini Media conducted the study in partnership with digital consultant and veteran research expert Michele Madansky and Digiday, an information company for professionals in digital media.

Madansky said of the study, “Luxury brands already know that affluent consumers are spending more time on digital and have become more difficult to reach through traditional media. This study’s intent was to gain a better understanding of what opportunities and issues are top of mind when luxury brands consider marketing to affluent consumers online.”

Context and targeting are the top criteria for luxury marketers to choose online media, with nine out of 10 luxury marketers in the study believing it’s possible to build reach through sites that consumers are passionate about.

How to start? Niche sites certainly make finding the target easier, but there’s still a process to follow for best results. O’Regan suggests jewelers approach their digital campaigns much the same way they would a print campaign: go where your audience goes, consider the context in which the ad appears, and the relevance of is content—and, of course, make it beautiful. While digital marketing is more cost-effective than print or television, it doesn’t mean going cheap, he warns.

“The first step is having beautiful creative and tracking the response,” he told The Centurion. Another great first-toe-in-the-water transition from print to digital is via tablet. Most viewing on a tablet is done via websites, he said, and you can do a print ad on a tablet.

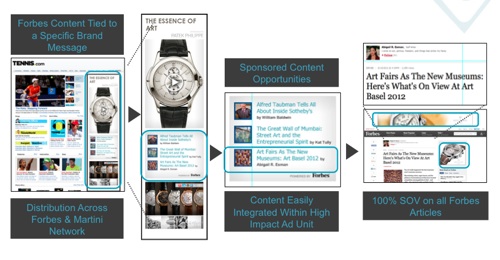

Relevance is key. Martini Media recently inked a deal with Forbes magazine to integrate the publication’s editorial content into ads for blue-chip advertisers.

In an interview with Adweek magazine, O’Regan said there’s way more engagement when content aligns with the brand message. “The most success I’ve seen is with integrated sponsorships with an editorial and advertising blend,” he told Adweek. For example, Emirates Airlines and Bentley Motors, two participants, will include in their ads links to travel and other articles from Forbes that are aimed at high-income executives. When the Forbes link is clicked, the ad redirects to the Forbes site, but the article in question is then surrounded by the sponsor’s ad content. While Forbes has a wider reach than a hobbyist publication, the program still targets a relatively narrow segment of its audience.

A demonstration of the Martini Media/Forbes consumer online ad program. Here, a Patek Phillipe ad is shown on Tennis.com, above left. Three links to subject-related articles in Forbes--such as an article on the Art Basel Fair, playing off both Patek's "art" themed ad and the importance of Basel to the watch world--are provided below the image of the watch, center. Once a reader clicks on the article link, ads for the watch appear in the article, right.

Video on the rise. Digital media is perceived by study respondents to be effective at driving favorability for both online and in-store shopping, but is a better mechanism for driving online sales. Hot areas for digital marketing investment are, of course, social media, but also rich media, mobile, and video. In fact, more than half the agencies polled believe their luxury brand clients will be shifting TV dollars to online video.

Indeed, diamond brand Forevermark tapped online video as a key channel for its holiday advertising. Last year, retailers were disappointed that the brand’s initial launch into the U.S. market did not include TV advertising, so a commercial for Q4 2012 was announced in July. Initial plans called mainly for online video, but by September the brand announced a strong television buy as well. The campaign, titled “Center of My Universe,” focuses on a halo diamond setting and relates it to the emotional aspect of how a man feels about a woman.

“At Forevermark we have a narrow, affluent target, so we typically use media outlets such as print and digital that allow us to target these consumers very effectively,” said company spokesperson Adelaide Polk-Baumann. “Our initial decision to run online was based on the strength of targeting that online provides. It allows us to show our message to those users who fall squarely into our core target or who are most likely to respond.”

But, said Polk-Baumann, enthusiastic response from Forevermark jewelers to the campaign, combined with the current situation in the diamond market, led the brand to add a television plan.

“This will complement our print and digital plan with a more broad reach medium—one that allows users to view the commercial on a bigger screen, with a greater chance of watching together as a couple, providing an easy opportunity for hinting,” she told The Centurion. “Combining print, digital and television media, along with PR, social media, and local jeweler activity, the “Center of My Universe” campaign will surround our target consumers on both a national and local level this holiday season.”

