Articles and News

Platinum Jewelry Demand Rises Here, Falls Globally | December 13, 2010 (1 comment)

New York, NY—Precious metals supplier Johnson Matthey has estimated that gross global demand for platinum jewelry will fall by 14% for 2010, though it forecasts growth in the North American market.

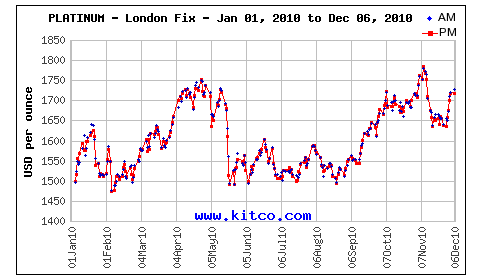

The global drop is attributed to both retailers and consumers reducing purchases in response to relatively high prices for the metal, according to the firm’s Platinum 2010 Interim Review, released in November.

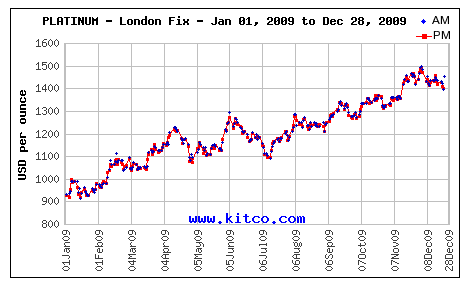

Platinum traded higher in the first nine months of 2010 than for the full year of 2009. At press time, the spot price was $1,697/oz. The increased price drove down wholesale purchasing in the jewelry sector, especially in the price-sensitive Chinese market, where high inventory levels left from 2009’s lower prices are coupled with reduced consumer spending this year. Heavy buying only emerges when the metal falls below $1,500/oz.

In North America, however, Johnson Matthey anticipates final 2010 figures to show growth. Higher prices appear to have been partly offset by improved economic conditions in the first half of the year, mid- to high-end retailers reported increased sales of platinum jewelry, and the bridal sector also is set to increase.

2010 demand in Europe and Japan is expected to remain steady, and worldwide recovery of platinum from recycling of jewelry is forecast to increase by 30%, says the report. This includes both old jewelry that consumers have traded in, as well as unsold retail and wholesale stock. Recycling in China and Japan is expected to be particularly strong as consumers return old pieces through well-established networks.

Total 2010 demand for palladium jewelry, meanwhile, is expected to fall in China, grow in Europe, and remain steady in the United States.