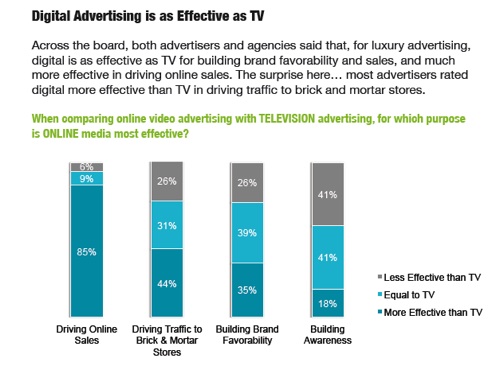

A chart from the Martini Media study showing that both luxury advertisers and their ad agencies feel digital is as effective as television for building brand favorability and overall sales; and more effective at driving e-commerce sales.

The spend. Luxury companies slightly trail their mass-market peers in how much they spend for digital marketing. 37% of mass marketers’ ad dollars are spent digitally, compared with only 31% of luxury companies’, but the race is on to catch up. Among survey respondents (remember the survey polled luxury companies’ ad/marketing agencies, not the companies themselves), more than three fourths of the agencies expect their luxury clients to increase their digital marketing budgets this year, and almost half expect the budgets will increase by at least 10% over what was spent up till summer 2012.

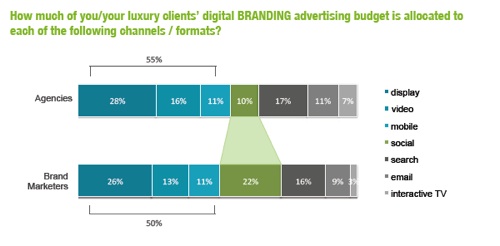

Digital display advertising still accounts for more than half of luxury companies’ online spending, says the study. In terms of social media, the study showed a significant disconnect between what agencies estimate their clients are spending (10% of budget) and what clients say they’re spending (22% of budget.) But going forward, agencies predict their clients’ biggest increases in digital spending will be for video, mobile, and social media.

This chart from Martini Media's study shows a disconnect between what ad agencies say their clients are spending on social meda (10% of their online ad budget, green section) and how much of their online budget marketers believe is going to social media (22%). Brands' and agencies estimates of how much they're spending for the remaining digital marketing categories were fairly close; usually within a point or two.

What’s worth paying for? Both the agencies and the luxury brand clients agree that it’s essential to have the right kind of targeting, and that it’s worth paying a premium to ensure they’re reaching luxury consumers. But a very surprising finding was that not only do most luxury advertisers feel that online advertising is as effective as TV for building brand favorability and sales, they also feel that digital advertising is more effective than TV in driving traffic to brick-and-mortar stores.

All this, however, hinges on having the right people see the ads and in the right context. Luxury companies are increasingly sensitive to the editorial environment their ads appear in online, and they’re also working on making sure their digital ads are more highly focused and less intrusive.

One thing that hasn’t evolved, says the study, is measuring ROI. While sales and “brand lift” are the most important metrics to measure, the study says the traditional method of assessing performance by counting clicks is limiting, and measurement methodologies need to expand to include a way to measure the “passion inducement” of content.

Paid search, a reigning darling of digital marketing, may not be as effective for a luxury jeweler as niche sites, says O’Regan. But it depends on the jeweler’s goals.

“We [niche] focus on brand representation; paid search is focused on e-commerce. It’s also very hard for a small independent jeweler to pay enough to bounce Tiffany from the top spot, he told The Centurion. But pay-per-click in general is relatively low-cost and it can provide some valuable analytics, he said. It also can drive local traffic to the store—which is a tactic even big companies use.

Separately, a new report from The Search Agency, a global online marketing firm and the largest independent U.S. search marketing agency, says that across all search engines, click traffic has increased 27% from last year; and impressions in the United States are up 21% over last year’s figures. This article on Adotas.com details the specific areas of growth, including Yahoo!-Bing, tablet, and mobile. While Google remains the dominant search engine, traffic growth on Yahoo!-Bing is higher quarter over quarter, says the article.